Answered step by step

Verified Expert Solution

Question

1 Approved Answer

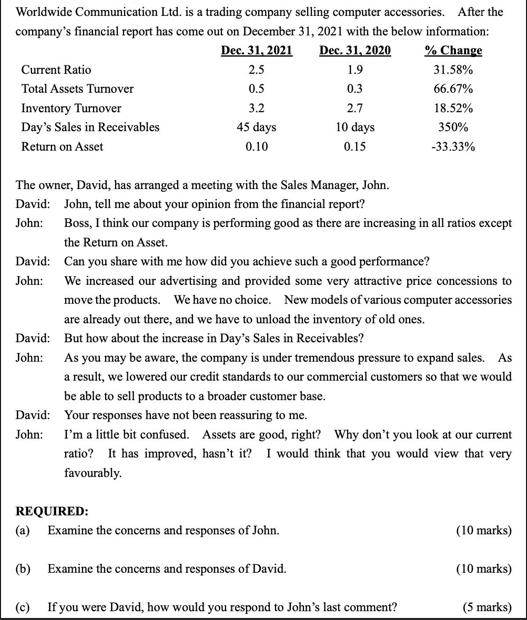

Worldwide Communication Ltd. is a trading company selling computer accessories. After the company's financial report has come out on December 31, 2021 with the

Worldwide Communication Ltd. is a trading company selling computer accessories. After the company's financial report has come out on December 31, 2021 with the below information: Dec. 31, 2021 Dec. 31, 2020 % Change Current Ratio 2.5 1.9 31.58% Total Assets Turnover 0.5 0.3 66.67% Inventory Turnover 3.2 2.7 18.52% Day's Sales in Receivables 45 days 10 days 350% Return on Asset 0.10 0.15 -33.33% The owner, David, has arranged a meeting with the Sales Manager, John. David: John, tell me about your opinion from the financial report? John: Boss, I think our company is performing good as there are increasing in all ratios except the Return on Asset. David: Can you share with me how did you achieve such a good performance? John: We increased our advertising and provided some very attractive price concessions to move the products. We have no choice. New models of various computer accessories are already out there, and we have to unload the inventory of old ones. David: But how about the increase in Day's Sales in Receivables? John: As you may be aware, the company is under tremendous pressure to expand sales. As a result, we lowered our credit standards to our commercial customers so that we would be able to sell products to a broader customer base. David: Your responses have not been reassuring to me. John: I'm a little bit confused. Assets are good, right? Why don't you look at our current ratio? It has improved, hasn't it? I would think that you would view that very favourably. REQUIRED: (a) Examine the concerns and responses of John. (b) Examine the concerns and responses of David. (10 marks) (10 marks) (c) If you were David, how would you respond to John's last comment? (5 marks)

Step by Step Solution

★★★★★

3.40 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Answers a Johns concerns and responses Johns concerns The companys financial report shows a decline ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started