Answered step by step

Verified Expert Solution

Question

1 Approved Answer

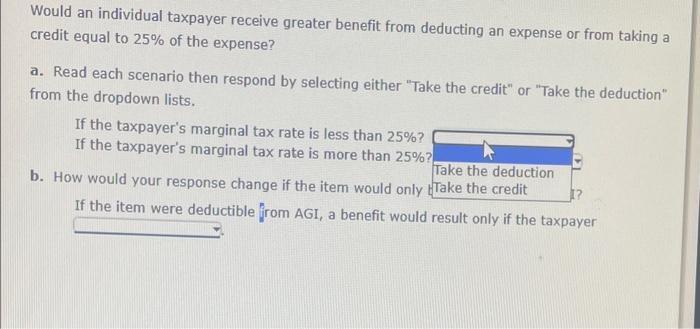

Would an individual taxpayer receive greater benefit from deducting an expense or from taking a credit equal to 25% of the expense? a. Read

Would an individual taxpayer receive greater benefit from deducting an expense or from taking a credit equal to 25% of the expense? a. Read each scenario then respond by selecting either "Take the credit" or "Take the deduction" from the dropdown lists. If the taxpayer's marginal tax rate is less than 25%? If the taxpayer's marginal tax rate is more than 25%? Take the deduction b. How would your response change if the item would only Take the credit If the item were deductible from AGI, a benefit would result only if the taxpayer

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started