Answered step by step

Verified Expert Solution

Question

1 Approved Answer

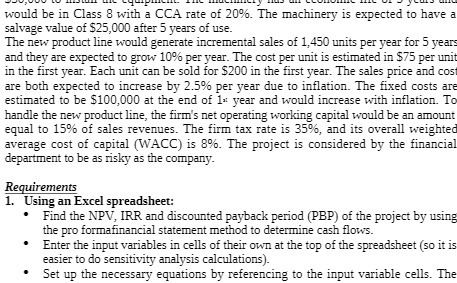

would be in Class 8 with a CCA rate of 20%. The machinery is expected to have a salvage value of $25,000 after 5

would be in Class 8 with a CCA rate of 20%. The machinery is expected to have a salvage value of $25,000 after 5 years of use. The new product line would generate incremental sales of 1,450 units per year for 5 years and they are expected to grow 10% per year. The cost per unit is estimated in $75 per unit in the first year. Each unit can be sold for $200 in the first year. The sales price and cost are both expected to increase by 2.5% per year due to inflation. The fixed costs are estimated to be $100,000 at the end of 1 year and would increase with inflation. To handle the new product line, the firm's net operating working capital would be an amount equal to 15% of sales revenues. The firm tax rate is 35%, and its overall weighted average cost of capital (WACC) is 8%. The project is considered by the financial department to be as risky as the company. Requirements 1. Using an Excel spreadsheet: Find the NPV, IRR and discounted payback period (PBP) of the project by using the pro formafinancial statement method to determine cash flows. . Enter the input variables in cells of their own at the top of the spreadsheet (so it is easier to do sensitivity analysis calculations). Set up the necessary equations by referencing to the input variable cells. The

Step by Step Solution

★★★★★

3.43 Rating (169 Votes )

There are 3 Steps involved in it

Step: 1

Here is the the calculations Inputs A1 Machinery Cost 100000 A2 Salvage Value 25000 A3 Initial Units ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started