Answered step by step

Verified Expert Solution

Question

1 Approved Answer

would it be possible to also show work, thank you State Income Tax. Round all amounts to the nearest cent as needed, XX.) You gathered

would it be possible to also show work, thank you

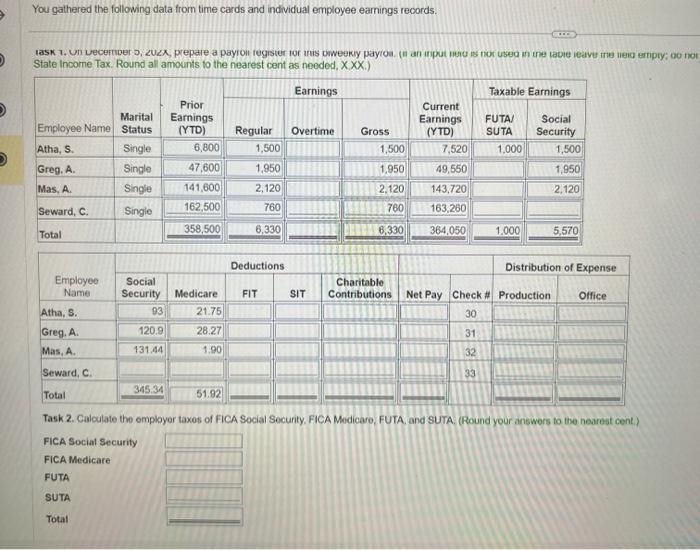

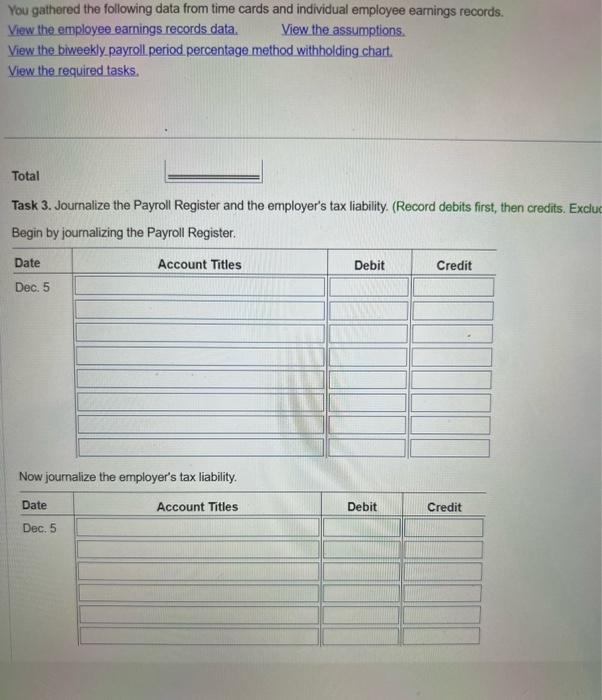

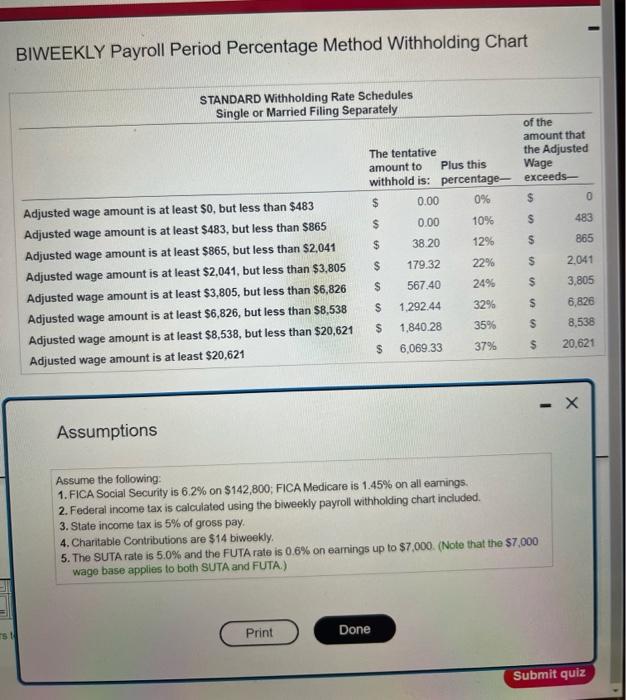

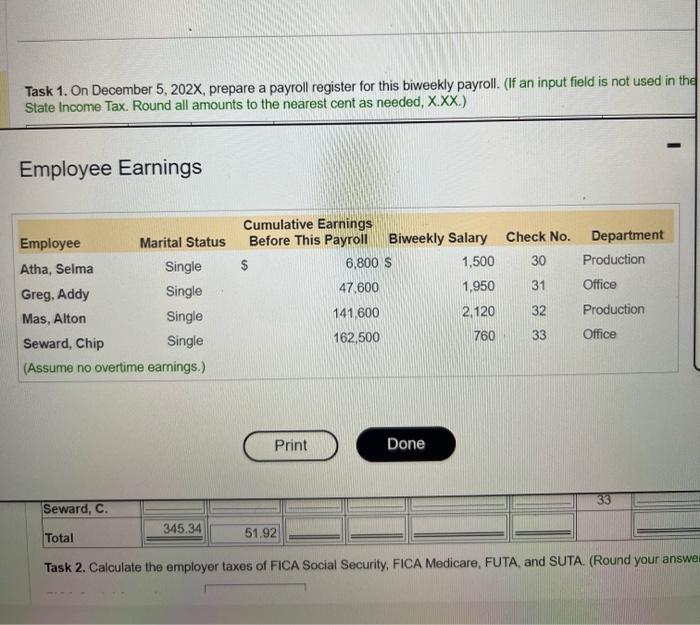

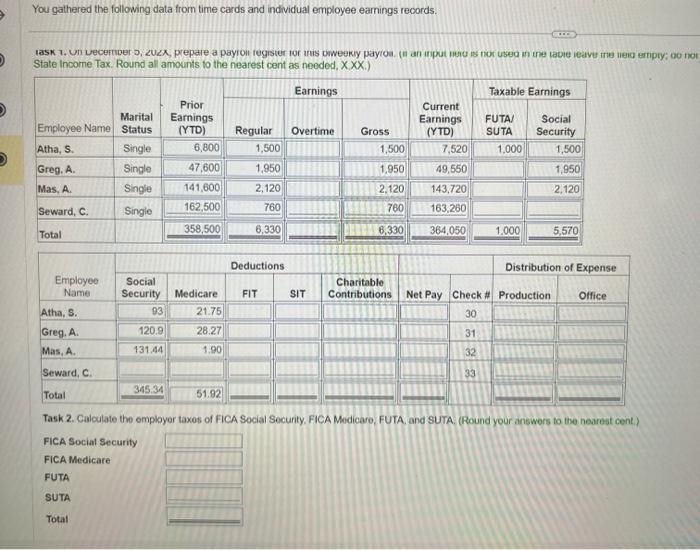

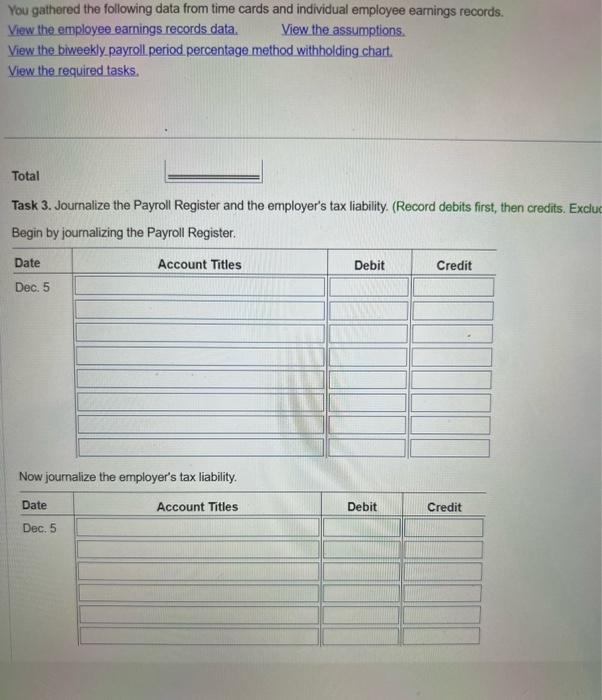

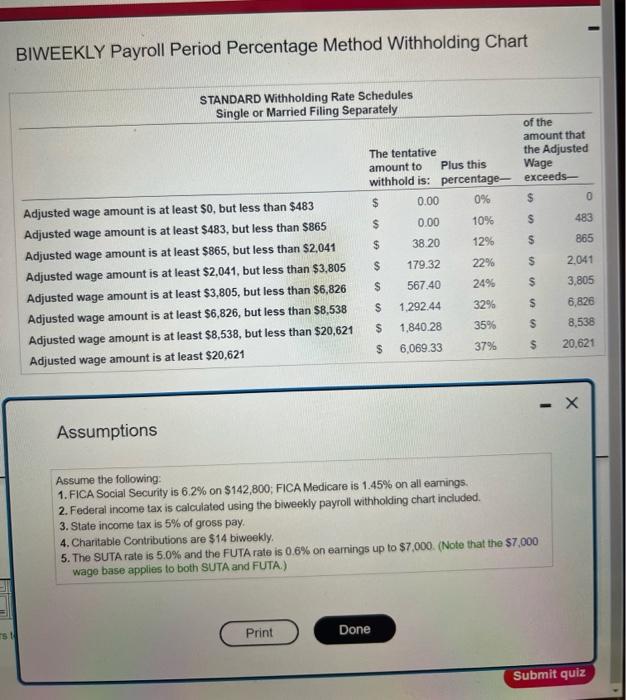

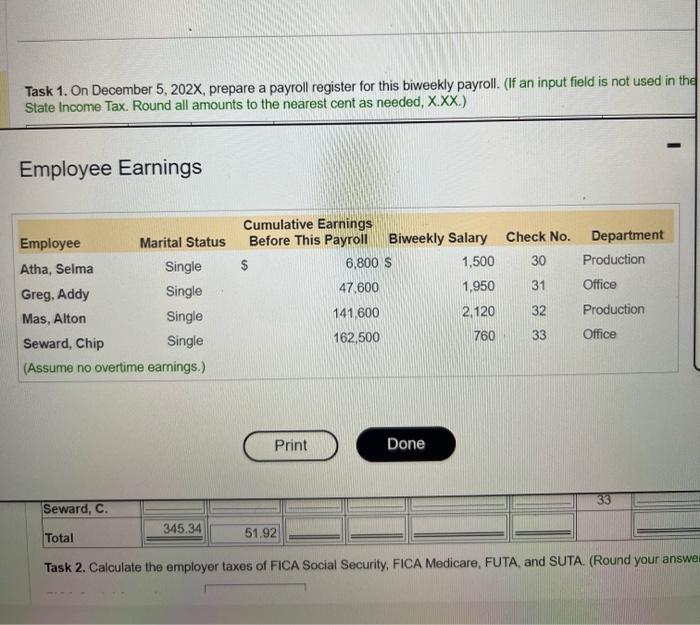

State Income Tax. Round all amounts to the nearest cent as needed, XX.) You gathered the following data from time cards and individual employee earnings records. View the employee earnings records data. View the assumptions. View the biweekly payroll period percentage method withholding chart. View the required tasks. Total Task 3. Journalize the Payroll Register and the employer's tax liability. (Record debits first, then credits. Exclu Begin by journalizing the Payroll Register. Now journalize the employer's tax liability. BIWEEKLY Payroll Period Percentage Method Withholding Chart Assumptions Assume the following: 1. FICA Social Security is 6.2% on $142,800; FICA Medicare is 1.45% on all earnings. 2. Federal income tax is calculated using the biweekly payroll withholding chart included. 3. State income tax is 5% of gross pay. 4. Charitable Contributions are $14 biweekly. 5. The SUTA rate is 5.0% and the FUTA rate is 0.6% on earnings up to $7,000. (Note that the $7,000 wage base applies to both SUTA and FUTA.) Task 1. On December 5, 202X, prepare a payroll register for this biweekly payroll. (If an input field is not used in the State Income Tax. Round all amounts to the nearest cent as needed, X.XX.) Employee Earnings Task 2. Calculate the employer taxes of FICA Social Security, FICA Medicare, FUTA, and SUTA. (Round your answe

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started