Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Would like any help or advice to be shown in excel if possible, thank you. Question 1 4 pts What is the future value of

Would like any help or advice to be shown in excel if possible, thank you.

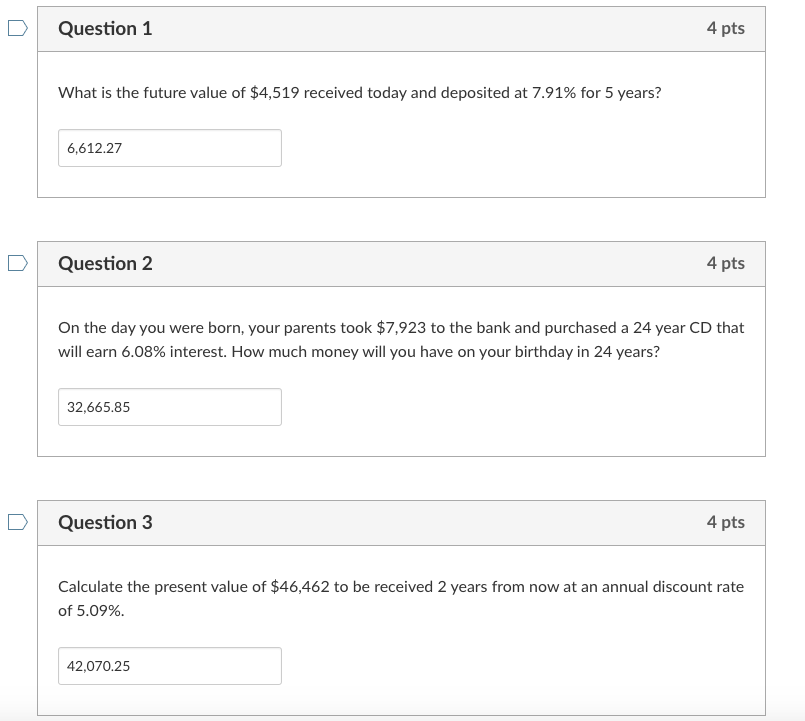

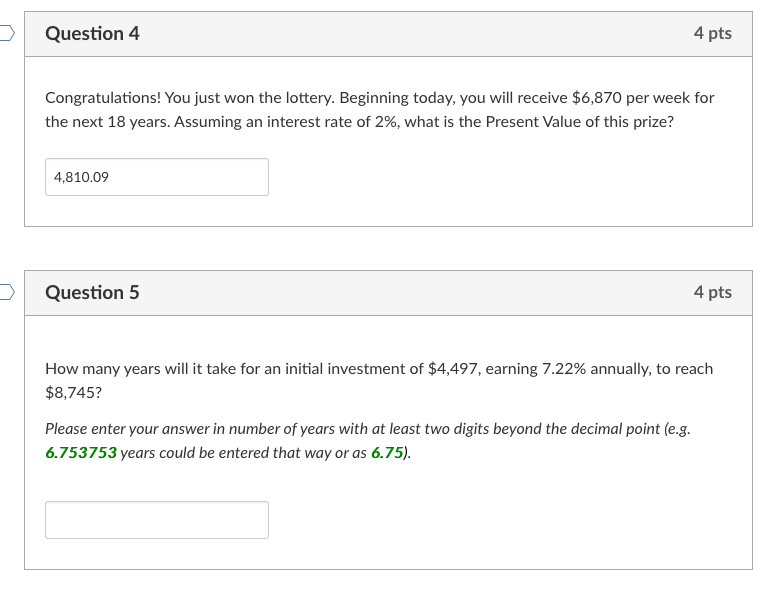

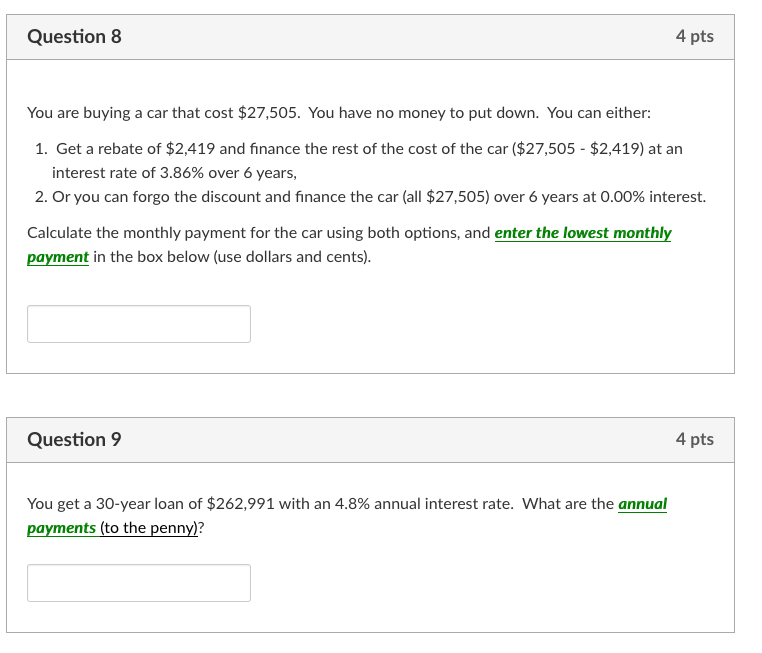

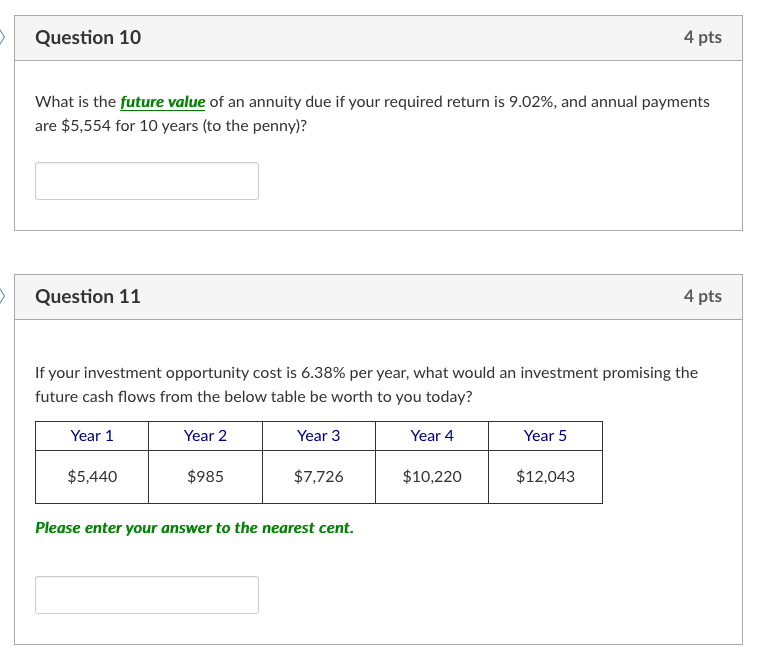

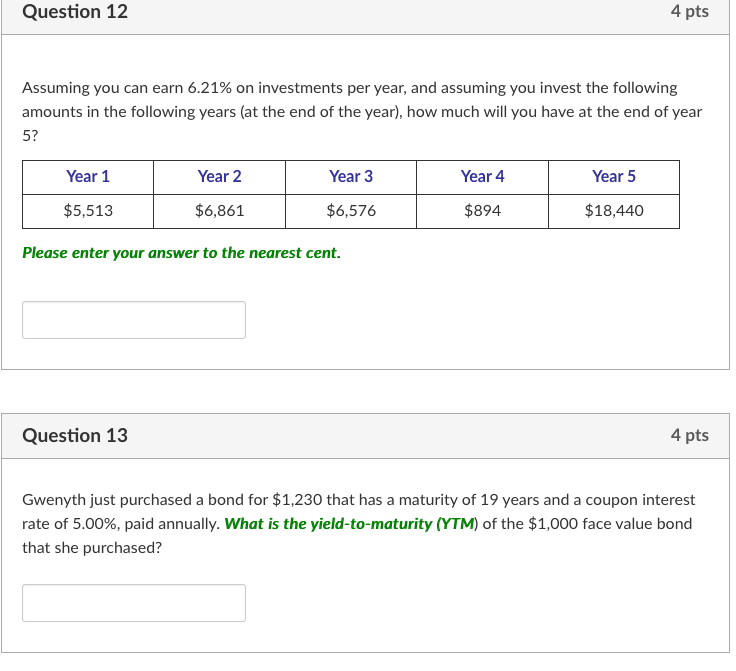

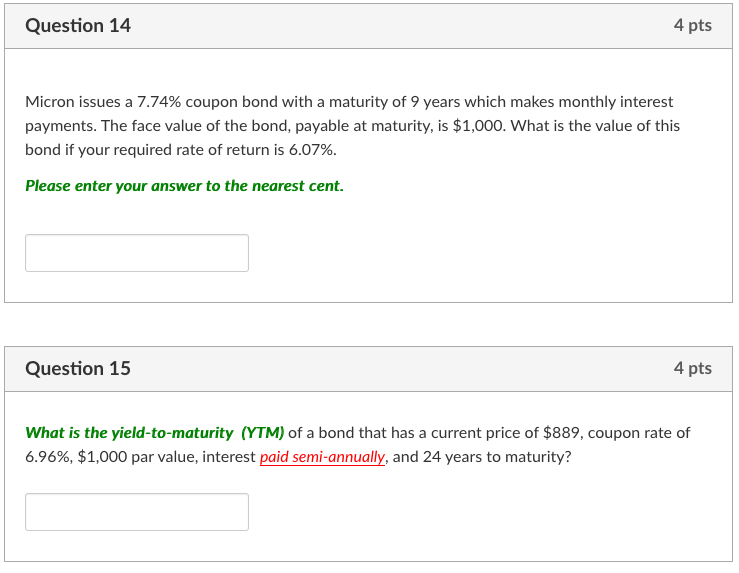

Question 1 4 pts What is the future value of $4,519 received today and deposited at 7.91% for 5 years? 6,612.27 Question 2 4 pts On the day you were born, your parents took $7,923 to the bank and purchased a 24 year CD that will earn 6.08% interest. How much money will you have on your birthday in 24 years? 32,665.85 Question 3 4 pts Calculate the present value of $46,462 to be received 2 years from now at an annual discount rate of 5.09%. 42,070.25 Question 4 4 pts Congratulations! You just won the lottery. Beginning today, you will receive $6,870 per week for the next 18 years. Assuming an interest rate of 2%, what is the Present Value of this prize? 4,810.09 Question 5 4 pts How many years will it take for an initial investment of $4,497, earning 7.22% annually, to reach $8,745? Please enter your answer in number of years with at least two digits beyond the decimal point (e.g. 6.753753 years could be entered that way or as 6.75). Question 6 4 pts You have future plans to buy a house 6 years from now. You estimate that a down payment of $22,517 will be required at that time. To accumulate that amount, you want to start making monthly payments into an account paying 7.66% interest. What will your monthly payments be? Enter your answer in dollars and cents! Question 7 4 pts You are buying a car. The one you have chosen to purchase is going to cost you $24,349. Your car salesman has told you that you can purchase this vehicle for $434 per month for 60 months. What annual interest rate will you be paying? Question 8 4 pts You are buying a car that cost $27,505. You have no money to put down. You can either: 1. Get a rebate of $2,419 and finance the rest of the cost of the car ($27,505 - $2,419) at an interest rate of 3.86% over 6 years, 2. Or you can forgo the discount and finance the car (all $27,505) over 6 years at 0.00% interest. Calculate the monthly payment for the car using both options, and enter the lowest monthly payment in the box below (use dollars and cents). Question 9 4 pts You get a 30-year loan of $262,991 with an 4.8% annual interest rate. What are the annual payments (to the penny)? Question 10 4 pts What is the future value of an annuity due if your required return is 9.02%, and annual payments are $5,554 for 10 years (to the penny)? Question 11 4 pts If your investment opportunity cost is 6.38% per year, what would an investment promising the future cash flows from the below table be worth to you today? Year 1 Year 2 Year 3 Year 4 Year 5 $5,440 $985 $7,726 $10,220 $12,043 Please enter your answer to the nearest cent. Question 12 4 pts Assuming you can earn 6.21% on investments per year, and assuming you invest the following amounts in the following years (at the end of the year), how much will you have at the end of year 5? Year 1 Year 2 Year 3 Year 4 Year 5 $5,513 $6,861 $6,576 $894 $18,440 Please enter your answer to the nearest cent. Question 13 4 pts Gwenyth just purchased a bond for $1,230 that has a maturity of 19 years and a coupon interest rate of 5.00%, paid annually. What is the yield-to-maturity (YTM) of the $1,000 face value bond that she purchased? Question 14 4 pts Micron issues a 7.74% coupon bond with a maturity of 9 years which makes monthly interest payments. The face value of the bond, payable at maturity, is $1,000. What is the value of this bond if your required rate of return is 6.07%. Please enter your answer to the nearest cent. Question 15 4 pts What is the yield-to-maturity (YTM) of a bond that has a current price of $889, coupon rate of 6.96%, $1,000 par value, interest paid semi-annually, and 24 years to maturity

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started