Answered step by step

Verified Expert Solution

Question

1 Approved Answer

would like help understanding how to calculate the attached Exercise 16-30 After-Tax Cash Flows (Section 2) (LO 16-4) Daly Publishing Corporation recently purchased a truck

would like help understanding how to calculate the attached

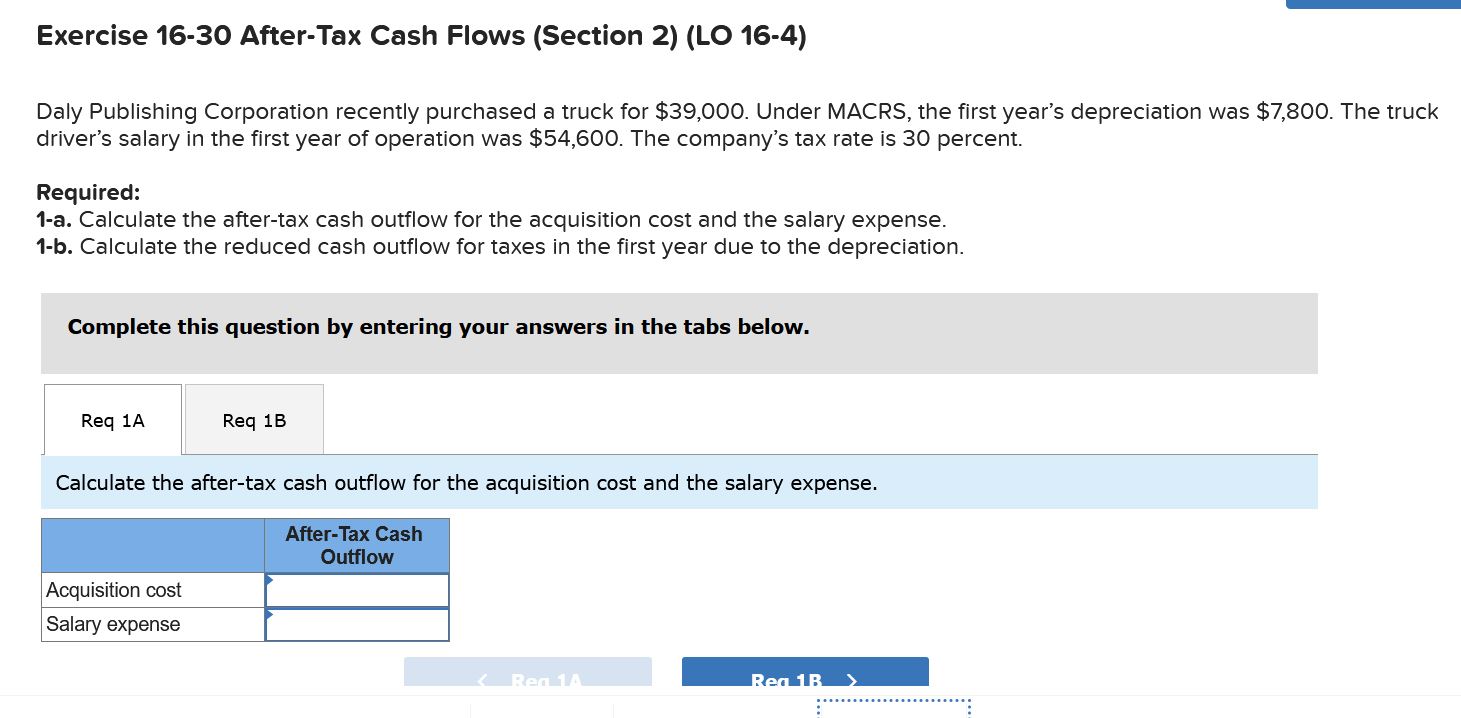

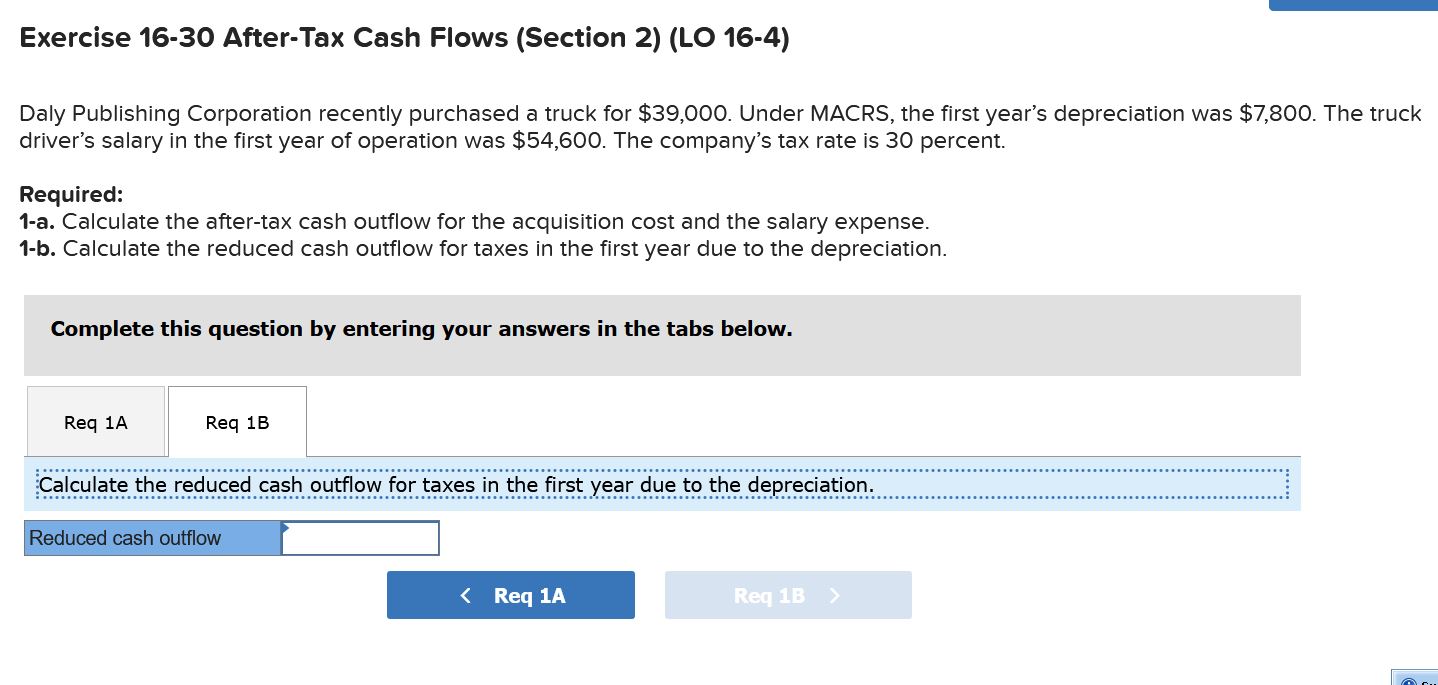

Exercise 16-30 After-Tax Cash Flows (Section 2) (LO 16-4) Daly Publishing Corporation recently purchased a truck for $39,000. Under MACRS, the first year's depreciation was $7,800. The truck driver's salary in the first year of operation was $54,600. The company's tax rate is 30 percent. Required: I-a. Calculate the after-tax cash outflow for the acquisition cost and the salary expense. I-b. Calculate the reduced cash outflow for taxes in the first year due to the depreciation. Complete this question by entering your answers in the tabs below. Req IA Req 1B Calculate the after-tax cash outflow for the acquisition cost and the salary expense. After-Tax Cash Outflow Acquisition cost Salary expense

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started