Would really need help with this assignment as I lost all my notes. Thank you!!

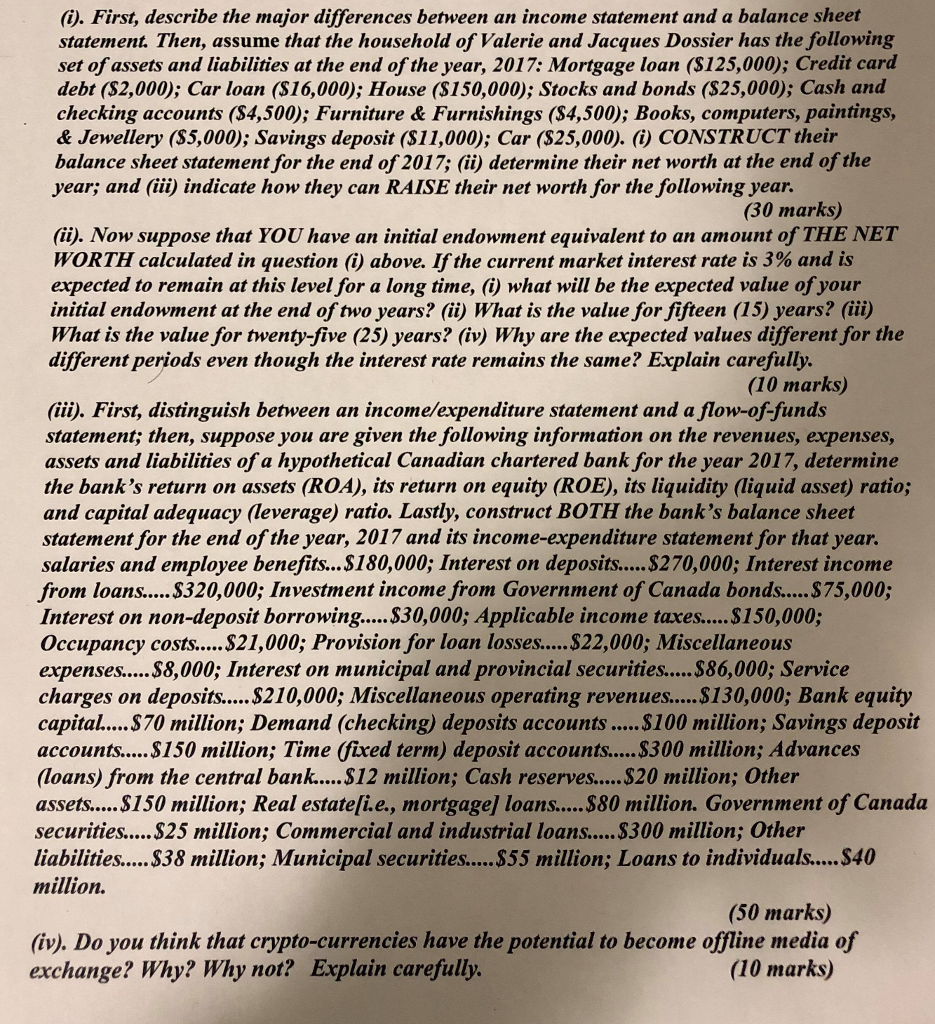

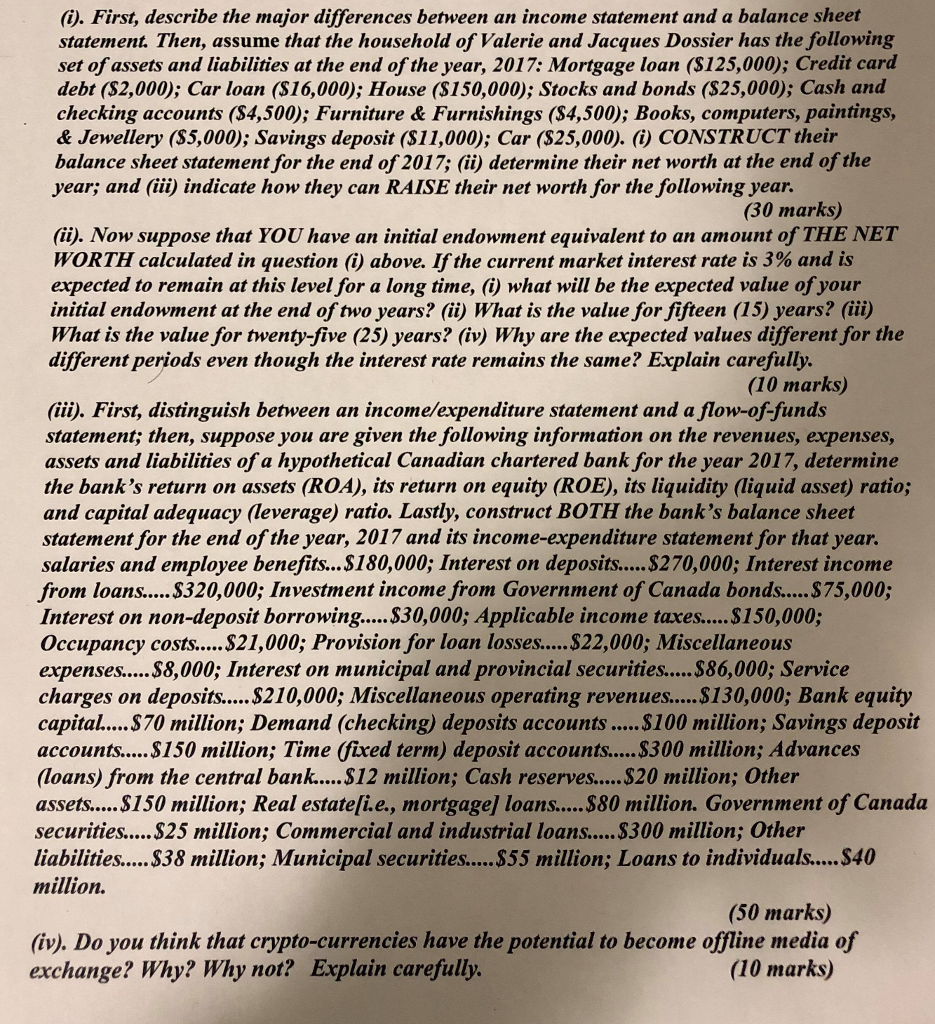

(i. First, describe the major differences between an income statement and a balance sheet statement. Then, assume that the household of Valerie and Jacques Dossier has the following set of assets and liabilities at the end of the year, 2017: Mortgage loan (S125,000); Credit card debt (S2,000); Car loan (S16,000); House (S150,000); Stocks and bonds (S25,000); Cash and checking accounts ($4,500); Furniture & Furnishings (S4,500); Books, computers, pa ih & Jewellery ($5,000); Savings deposit ($11,000); Car ($25,000), (i) CONSTRUCT their balance sheet statement for the end of 2017; (ii) determine their net worth at the end of the year; and (iii) indicate how they can RAISE their net worth for the following year (30 marks) (i). Now suppose that YOU have an initial endowment equivalent to an amount of THE NET WORTH calculated in question (i) above. If the current market interest rate is 3% and is expected to remain at this level for a long time, (i) what will be the expected value of your initial endowment at the end of two years? (ii) What is the value for fifteen (15) years? (i) What is the value for twenty-five (25) years? (iv) Why are the expected values different for the different periods even though the interest rate remains the same? Explain carefu (10 marks) (iii). First, distinguish between an income/expenditure statement and a flow-of-funds statement; then, suppose you are given the following information on the revenues, expenses assets and liabilities of a hypothetical Canadian chartered bank for the year 2017, determine the bank's return on assets (ROA), its return on equity (ROE), its liquidity (liquid asset) ratio; and capital adequacy (leverage) ratio. Lastly, construct BOTH the ban statement for the end of the year, 2017 and its income-expenditure statement for that year. salaries and employee benefits...S180,000; Interest on deposits..... $270,000; Interest income from loansS320,000; Investment income from Government of Canada bonds.... $75,000; Interest on non-deposit borrowing.. $30,000; Applicable income taxes....$150,000; Occupancy costs.... S21,000; Provision for loan losses..... $22,000; Miscellaneous expenses.....$8,000; Interest on municipal and provincial securities....S86,000; Service charges on deposits....$210,000; Miscellaneous operating revenues....$130,000; Bank equity capital.... S70 million; Demand (checking) deposits accounts..$100 million; Savings deposit (loans) from the central bank....S12 million; Cash reserves....$20 million; Other assets.... S150 million; Real estateli.e., mortgage] loans.... S80 million. Government of Canada securities.....S25 million; Commercial and industrial loans.... $300 million; Other million. (50 marks) (iv). Do you think that crypto-currencies have the potential to become offline media of exchange? Why? Why not? Explain carefully (10 marks) (i. First, describe the major differences between an income statement and a balance sheet statement. Then, assume that the household of Valerie and Jacques Dossier has the following set of assets and liabilities at the end of the year, 2017: Mortgage loan (S125,000); Credit card debt (S2,000); Car loan (S16,000); House (S150,000); Stocks and bonds (S25,000); Cash and checking accounts ($4,500); Furniture & Furnishings (S4,500); Books, computers, pa ih & Jewellery ($5,000); Savings deposit ($11,000); Car ($25,000), (i) CONSTRUCT their balance sheet statement for the end of 2017; (ii) determine their net worth at the end of the year; and (iii) indicate how they can RAISE their net worth for the following year (30 marks) (i). Now suppose that YOU have an initial endowment equivalent to an amount of THE NET WORTH calculated in question (i) above. If the current market interest rate is 3% and is expected to remain at this level for a long time, (i) what will be the expected value of your initial endowment at the end of two years? (ii) What is the value for fifteen (15) years? (i) What is the value for twenty-five (25) years? (iv) Why are the expected values different for the different periods even though the interest rate remains the same? Explain carefu (10 marks) (iii). First, distinguish between an income/expenditure statement and a flow-of-funds statement; then, suppose you are given the following information on the revenues, expenses assets and liabilities of a hypothetical Canadian chartered bank for the year 2017, determine the bank's return on assets (ROA), its return on equity (ROE), its liquidity (liquid asset) ratio; and capital adequacy (leverage) ratio. Lastly, construct BOTH the ban statement for the end of the year, 2017 and its income-expenditure statement for that year. salaries and employee benefits...S180,000; Interest on deposits..... $270,000; Interest income from loansS320,000; Investment income from Government of Canada bonds.... $75,000; Interest on non-deposit borrowing.. $30,000; Applicable income taxes....$150,000; Occupancy costs.... S21,000; Provision for loan losses..... $22,000; Miscellaneous expenses.....$8,000; Interest on municipal and provincial securities....S86,000; Service charges on deposits....$210,000; Miscellaneous operating revenues....$130,000; Bank equity capital.... S70 million; Demand (checking) deposits accounts..$100 million; Savings deposit (loans) from the central bank....S12 million; Cash reserves....$20 million; Other assets.... S150 million; Real estateli.e., mortgage] loans.... S80 million. Government of Canada securities.....S25 million; Commercial and industrial loans.... $300 million; Other million. (50 marks) (iv). Do you think that crypto-currencies have the potential to become offline media of exchange? Why? Why not? Explain carefully (10 marks)