Would someone be able to help me with example #1 ? Thank you.

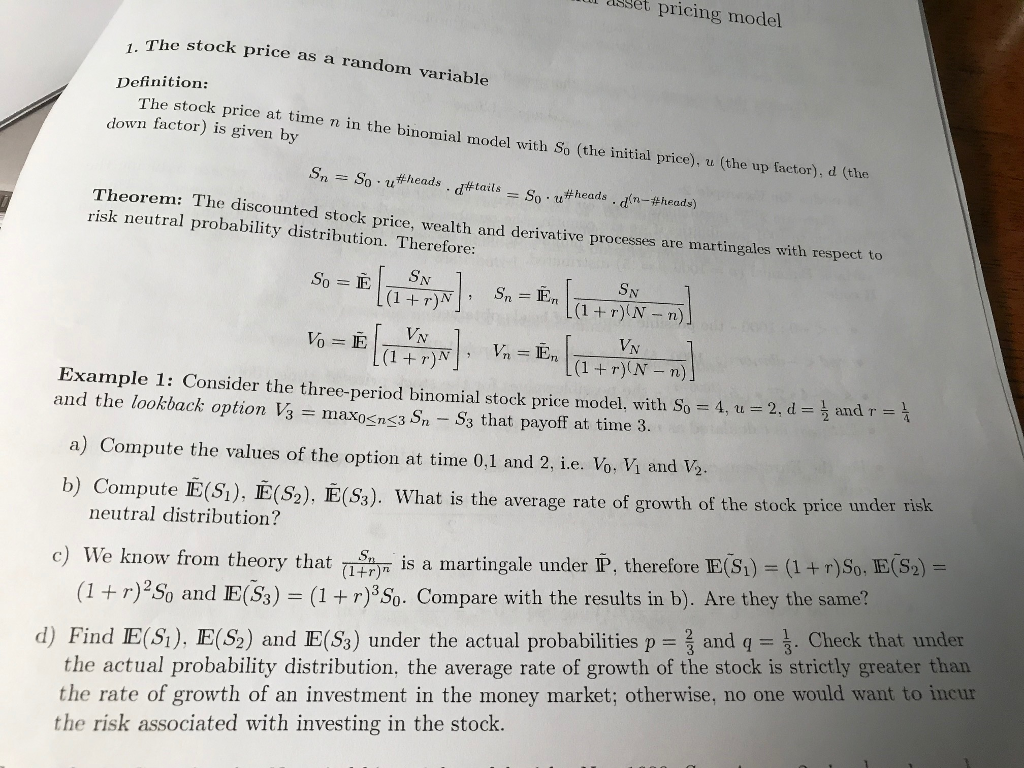

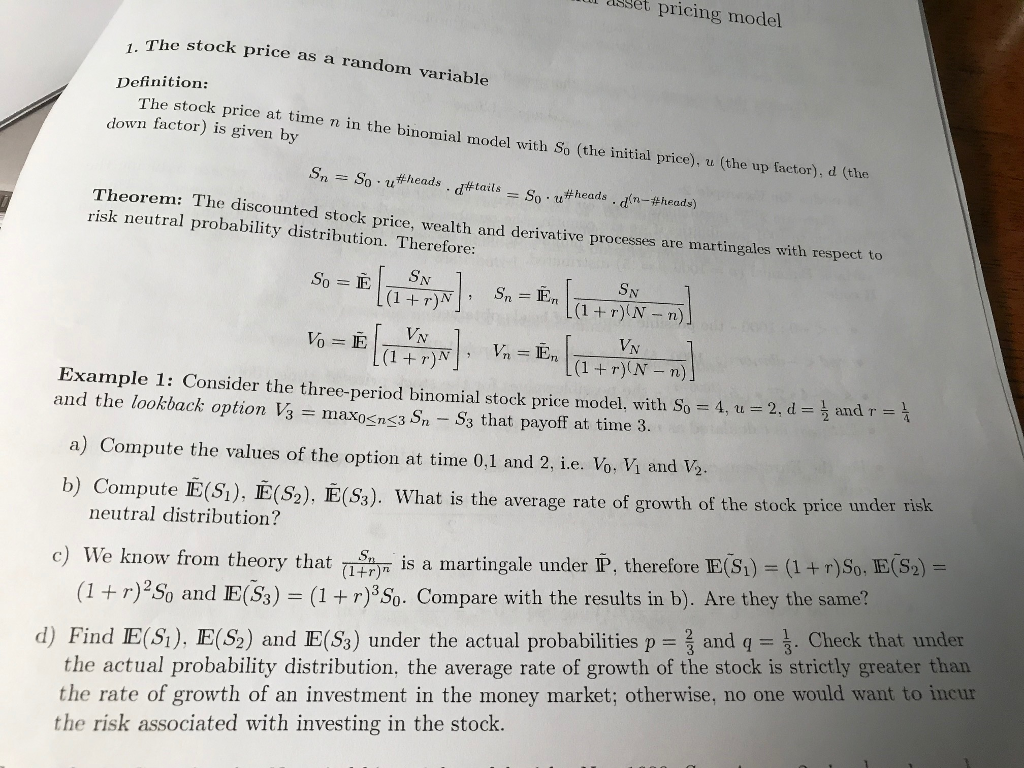

asset pricing model 1. The stock price as a random variable Definition: The stock price at time n in the binomial model with So (the initial price), u (the up factor), d (the down factor) is given by Theorem: The discounted stock price, wealth and derivative processes are martingales with respect to risk neutral probability distribution. Therefore: SN (1 + r)N] , v,-En l(1 + r)(N-n) Example 1: Consider the three-period binomial stock price model, with So 4, u 2, d and the lookback option V3 maxosng3 Sn S3 that payoff at time 3. and r a) Compute the values of the option at time 0,1 and 2, i.e. Vo. Vi and V2. b) Compute E(s). E), E( 3) What is the average rate of growth of the stock price under risk neutral distribution? c) We know from theory thati a martingale under P, therefore E(s) (+r)So. E(S2) (1 +r)2So and E(S3) 1)3So. Compare with the results in b). Are they the same? and q. Check that under the actual probability distribution, the average rate of growth of the stock is strictly greater than the rate of growth of an investment in the money market; otherwise, no one would want to incur the risk associated with investing in the stock. d) Find E(S). E(S2) and IE(S3) under the actual probabilities p asset pricing model 1. The stock price as a random variable Definition: The stock price at time n in the binomial model with So (the initial price), u (the up factor), d (the down factor) is given by Theorem: The discounted stock price, wealth and derivative processes are martingales with respect to risk neutral probability distribution. Therefore: SN (1 + r)N] , v,-En l(1 + r)(N-n) Example 1: Consider the three-period binomial stock price model, with So 4, u 2, d and the lookback option V3 maxosng3 Sn S3 that payoff at time 3. and r a) Compute the values of the option at time 0,1 and 2, i.e. Vo. Vi and V2. b) Compute E(s). E), E( 3) What is the average rate of growth of the stock price under risk neutral distribution? c) We know from theory thati a martingale under P, therefore E(s) (+r)So. E(S2) (1 +r)2So and E(S3) 1)3So. Compare with the results in b). Are they the same? and q. Check that under the actual probability distribution, the average rate of growth of the stock is strictly greater than the rate of growth of an investment in the money market; otherwise, no one would want to incur the risk associated with investing in the stock. d) Find E(S). E(S2) and IE(S3) under the actual probabilities p