Would this be considered a good balance and income statement for a company?

Would this be considered a good balance and income statement for a company?

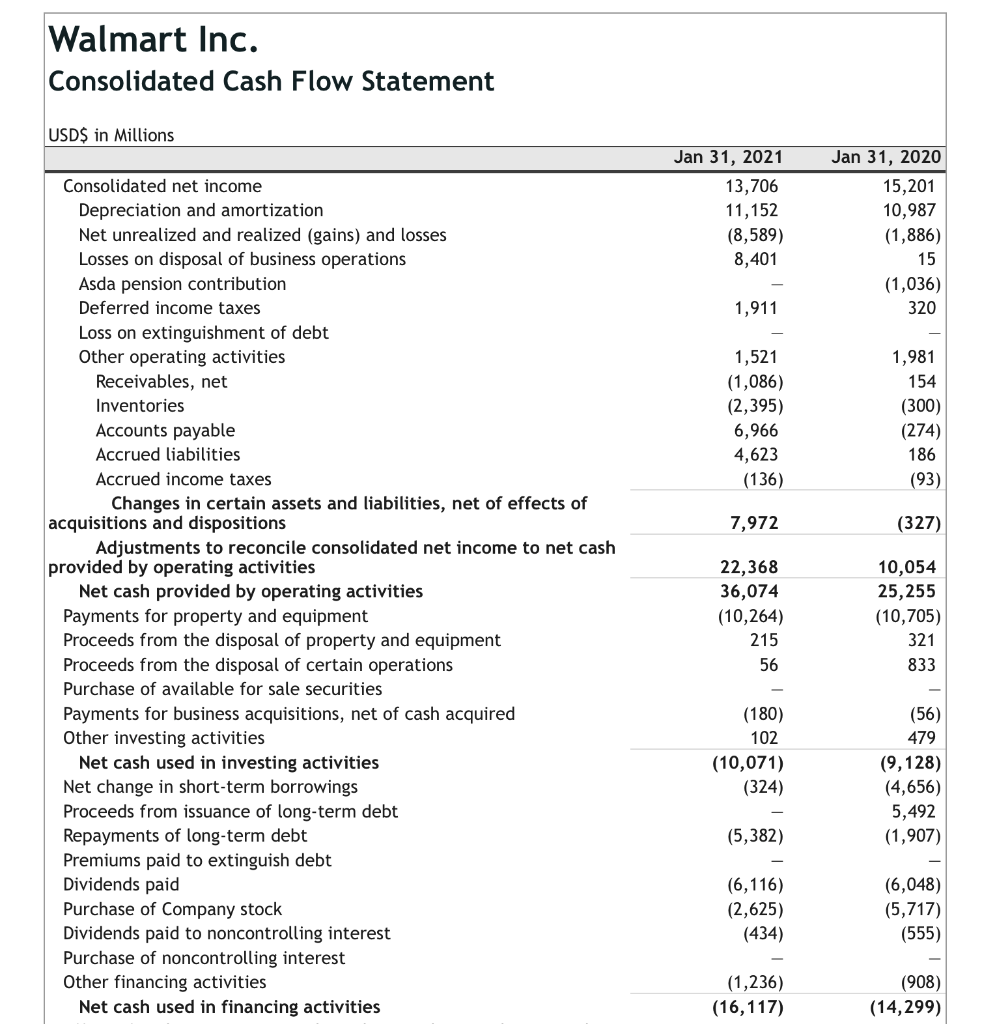

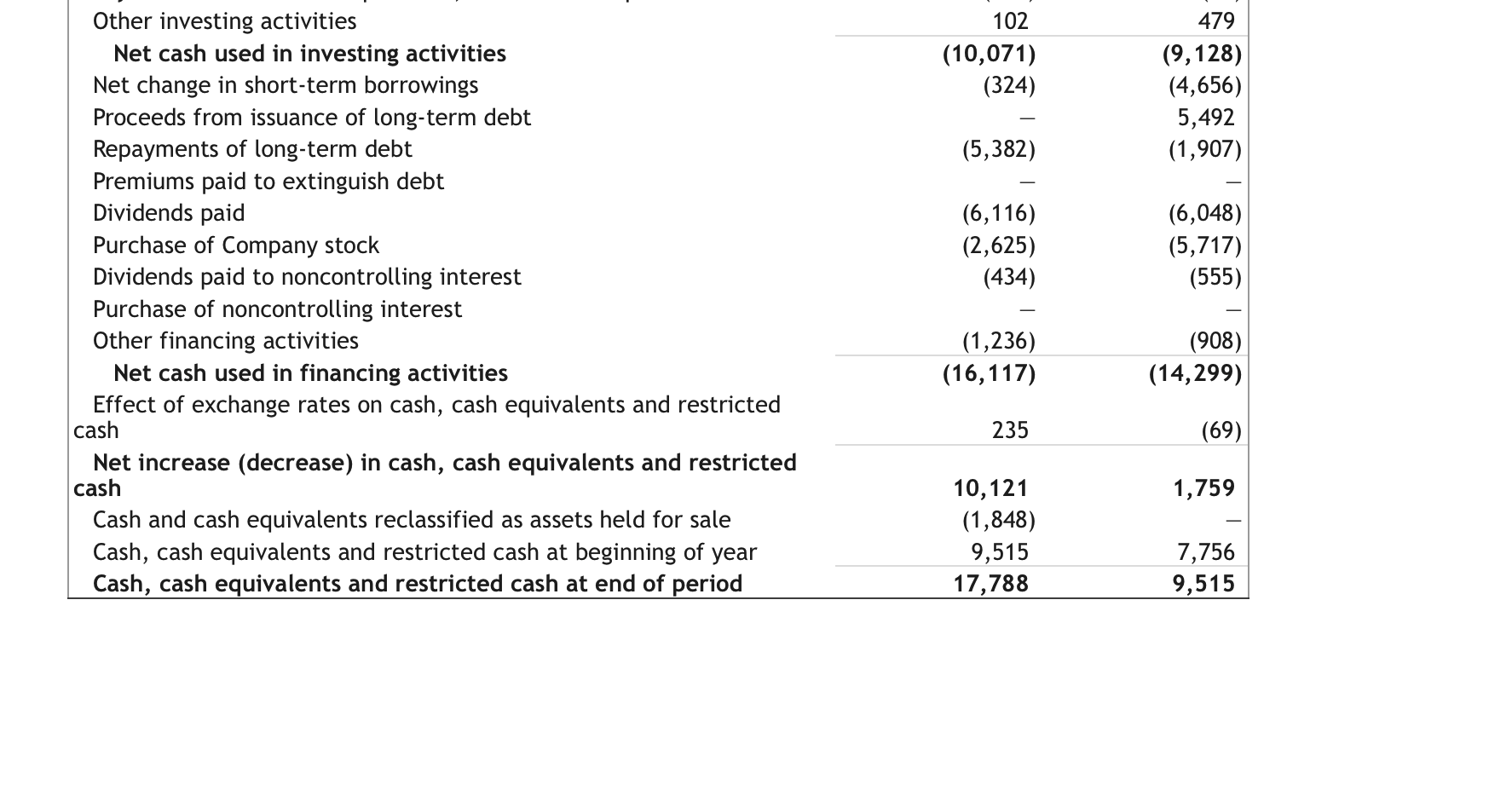

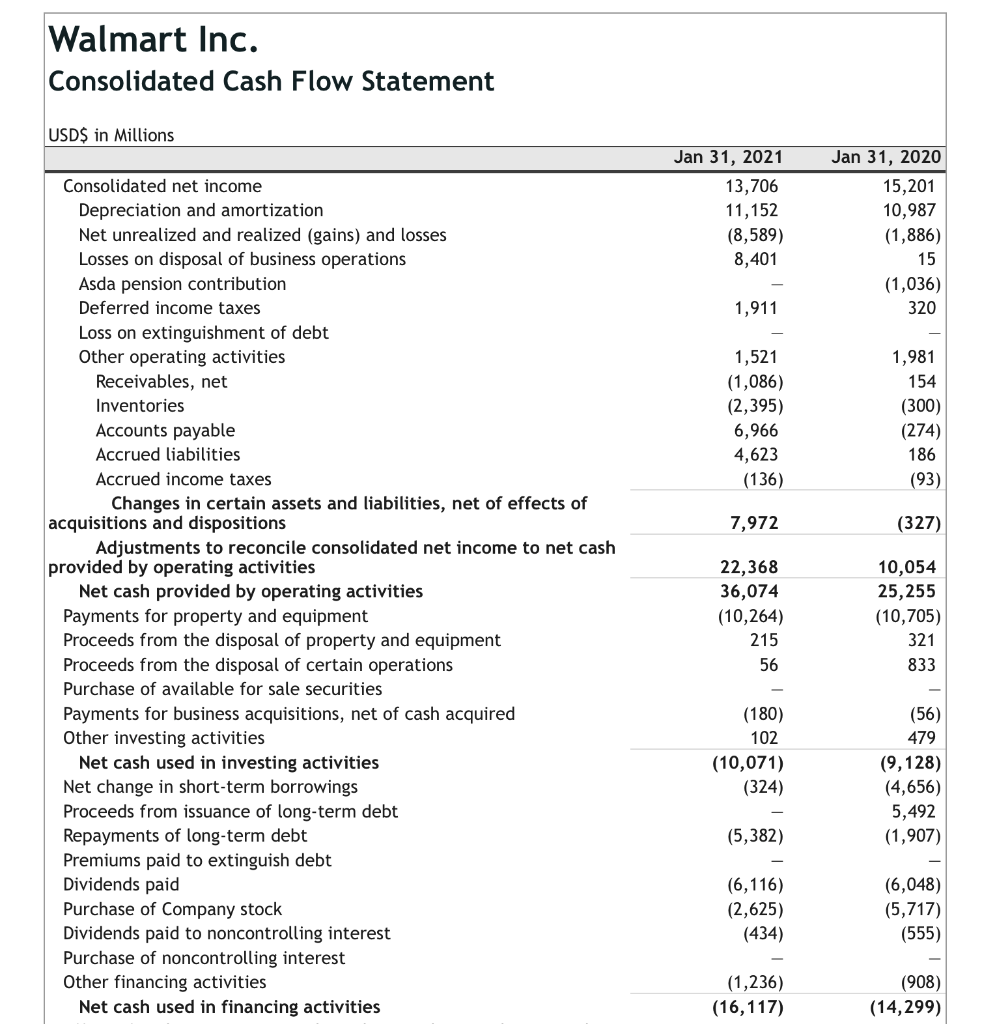

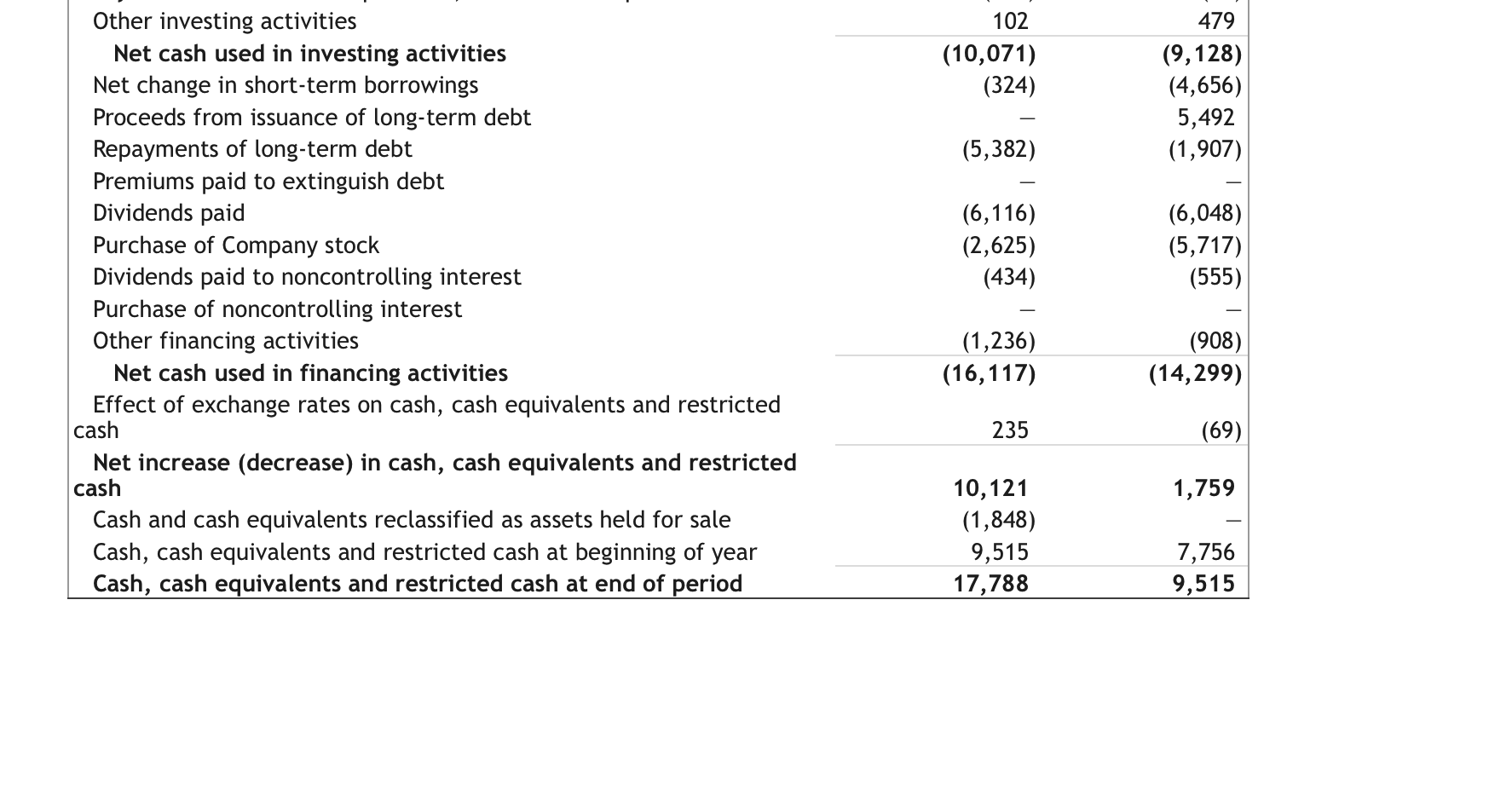

Walmart Inc. Consolidated Cash Flow Statement USD$ in Millions Jan 31, 2021 13,706 11,152 (8,589) 8,401 Jan 31, 2020 15,201 10,987 (1,886) 15 (1,036) 320 1,911 1,521 (1,086) (2,395) 6,966 4,623 (136) 1,981 154 (300) (274) 186 (93) 7,972 (327) Consolidated net income Depreciation and amortization Net unrealized and realized (gains) and losses Losses on disposal of business operations Asda pension contribution Deferred income taxes Loss on extinguishment of debt Other operating activities Receivables, net Inventories Accounts payable Accrued liabilities Accrued income taxes Changes in certain assets and liabilities, net of effects of acquisitions and dispositions Adjustments to reconcile consolidated net income to net cash provided by operating activities Net cash provided by operating activities Payments for property and equipment Proceeds from the disposal of property and equipment Proceeds from the disposal of certain operations Purchase of available for sale securities Payments for business acquisitions, net of cash acquired Other investing activities Net cash used in investing activities Net change in short-term borrowings Proceeds from issuance of long-term debt Repayments of long-term debt Premiums paid to extinguish debt Dividends paid Purchase of Company stock Dividends paid to noncontrolling interest Purchase of noncontrolling interest Other financing activities Net cash used in financing activities 22,368 36,074 (10,264) 215 56 10,054 25,255 (10,705) 321 833 (180) 102 (10,071) (324) (56) 479 (9,128) (4,656) 5,492 (1,907) (5,382) (6,116) (2,625) (434) (6,048) (5,717) (555) (1,236) (16,117) (908) (14,299) 102 (10,071) (324) 479 (9,128) (4,656) 5,492 (1,907) (5,382) (6,116) (2,625) (434) (6,048) (5,717) (555) Other investing activities Net cash used in investing activities Net change in short-term borrowings Proceeds from issuance of long-term debt Repayments of long-term debt Premiums paid to extinguish debt Dividends paid Purchase of Company stock Dividends paid to noncontrolling interest Purchase of noncontrolling interest Other financing activities Net cash used in financing activities Effect of exchange rates on cash, cash equivalents and restricted cash Net increase (decrease) in cash, cash equivalents and restricted cash Cash and cash equivalents reclassified as assets held for sale Cash, cash equivalents and restricted cash at beginning of year Cash, cash equivalents and restricted cash at end of period (1,236) (16,117) (908) (14,299) 235 (69) 1,759 10,121 (1,848) 9,515 17,788 7,756 9,515 Walmart Inc. Consolidated Cash Flow Statement USD$ in Millions Jan 31, 2021 13,706 11,152 (8,589) 8,401 Jan 31, 2020 15,201 10,987 (1,886) 15 (1,036) 320 1,911 1,521 (1,086) (2,395) 6,966 4,623 (136) 1,981 154 (300) (274) 186 (93) 7,972 (327) Consolidated net income Depreciation and amortization Net unrealized and realized (gains) and losses Losses on disposal of business operations Asda pension contribution Deferred income taxes Loss on extinguishment of debt Other operating activities Receivables, net Inventories Accounts payable Accrued liabilities Accrued income taxes Changes in certain assets and liabilities, net of effects of acquisitions and dispositions Adjustments to reconcile consolidated net income to net cash provided by operating activities Net cash provided by operating activities Payments for property and equipment Proceeds from the disposal of property and equipment Proceeds from the disposal of certain operations Purchase of available for sale securities Payments for business acquisitions, net of cash acquired Other investing activities Net cash used in investing activities Net change in short-term borrowings Proceeds from issuance of long-term debt Repayments of long-term debt Premiums paid to extinguish debt Dividends paid Purchase of Company stock Dividends paid to noncontrolling interest Purchase of noncontrolling interest Other financing activities Net cash used in financing activities 22,368 36,074 (10,264) 215 56 10,054 25,255 (10,705) 321 833 (180) 102 (10,071) (324) (56) 479 (9,128) (4,656) 5,492 (1,907) (5,382) (6,116) (2,625) (434) (6,048) (5,717) (555) (1,236) (16,117) (908) (14,299) 102 (10,071) (324) 479 (9,128) (4,656) 5,492 (1,907) (5,382) (6,116) (2,625) (434) (6,048) (5,717) (555) Other investing activities Net cash used in investing activities Net change in short-term borrowings Proceeds from issuance of long-term debt Repayments of long-term debt Premiums paid to extinguish debt Dividends paid Purchase of Company stock Dividends paid to noncontrolling interest Purchase of noncontrolling interest Other financing activities Net cash used in financing activities Effect of exchange rates on cash, cash equivalents and restricted cash Net increase (decrease) in cash, cash equivalents and restricted cash Cash and cash equivalents reclassified as assets held for sale Cash, cash equivalents and restricted cash at beginning of year Cash, cash equivalents and restricted cash at end of period (1,236) (16,117) (908) (14,299) 235 (69) 1,759 10,121 (1,848) 9,515 17,788 7,756 9,515

Would this be considered a good balance and income statement for a company?

Would this be considered a good balance and income statement for a company?