would this T account be correct based on the jnformation fiven for direct write off method?

fill in the blanks:

allowance information

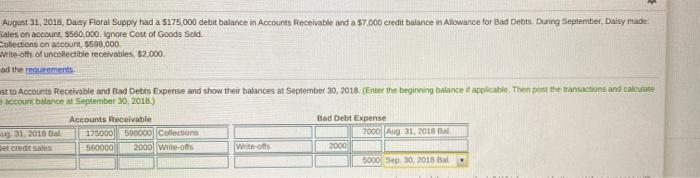

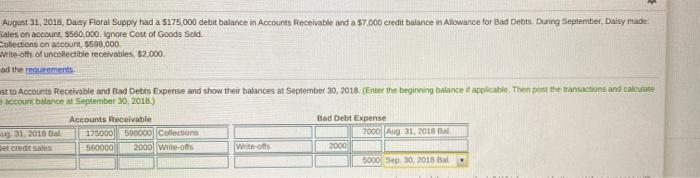

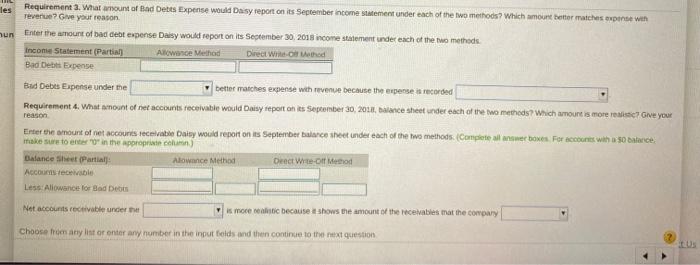

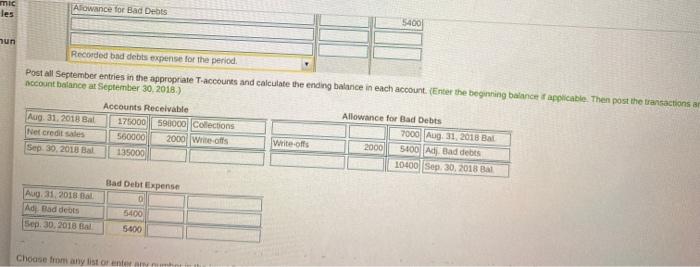

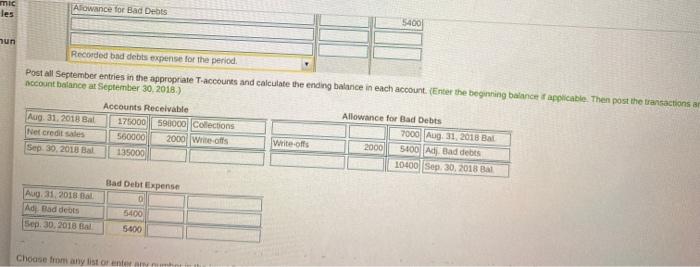

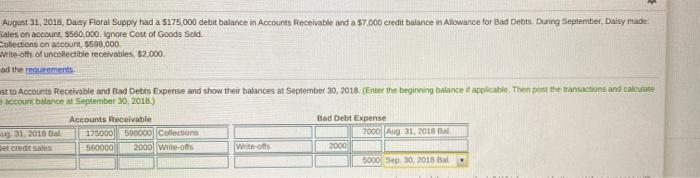

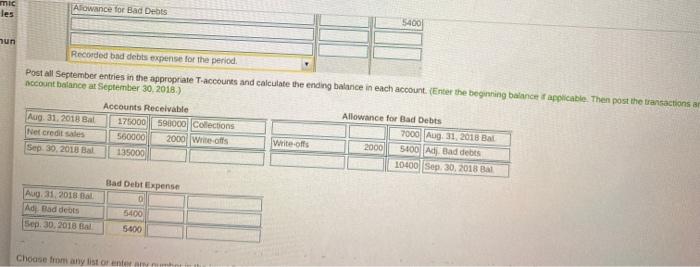

August 31, 2018, Daisy Floral Supply had a $175.000 debit balance in Accounts Receivable and a $7.000 credit balance in Allowance for Bad Debts. During September, Daisy made Sales on account, $560,000. Ignore Cost of Goods Sold Collections on account, 5598,000. Write-olisot uncollectible receivables $2.000 ad the regurements Sto Accounts Receivable and Bad Debts Expense and show their balances at September 30, 2018. (Enter the beginning balance applicable. The post the transactions and calculate account balance at September 30, 2018.) Accounts Receivable Bad Debt Expense - 31, 2018 Bal 175000 598000 Collections 7000 AUD 31, 2018 M et credit sales 560000 2000 Wite-ott's Write-otts 2000 5000 S 30, 2018 Bu les hun Requirement 3. What amount of Bad Debts Expense would Daisy report on its September income statement under each of the two methods? Which mount better matches were with Tevenue? Give your reason Enter the amount of bad debt expense Daisy would report on its September 30, 2015 income statement under each of the two methods Income Statement (Partial Alwce Method Direct weethod Bad Debit Expense Bad Debts Expense under the better matches expense with revenue because the expense is recorded Requirements. What amount of net accounts receivable would Daisy report on its September 30, 2016. balance sheet under each of the two methods? Which amount is more realise Give your reason Enter ere anourt of niet accounts receivable Daisy would report on September balance sheet under each of the two methods. (Complete all answer boxes. For accounts with a $0 baterice Make sure to enter in the appropriate column) Balance Sheet(Partial Allowance Method Denet Wire-O Mod Accountable Less Allowance for Bod Deos Net accounts receivable under the is more because shows the amount of the receivable at the company Choose any list or enter any number in the input folds and then continue to the question mic les Alowance for Bad Deats 54001 hun Recorded bad debts expense for the period Post all September entries in the appropriate Taccounts and calculate the ending balance in each account. (Enter the beginning balance applicable. Then post the transactions an account balance at September 30, 2018.) Accounts Receivable Allowance for Bad Debts Aug 31, 2018 Bal 175000 590000 Collections 7000 Aug 31, 2018 Bal Net credit sales 560000 2000 Write offs Write-off's 2000 5100 Ad Bad debts Sep 30, 2018 Bal 135000 10400 Sep 30, 2018 B Bad Debt Expense Aug 31, 2018 al ING Bad debts Sep 30, 2018 Bal 5400 5.000 Choose from any list or enter