Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Would you answers these 3 Qs Please ASAP. Thank You! The phenomenon called multiple internal rates of return arises when the project manager assumes cash

Would you answers these 3 Qs Please ASAP. Thank You!

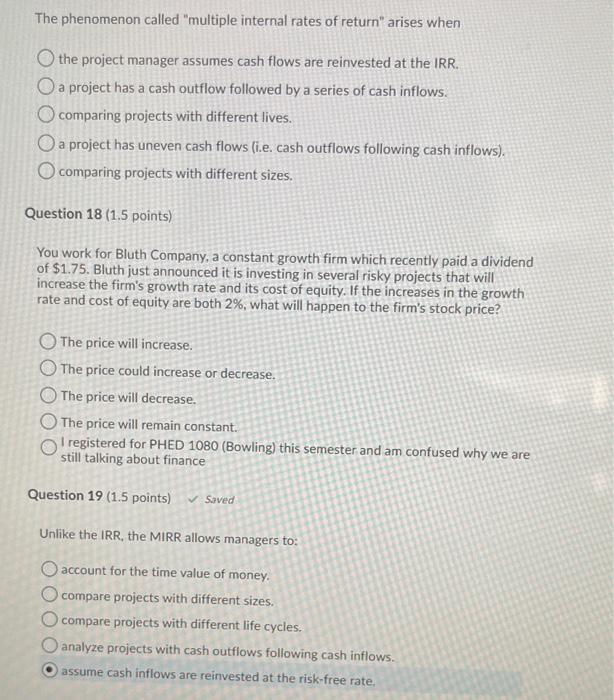

The phenomenon called "multiple internal rates of return" arises when the project manager assumes cash flows are reinvested at the IRR. O a project has a cash outflow followed by a series of cash inflows. O comparing projects with different lives. O a project has uneven cash flows (i.e. cash outflows following cash inflows). O comparing projects with different sizes. Question 18 (1.5 points) You work for Bluth Company, a constant growth firm which recently paid a dividend of $1.75. Bluth just announced it is investing in several risky projects that will increase the firm's growth rate and its cost of equity. If the increases in the growth rate and cost of equity are both 2%, what will happen to the firm's stock price? The price will increase. The price could increase or decrease. The price will decrease. The price will remain constant. 1 registered for PHED 1080 (Bowling) this semester and am confused why we are still talking about finance Question 19 (1.5 points) Saved Unlike the IRR, the MIRR allows managers to: account for the time value of money. compare projects with different sizes. O compare projects with different life cycles. O analyze projects with cash outflows following cash inflows. assume cash inflows are reinvested at the risk-free rate

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started