Answered step by step

Verified Expert Solution

Question

1 Approved Answer

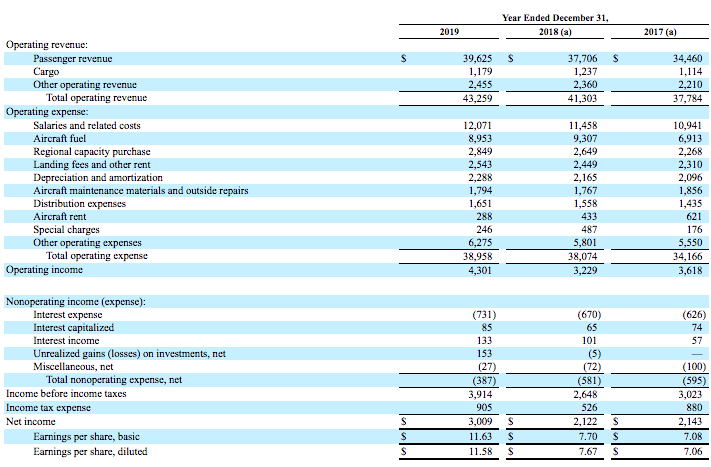

Would you consider this weak or strong? Why? Year Ended December 31, 2018 (a) 2019 2017 (a) $ 39,625 1,179 2,455 43,259 37,706 1,237 2,360

Would you consider this weak or strong? Why?

Year Ended December 31, 2018 (a) 2019 2017 (a) $ 39,625 1,179 2,455 43,259 37,706 1,237 2,360 41,303 34,460 1.114 2,210 37,784 Operating revenue: Passenger revenue Cargo Other operating revenue Total operating revenue Operating expense: Salaries and related costs Aircraft fuel Regional capacity purchase Landing fees and other rent Depreciation and amortization Aircraft maintenance materials and outside repairs Distribution expenses Aircraft rent Special charges Other operating expenses Total operating expense Operating income 12,071 8,953 2,849 2,543 2,288 1,794 1,651 11,458 9,307 2,649 2,449 2,165 1,767 1,558 433 487 5,801 38,074 3,229 10,941 6,913 2,268 2,310 2,096 1,856 1,435 621 176 5,550 34,166 288 246 6,275 38,958 4,301 3,618 (626) 74 57 Nonoperating income (expense): Interest expense Interest capitalized Interest income Unrealized gains (losses) on investments, net Miscellaneous, net Total nonoperating expense, net Income before income taxes Income tax expense Net income Earnings per share, basic Earnings per share, diluted (731) 85 133 153 (27) (387) 3,914 905 3,009 11.63 11.98 (670) 65 101 (5) (72) (581) 2,648 526 2,122 7.70 7.67 (100) (595) 3,023 880 2,143 7.08 7.06 S S S S S S $ $ $Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started