Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Would you please type the solution and answer clearly ? Also, please solve all the questions! Mahon Corporation has two production departments, Casting and Customizing.

Would you please type the solution and answer clearly?

Also, please solve all the questions!

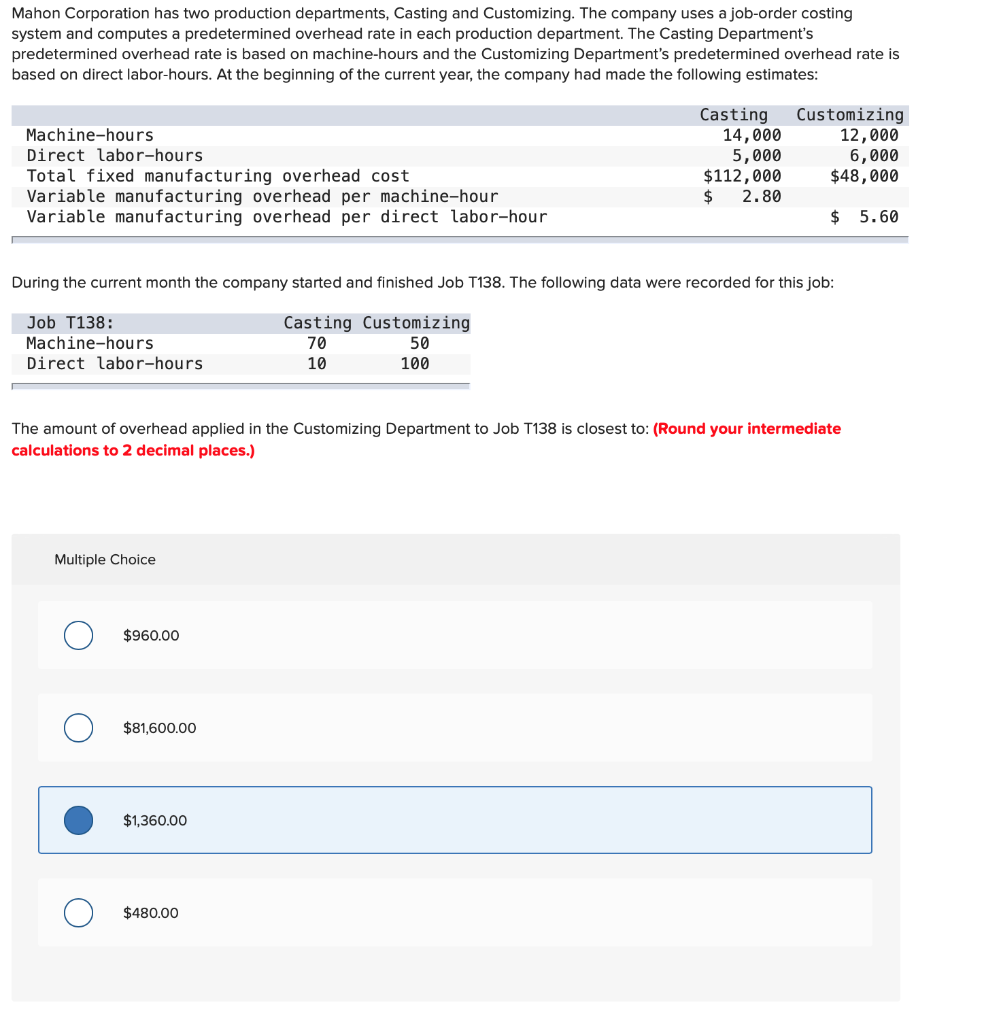

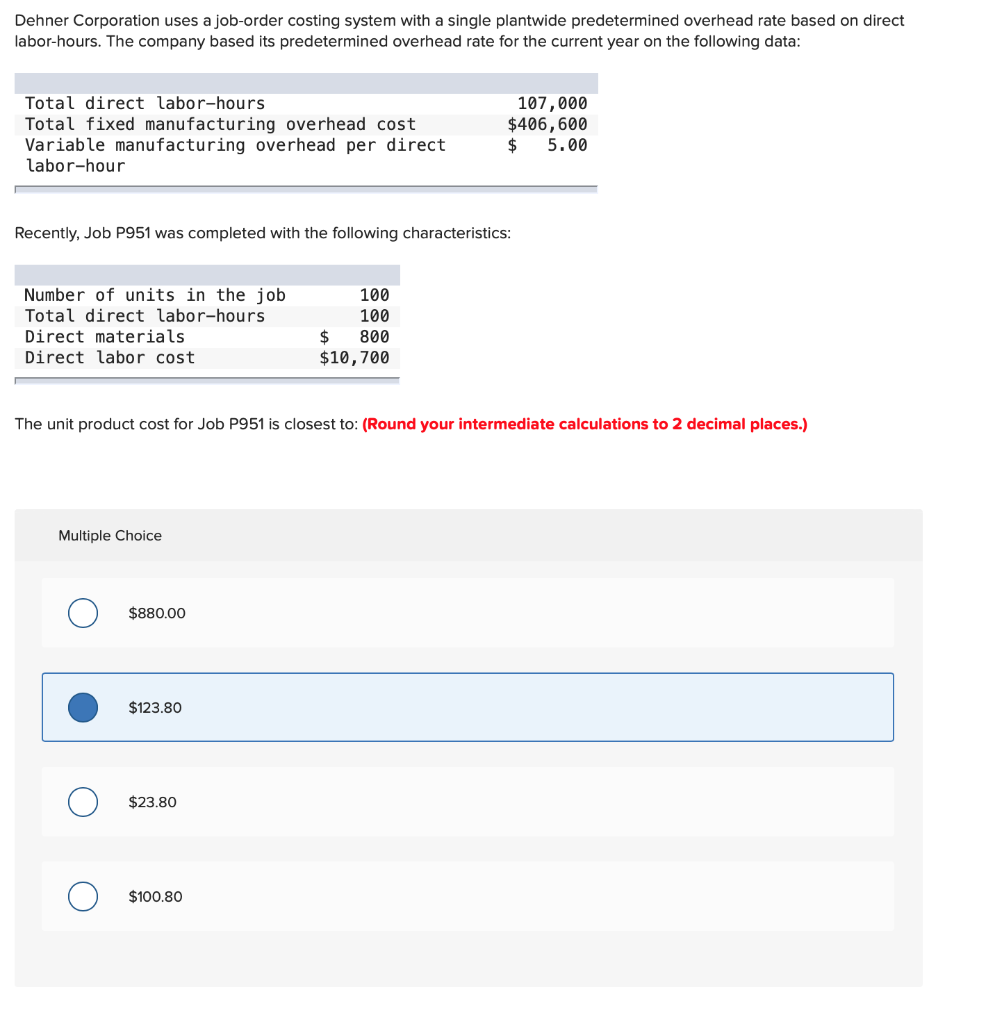

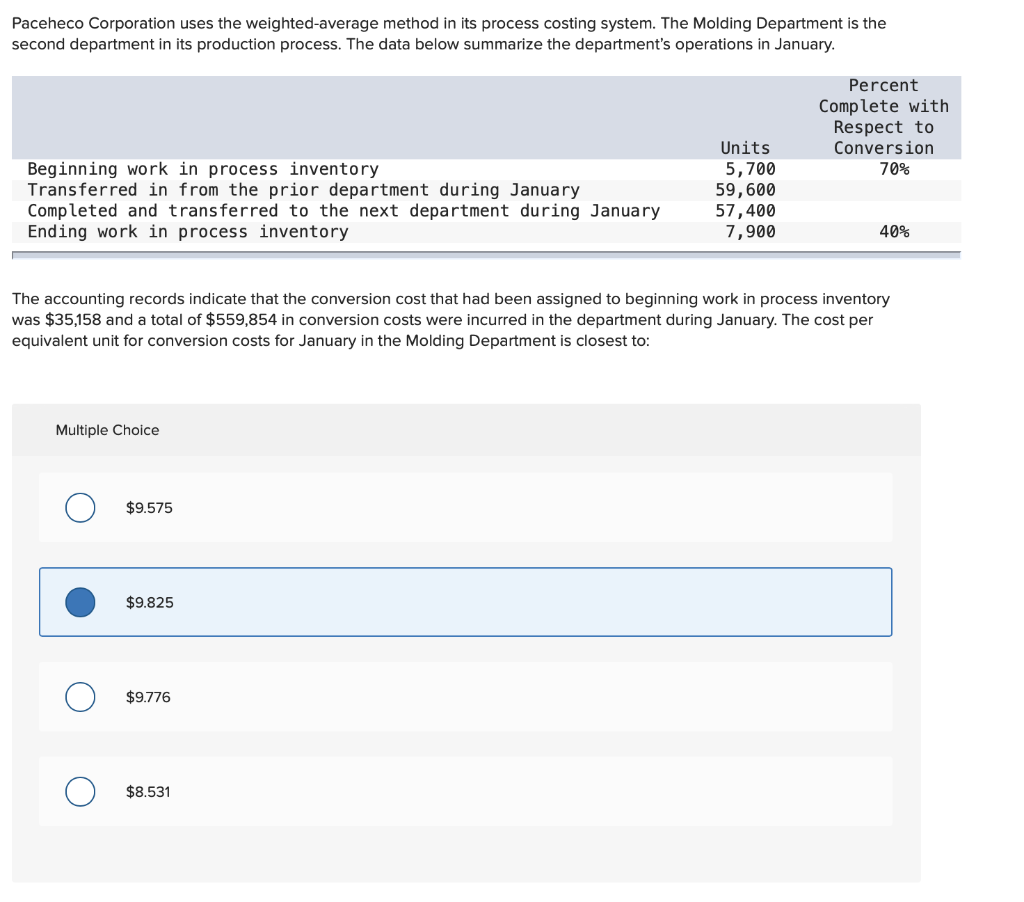

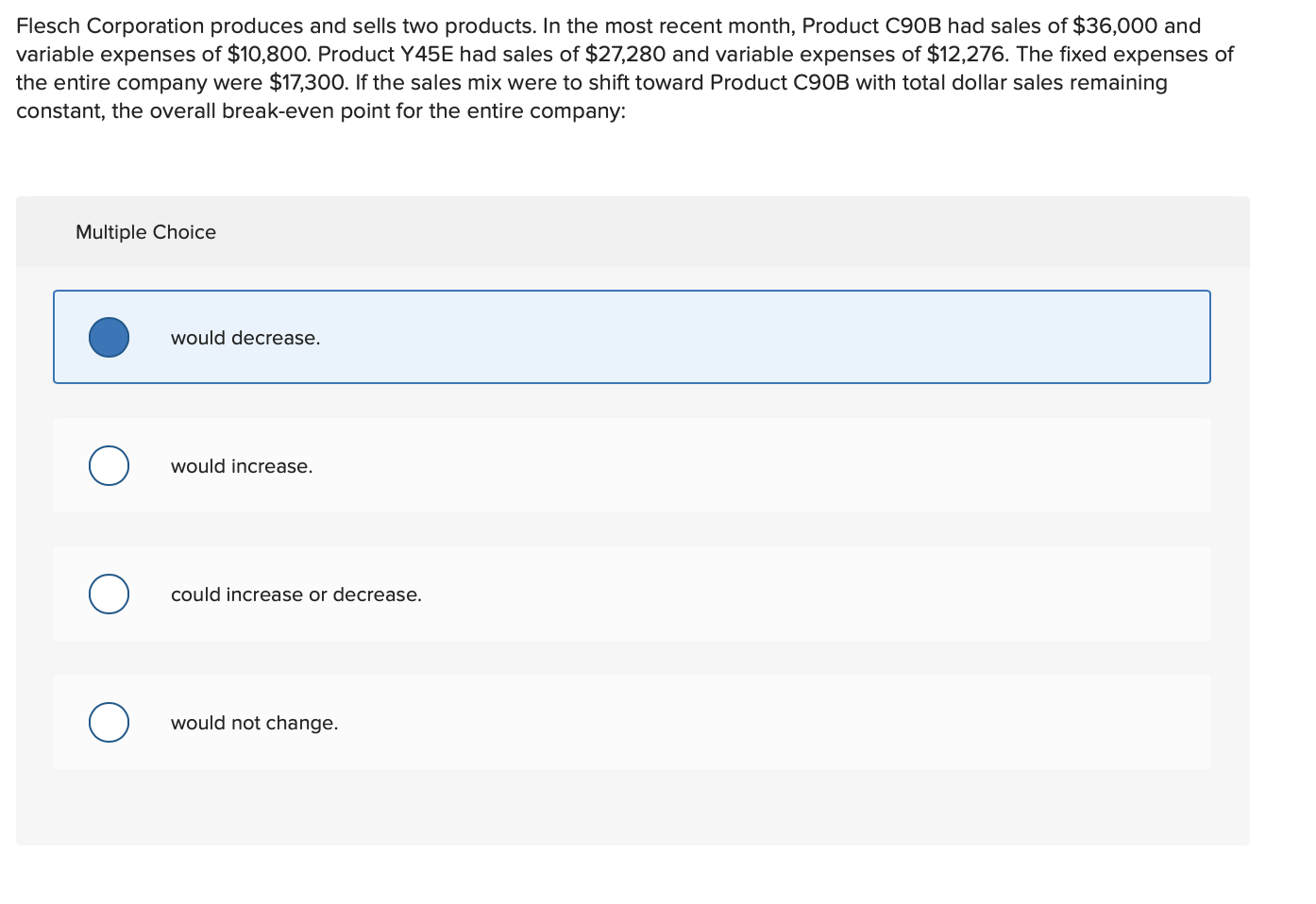

Mahon Corporation has two production departments, Casting and Customizing. The company uses a job-order costing system and computes a predetermined overhead rate in each production department. The Casting Department's predetermined overhead rate is based on machine-hours and the Customizing Department's predetermined overhead rate is based on direct labor-hours. At the beginning of the current year, the company had made the following estimates: Customizing 12,000 Casting 14,000 5,000 $112,000 $ 2.80 Machine-hours Direct labor-hours Total fixed manufacturing overhead cost Variable manufacturing overhead per machine-hour Variable manufacturing overhead per direct labor-hour 6,000 $48,000 $ 5.60 During the current month the company started and finished Job T138. The following data were recorded for this job: Job T138: Machine-hours Direct labor-hours Casting Customizing 70 50 10 100 The amount of overhead applied in the Customizing Department to Job T138 is closest to: (Round your intermediate calculations to 2 decimal places.) Multiple Choice $960.00 $81,600.00 $1,360.00 $480.00 Dehner Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on direct labor-hours. The company based its predetermined overhead rate for the current year on the following data: Total direct labor-hours Total fixed manufacturing overhead cost Variable manufacturing overhead per direct labor-hour 107,000 $406,600 $ 5.00 Recently, Job P951 was completed with the following characteristics: Number of units in the job Total direct labor-hours Direct materials Direct labor cost 100 100 $ 800 $10,700 The unit product cost for Job P951 is closest to: (Round your intermediate calculations to 2 decimal places.) Multiple Choice $880.00 $123.80 $23.80 $100.80 Paceheco Corporation uses the weighted average method in its process costing system. The Molding Department is the second department in its production process. The data below summarize the department's operations in January. Percent Complete with Respect to Conversion 70% Beginning work in process inventory Transferred in from the prior department during January Completed and transferred to the next department during January Ending work in process inventory Units 5,700 59,600 57,400 7,900 40% The accounting records indicate that the conversion cost that had been assigned to beginning work in process inventory was $35,158 and a total of $559,854 in conversion costs were incurred in the department during January. The cost per equivalent unit for conversion costs for January in the Molding Department is closest to: Multiple Choice $9.575 $9.825 O $9.776 O $8.531 Flesch Corporation produces and sells two products. In the most recent month, Product C90B had sales of $36,000 and variable expenses of $10,800. Product Y45E had sales of $27,280 and variable expenses of $12,276. The fixed expenses of the entire company were $17,300. If the sales mix were to shift toward Product C90B with total dollar sales remaining constant, the overall break-even point for the entire company: Multiple Choice would decrease. would increase. could increase or decrease. would not changeStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started