Question

Write a letter of proposal for CANNOLI, including hypothesis, objectives, and a proposed approach. Background Since its founding almost 100 years ago, CANNONI has been

Write a letter of proposal for CANNOLI, including hypothesis, objectives, and a proposed approach.

Background

Since its founding almost 100 years ago, CANNONI has been true to the philosophy that "only the highest quality is enough". As the traditional leader in the German preserved baked goods market, CANOLI enjoys a tremendous reputation with consumers. This year, CANNONI planned ?7.5 million investment in social media, TV, radio, and newspaper/magazine advertising will help ensure the company remains top of mind. In addition, 2019's ?50 million investment in new equipment will ensure CANNONI continues to sell top-quality products.

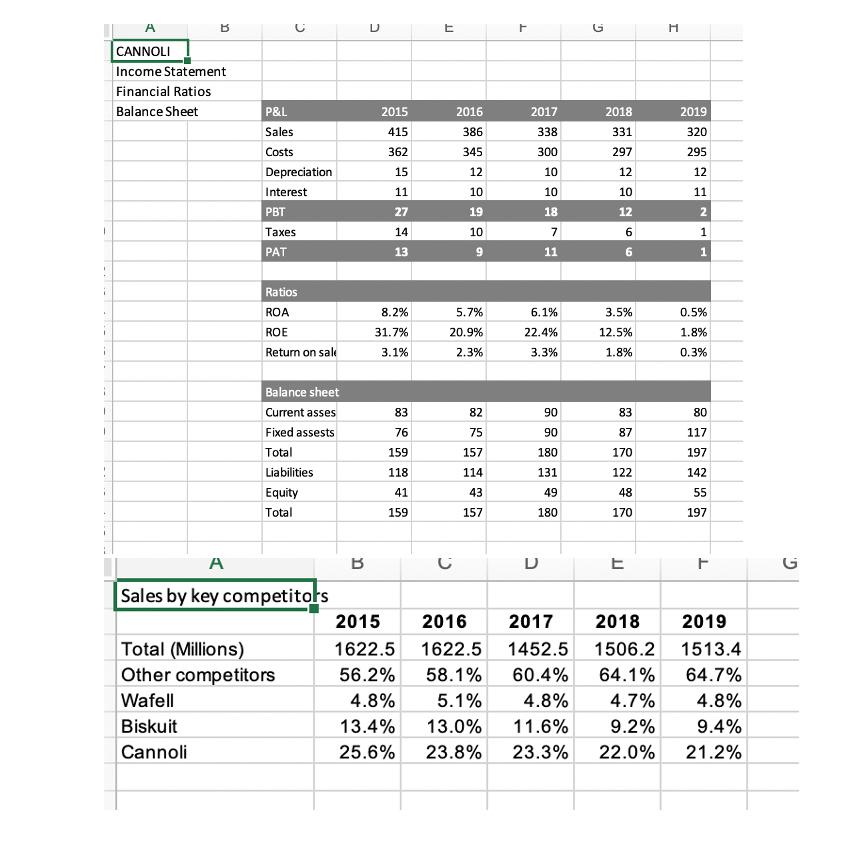

Despite its rich heritage and ongoing investments, CANNONIs performance has been declining since 2015. The company's dramatic decline in market share (from 25 percent in 2015 to 21.2 percent today) has driven down sales revenues by 23 percent and reduced CANNON'Is after-tax profit to a mere ?1 million. CANOLI's current 1.8 percent return on equity (down from a high of 31.7 percent in 2015) is unacceptable to shareholders, and they have requested an action plan to immediately improve performance. Exhibits 1 highlight the changes that have occurred over the past 5 years.This decline in CANNON's performance is due in large part to significant changes in the German sweet bakery products market.

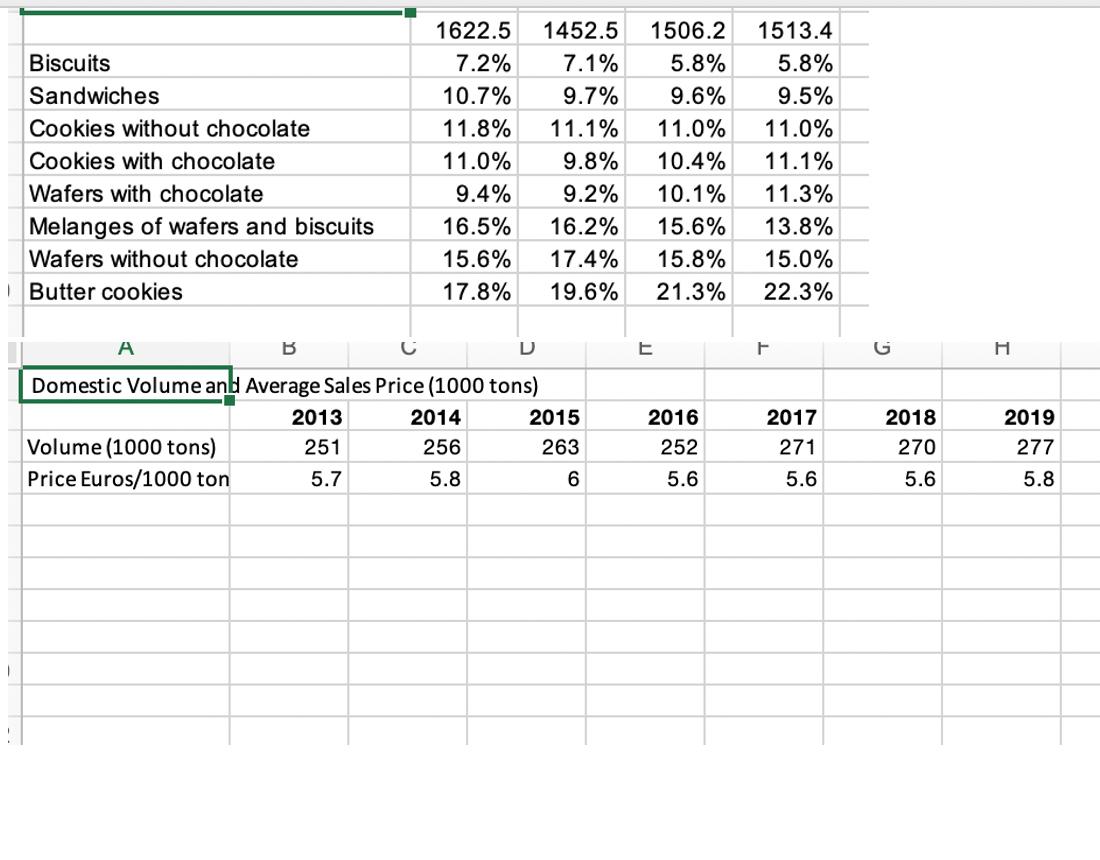

Stagnating market demand. The German sweet bakery products market is nearly saturated. Exhibit 2 clearly shows the combined market share of the three key competitors shrank by 13 percent from 2015 to 2019, while the overall market declined 1.7 percent per annum. Average prices remain at 2015 levels and given the average annual inflation growth rate of 2.5 percent over the past 5 years, the current price levels represent a real price decrease. Several of the eight segments in this market show stagnating or decreasing sales (Exhibit 3). Sales of mlanges of wafers and biscuits, for example, decreased by 16 percent from 2016 to 2019. Butter cookie sales, however, grew 7 to 8 percent annually ? and chocolate wafer sales grew 20 percent over the past 3 years.

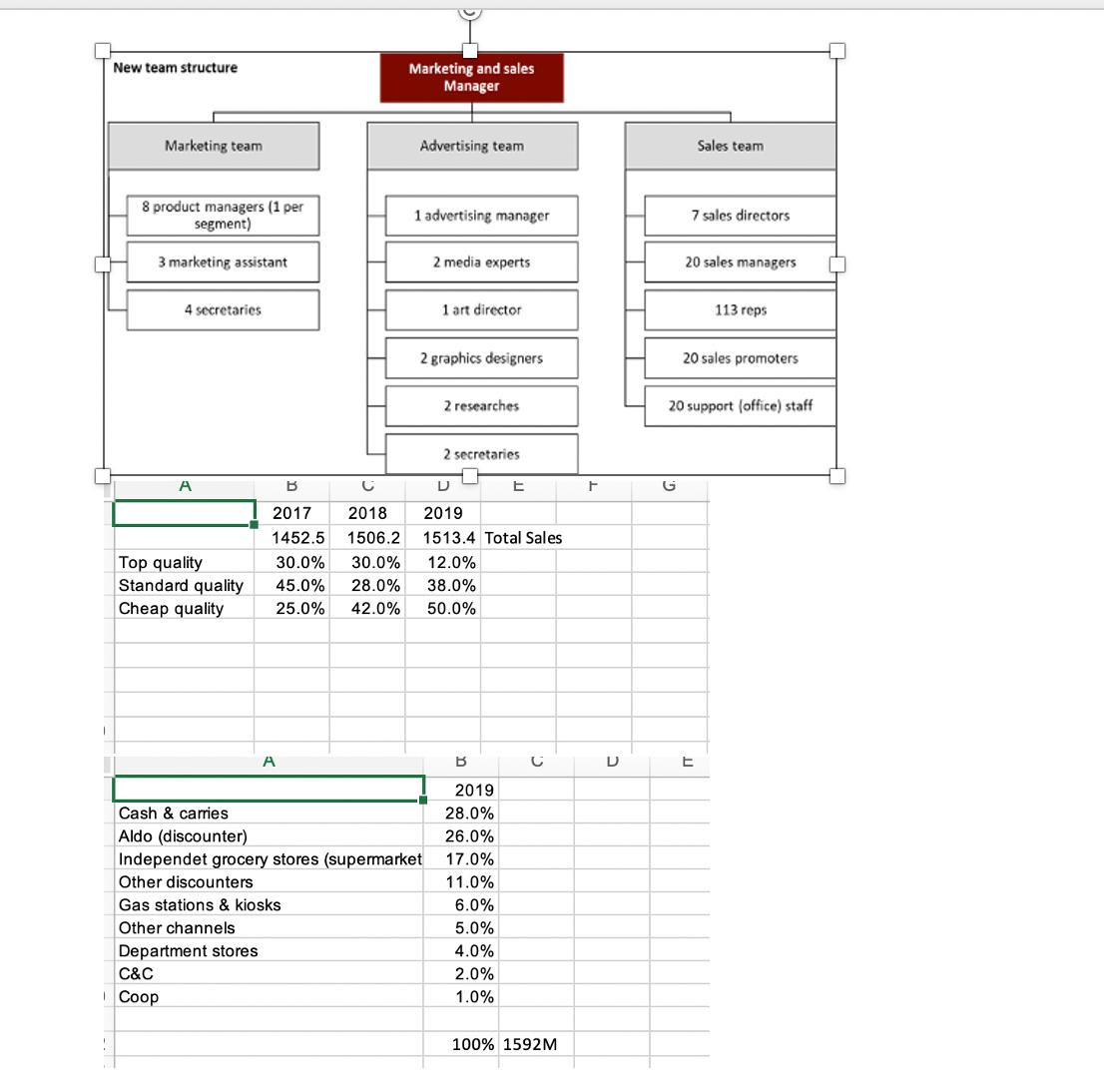

Changing consumer preferences. To compete against smaller competitors, CANNON is considering developing new products that require special technical know-how and manufacturing equipment. Industry experience over the past few years, however, suggests that as many as 97 percent of all new sweet bakery products have failed. This high failure rate may be driven by changes in consumer preferences (Exhibit 4). Since 2015, for example, the less expensive products have doubled their share, gaining some volume from the medium-priced group and significantly reducing the top end of the market by a huge 18 percentage points. Consumer analysis indicates that 17 percent of those aged 14 and over (9.69 million out of 57 million) are sweet bakery product consumers, with a slightly greater number of women than men. Those aged 14 to 30 consume the most sweet bakery products. Blue-collar workers, civil servants, and trained workers with middle incomes are either average or intensive consumers who buy at least once a week.

Growing importance of non-traditional channels. The less expensive distributors ? cash & carries and discount stores (in particular Aldo) ? have increasingly gained significance over traditional food stores. More than two-thirds of all sweet bakery products are now distributed through these channels (Exhibit 5). CANNOLI currently represents 8 percent of Aldo's sweet bakery product sales, and the volume continues to grow. Sales are also increasing at discounters Plus and Lidl, which have been selling CANNOLI's products since January 2019. CANNOLI's share at Penny (another discounter), however, is decreasing ? as it is at the large cash & carry chains like Allkauf and Massa. Losses in market share and sales can be seen in almost all product segments. CANNON continues to concentrate primarily on retail grocery stores, which it supplies directly, and does not supply the kiosk, canteen, or gas station markets.

Increasing competition. CANNON's position is further complicated by the fact that preserved sweet baked goods are now standard products, and it is increasingly difficult to distinguish oneself from the competition. Moreover, there have been significant shifts in the competitive landscape.

Chocolate continues to dominate the 3.7 billion German sweet bakery products market, with a 41 percent market share. In the preserved sweet bakery segment, CANNON remains the largest by far (in sales) of the 683 players. Its ?320 million in annual sales is more than double that of its closest competitor, Biskuit, and almost five times that of third-placed Waffel. Given the saturated nature of the preserved sweet bakery products market, however, the bigger players have, in fact, been major losers (Exhibit 2). CANNOLI has lost 4 percent of its market share since 2015, and Biskuit 5 percent. In sharp contrast, the overall market share of the smaller players has grown by over 9 percent since 2015. In addition to losing to smaller players, the classical producers like CANNOLI, Biskuit, and Waffel also lost volume and share to substitutes (snacks, salt cookies, bars, etc.), less expensive products, and private labels. As part of your efforts to improve CANNON sales and financial performance, Mr. Buhlman recently recruited Mr. Ohm to restructure CANNON marketing and sales function (Exhibit 6). The leadership team believes that this streamlined organization will address the declining productivity the company has experienced over the past few years. Mr. Ohm believes the 133-member sales team should be able to exceed the 234,000 visits to 50,000 stores that it completed last year.

While you have begun to address CANNON recent poor performance, much more remains to be done to return the company to the profitable position it has traditionally enjoyed.

New team structure Marketing team 8 product managers (1 per segment) 3 marketing assistant 4 secretaries A Top quality Standard quality Cheap quality C&C Coop Cash & carries Aldo (discounter) Marketing and sales Manager A Advertising team 1 advertising manager 2 media experts Independet grocery stores (supermarket Other discounters Gas stations & kiosks Other channels Department stores 1 art director 2 graphics designers 2 researches B D 2017 2018 2019 1452.5 1506.2 1513.4 Total Sales 30.0% 30.0% 12.0% 45.0% 28.0% 38.0% 25.0% 42.0% 50.0% 2 secretaries B E 2019 28.0% 26.0% 17.0% 11.0% 6.0% 5.0% 4.0% 2.0% 1.0% C 100% 1592M F G Sales team 7 sales directors 20 sales managers 113 reps 20 sales promoters 20 support (office) staff E

Step by Step Solution

3.45 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

Your Name Your Title Your Company Date Dear Recipients Name Subject Proposal for CANNOLI Revitalizing Market Presence and Profitability I hope this le...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started