Question

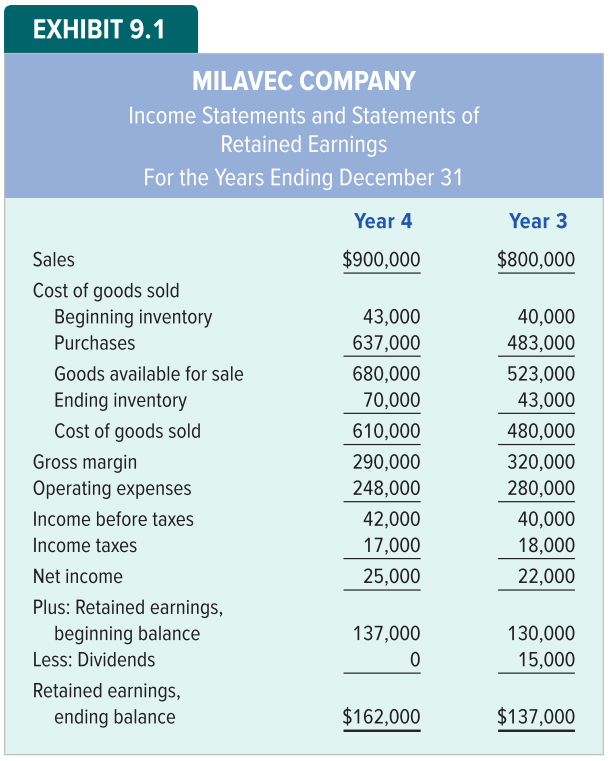

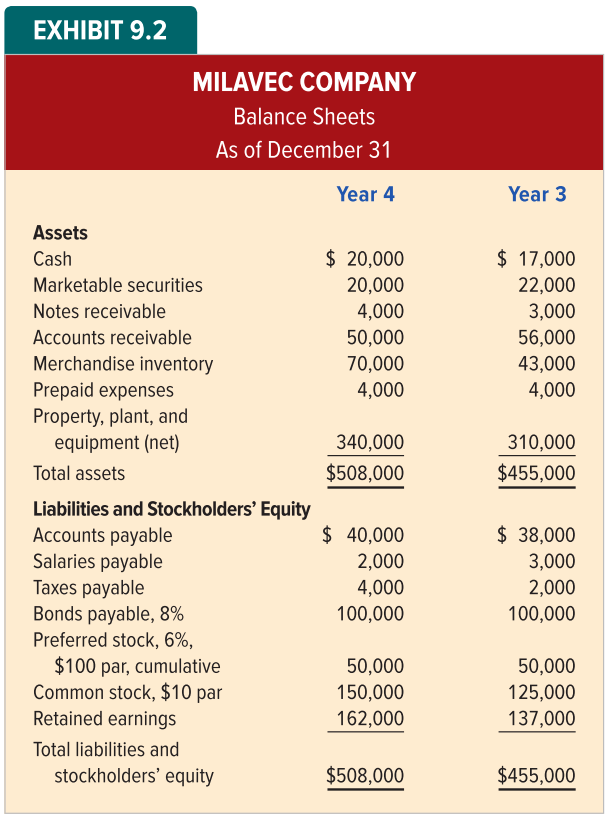

write a recommendation / summary of milavec financial reports using the following formula sheet Liquidity Ratios Working Capital = Current assets Current liabilities Current Ratio

write a recommendation / summary of milavec financial reports using the following formula sheet

Liquidity Ratios

Working Capital = Current assets Current liabilities

Current Ratio = Current assets/Current liabilities

Quick Ratio (acid-test) = Quick assets/Current liabilities

Accounts Receivable Turnover = Net credit sales/Average accounts receivable

Average Days to Collect Receivables = 365/Accounts receivable turnover

Inventory Turnover = COGS/Average ending inventory

Average Days to Sell Inventory = 365/Inventory turnover

Solvency Ratios

Debt to Assets = Total liabilities/Total assets

Debt to Equity = Total liabilities/Total stockholders equity

Number of Times Interest is Earned = Earnings before interest & tax exp/Interest exp

Plant Assets to Long-Term Liabilities = Net plant assets/Long-term liabilities

Management Effectiveness Ratios

Net Margin (return on sales) = Net income/Net sales

Asset Turnover = Net sales/Average total assets

Return on Investment (ROI) = Net income/Average total assets

Return on Equity (ROE) = Net income/Avg total stockholders equity

Stock Market Ratios

Earnings per Share = Net earnings avail for CS/Avg number CS shares outstanding

Book Value per Share = Stockholders equity Preferred stock/Outstanding CS shares

Price-Earnings Ratio = Market price per share/Earnings per share

Dividend Yield = Dividends per share/Market price per share

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started