Question

Write a ROI assessment for the NFL to adopt the NBA's model of a 50/50 revenue split, and to invest in their pension plan for

Write a ROI assessment for the NFL to adopt the NBA's model of a 50/50 revenue split, and to invest in their pension plan for their former players. Below is the budget I've created for this.

This is my current ROI: After gaging this, it has become clear that each respective league has their work cut out for them when it comes to properly accounting for their players' well being on and off the court or field. To move forward with finding ways to ratify the CBA, it is necessary to use data analysis to project the potential revenue growth resulting from the implementation of the CBA, including increased ticket sales, merchandising, and sponsorships. It would also be useful to meet with a third-party mediator to ensure that no one is being left out on the terms that are established. Monitor the feedback of the current CBA by surveying players and coaches anonymously, and always be sure to announce the ratification of the CBA publicly and highlight the positive impact on the players to ensure positive ROI.

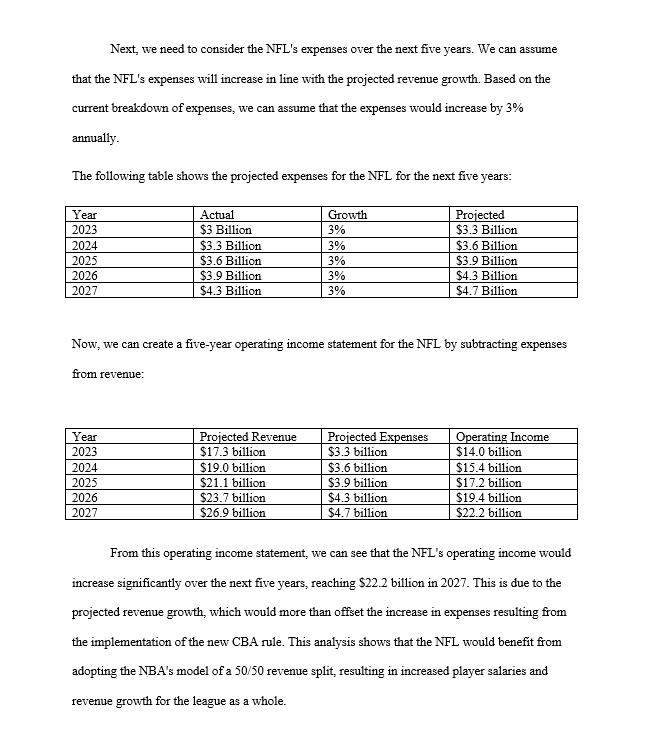

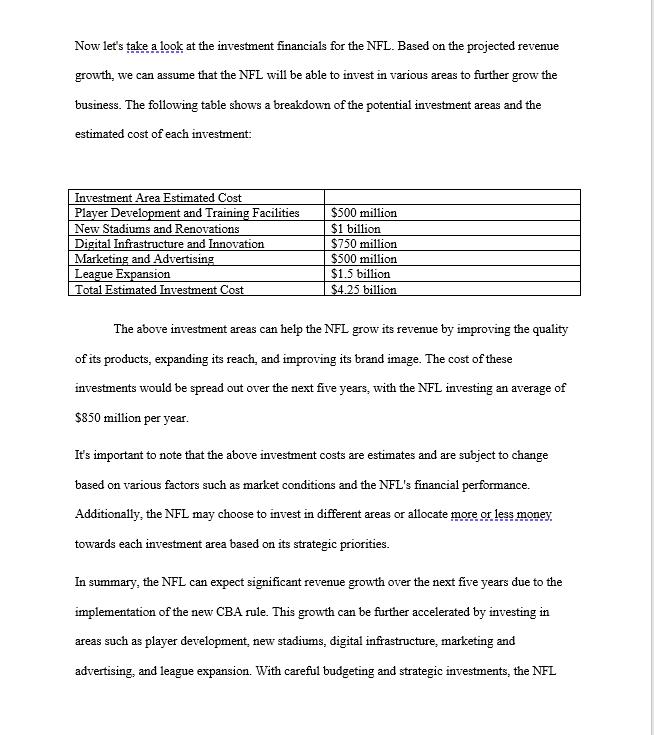

Next, we need to consider the NFL's expenses over the next five years. We can assume that the NFL's expenses will increase in line with the projected revenue growth. Based on the current breakdown of expenses, we can assume that the expenses would increase by 3% annually. The following table shows the projected expenses for the NFL for the next five years: Year 2023 2024 2025 2026 2027 Year 2023 Actual $3 Billion $3.3 Billion $3.6 Billion $3.9 Billion $4.3 Billion 2024 2025 2026 2027 Now, we can create a five-year operating income statement for the NFL by subtracting expenses from revenue: Growth 3% 3% 3% 3% 3% Projected Revenue $17.3 billion $19.0 billion $21.1 billion $23.7 billion $26.9 billion Projected Expenses $3.3 billion $3.6 billion $3.9 billion Projected $3.3 Billion $3.6 Billion $3.9 Billion $4.3 Billion $4.7 Billion $4.3 billion $4.7 billion Operating Income $14.0 billion $15.4 billion $17.2 billion $19.4 billion $22.2 billion From this operating income statement, we can see that the NFL's operating income would increase significantly over the next five years, reaching $22.2 billion in 2027. This is due to the projected revenue growth, which would more than offset the increase in expenses resulting from the implementation of the new CBA rule. This analysis shows that the NFL would benefit from adopting the NBA's model of a 50/50 revenue split, resulting in increased player salaries and revenue growth for the league as a whole.

Step by Step Solution

3.54 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

ROI Assessment for the NFL Adoption of NBAs Revenue Split and Investment in Pension Plan Introduction The NFL is considering adopting the NBAs model of a 5050 revenue split and investing in their pens...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started