Write a short memo for Ms Smith that addresses profitability, efficiency, Liquidity and financial flexibility of the seven companies. Limit to 600 words. 1.Explain what

Write a short memo for Ms Smith that addresses profitability, efficiency, Liquidity and financial flexibility of the seven companies. Limit to 600 words.

1.Explain what the ratios reveal about the profitability of the companies.

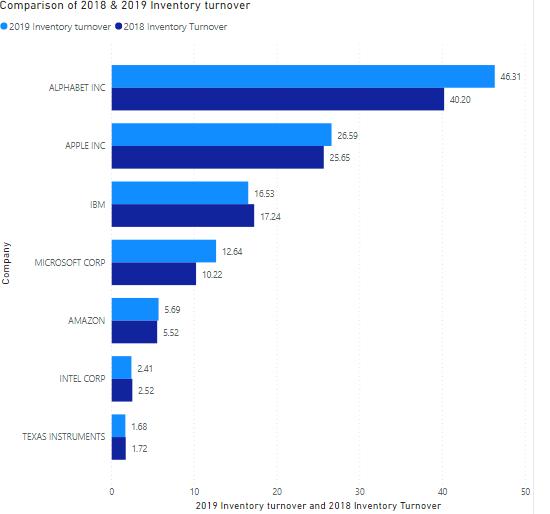

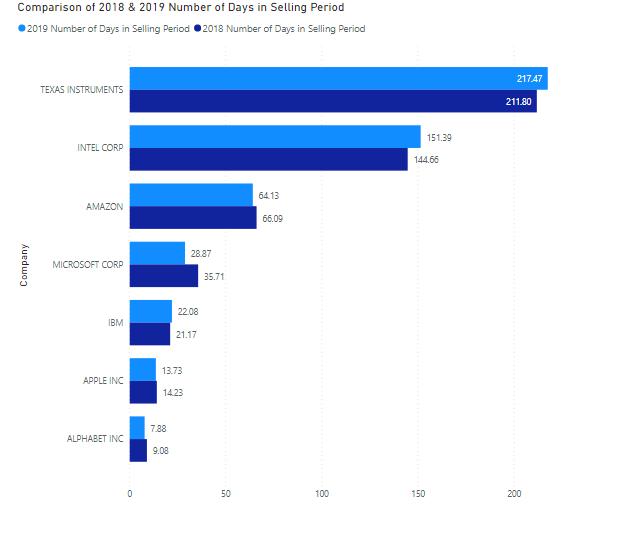

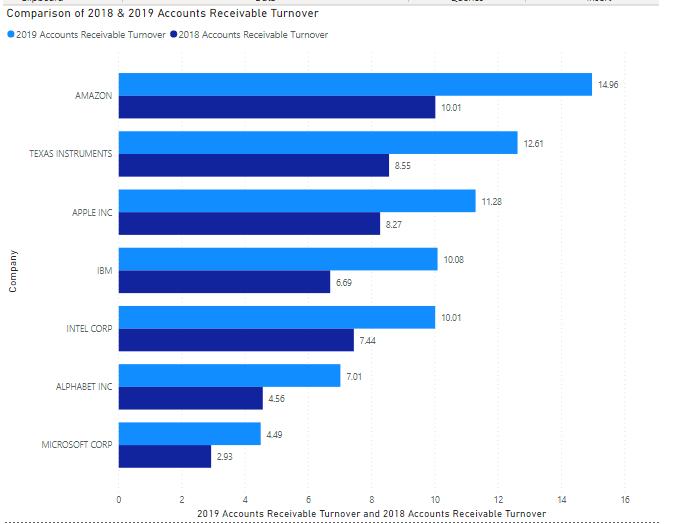

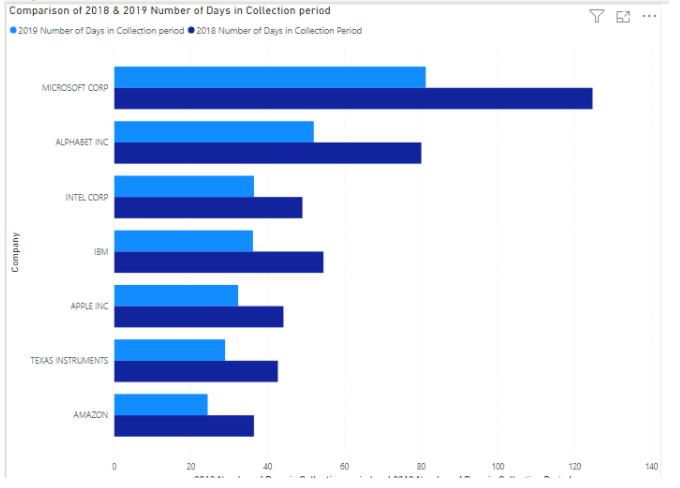

2.Evaluate the efficiency of the management of accounts receivable and inventories and advise on how best to improve.

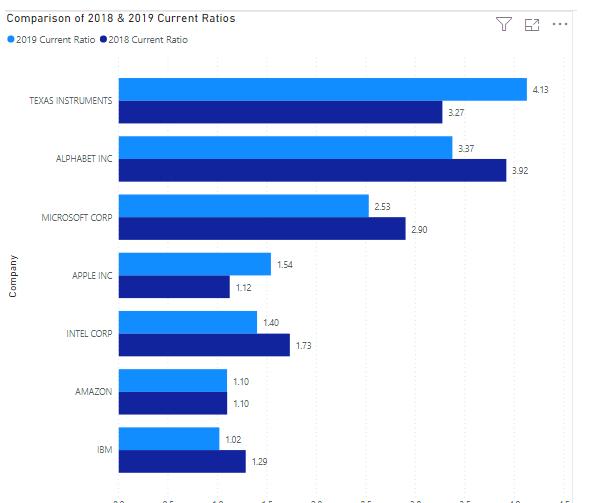

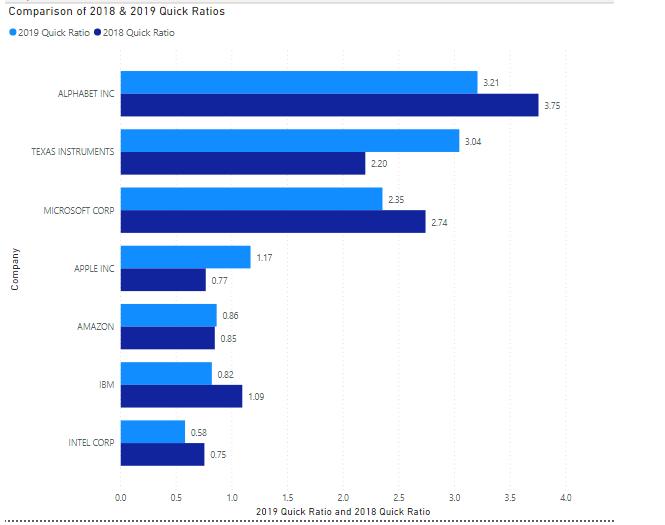

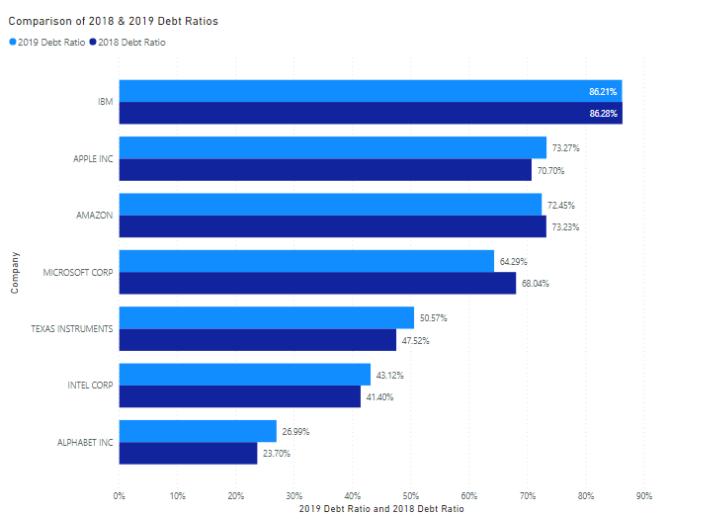

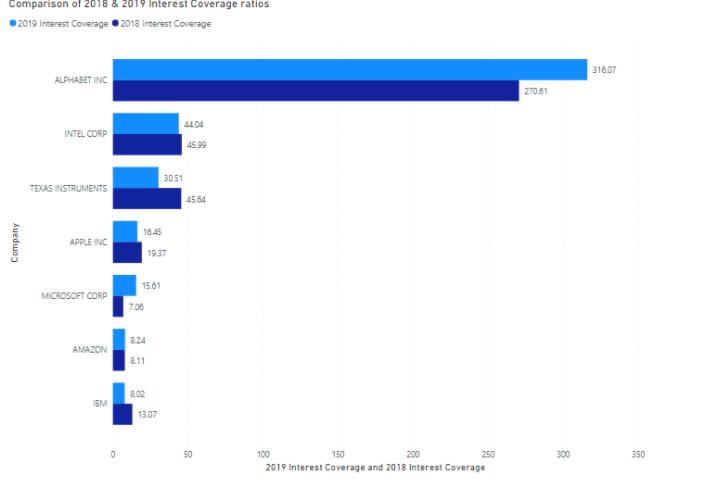

3. Discuss the liquidity and financial flexibility of the companies.

Answers should be well reasoned, comprehensive and supported by the data from the ratios below calculated.

All information provided

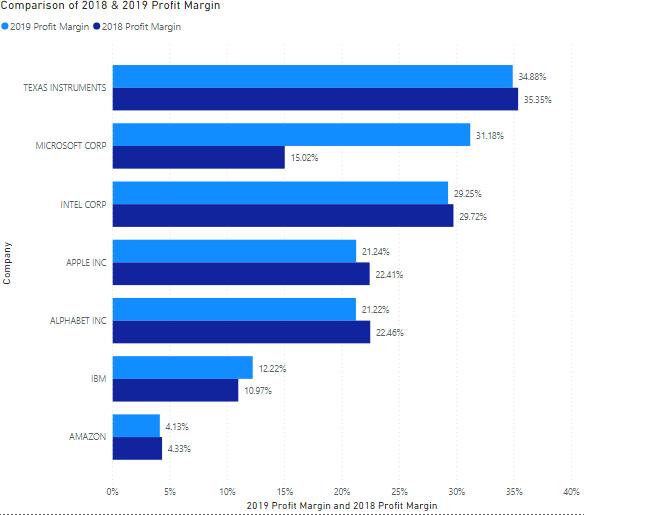

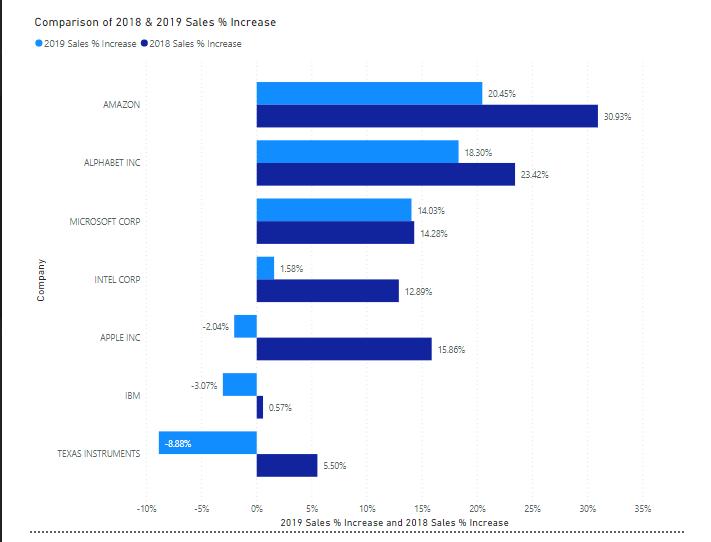

Comparison of 2018 & 2019 Profit Margin 2019 Profit Margin 2018 Profit Margin 34.88% TEXAS INSTRUMENTS 35.35% 31,18% MICROSOFT CORP 15.02% 29.25% INTEL CORP 29.725 21.24% APPLE INC 22.41% 21.22% ALPHABET INC 2246% 12.22% IBM 10.9795 4.13% AMAZON 4.33% 0% 5% 10% 15% 20% 25% 30% 35% 40% 2019 Profit Margin and 2018 Profit Margin Company

Step by Step Solution

3.40 Rating (175 Votes )

There are 3 Steps involved in it

Step: 1

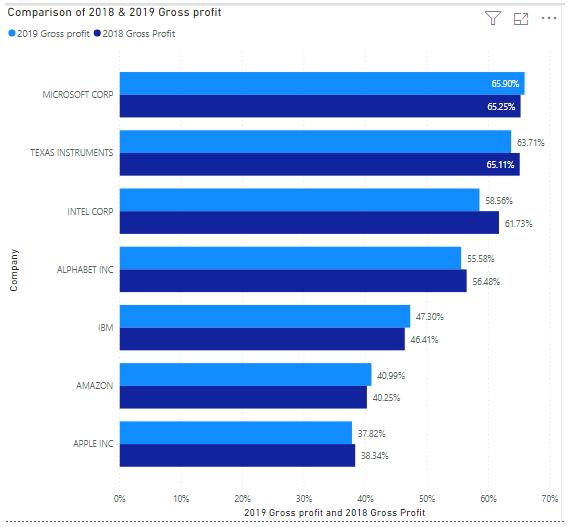

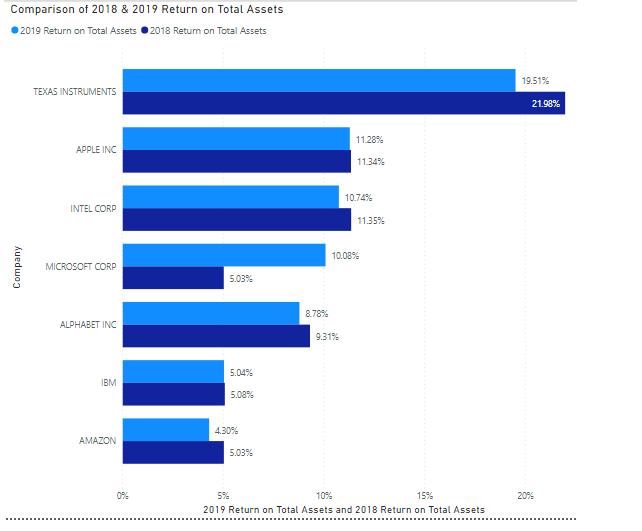

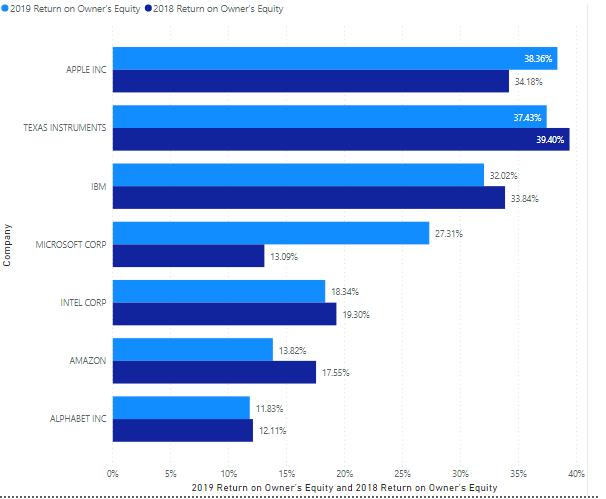

Ms Smith This short memo addresses the profitability efficiency liquidity and financial flexibility of the seven companies under study Profitability ratios shows to what extent sales are generating pr...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started