Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Write a short memo for Ms Smith that addresses profitability, efficiency, Liquidity and financial flexibility of the seven companies. Limit to 600 words. 1.Explain what

Write a short memo for Ms Smith that addresses profitability, efficiency, Liquidity and financial flexibility of the seven companies. Limit to 600 words.

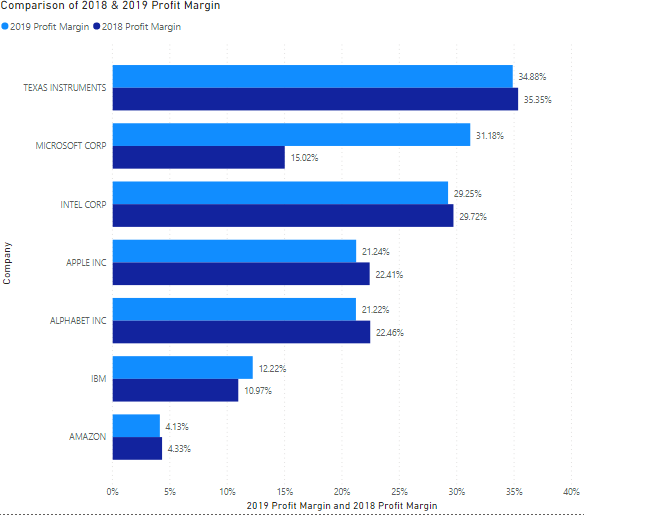

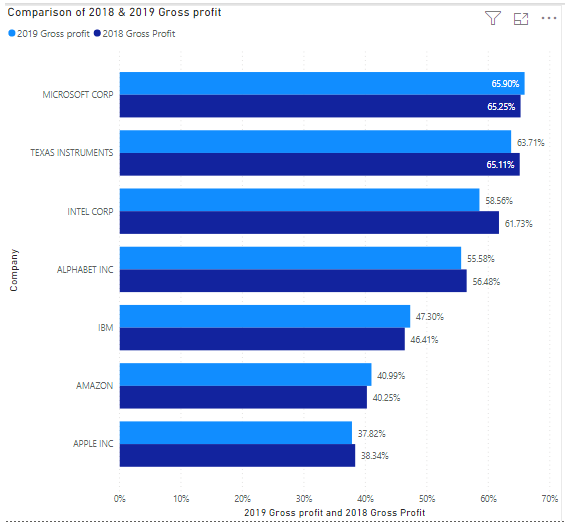

1.Explain what the ratios reveal about the profitability of the companies.

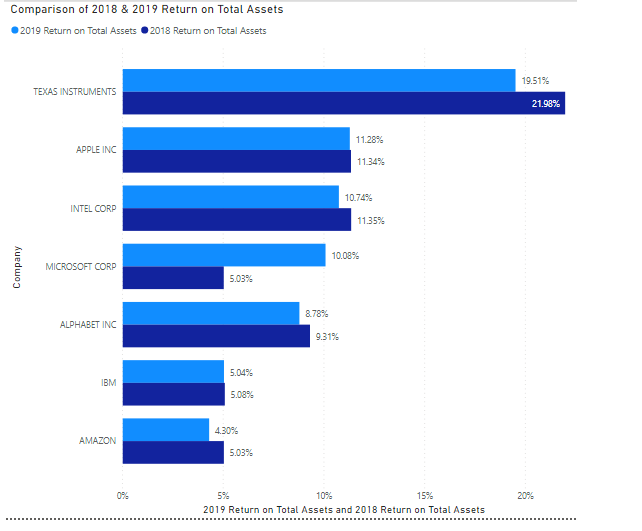

2.Evaluate the efficiency of the management of accounts receivable and inventories and advise on how best to improve.

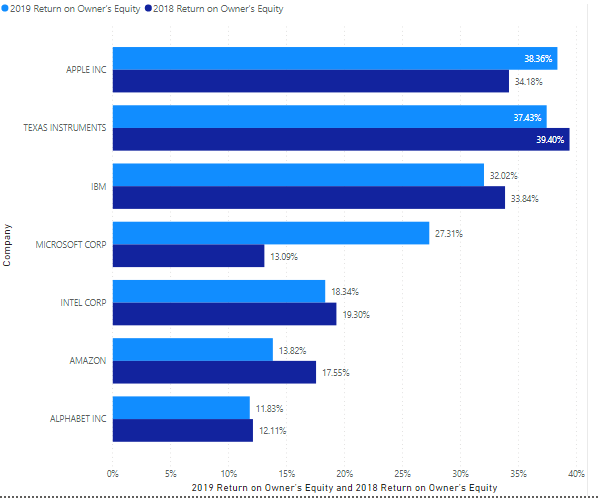

3. Discuss the liquidity and financial flexibility of the companies.

Answers should be well reasoned, comprehensive and supported by the data from the ratios below calculated.

All information provided

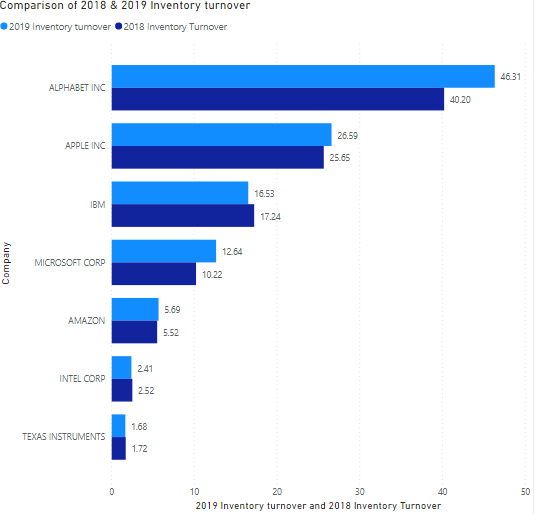

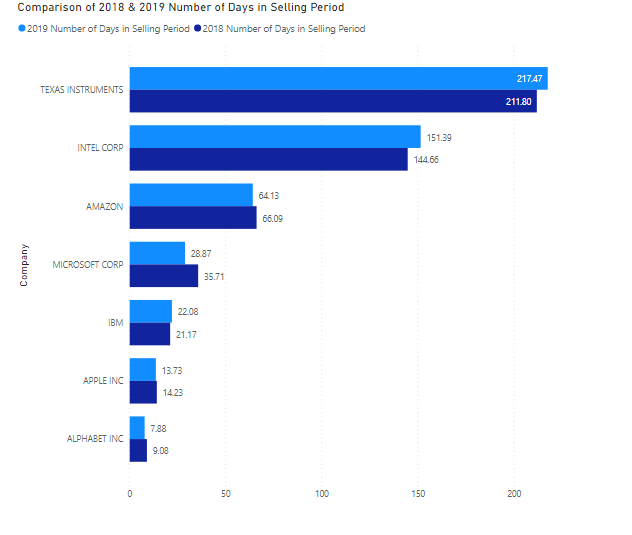

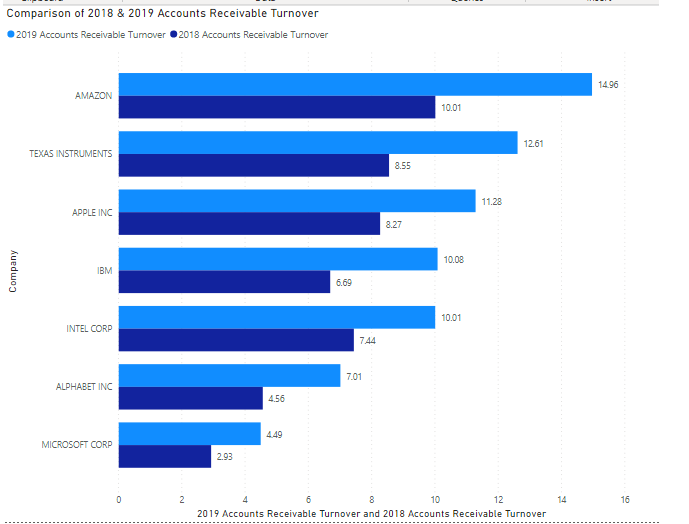

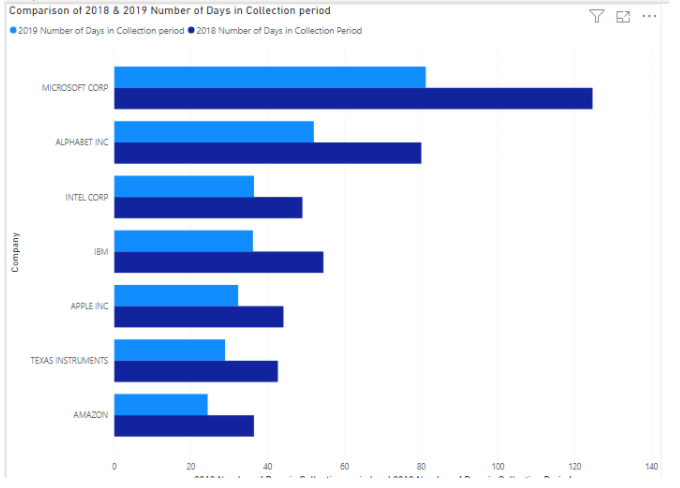

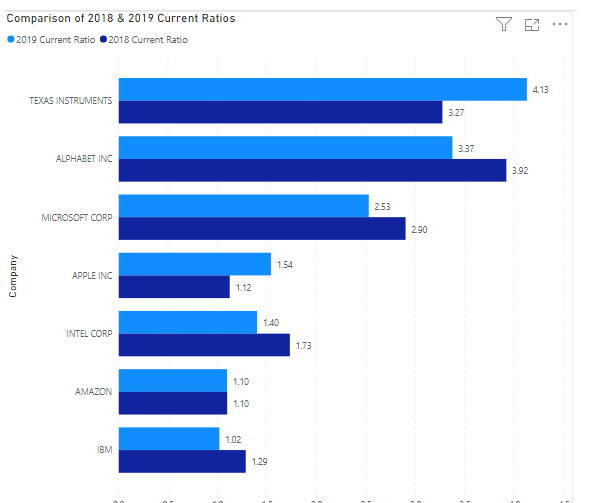

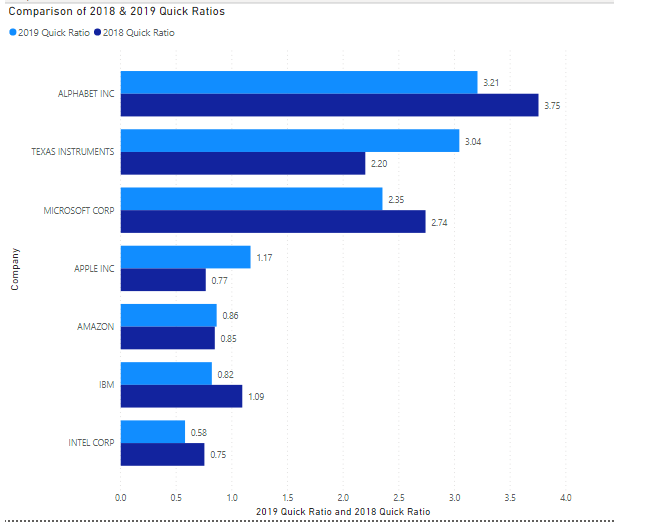

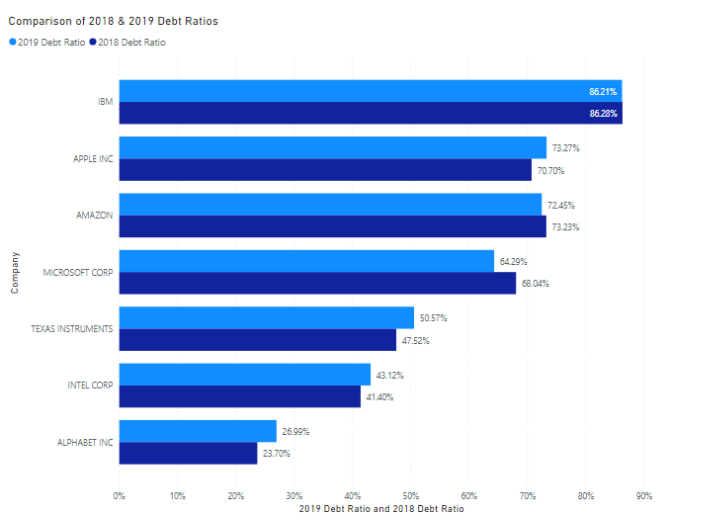

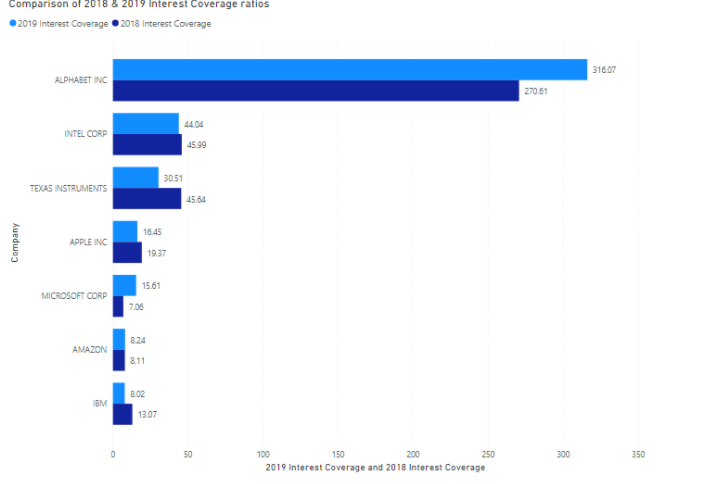

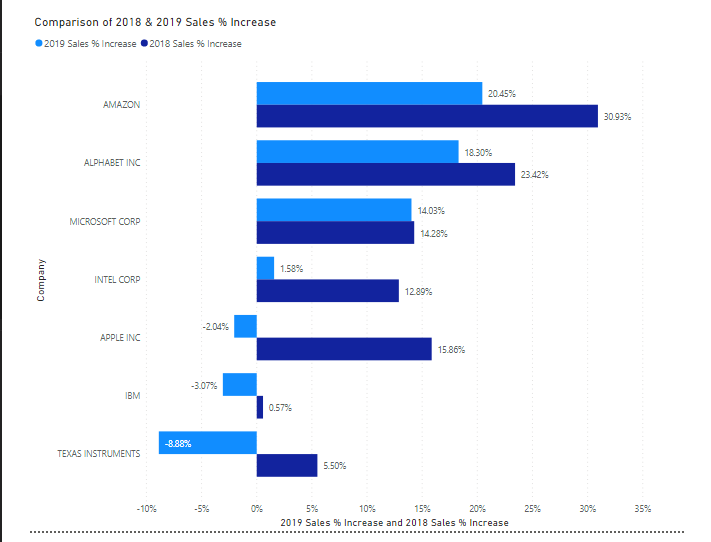

Comparison of 2018 & 2019 Profit Margin .2019 Profit Margin 2018 Profit Margin 34.88% TEXAS INSTRUMENTS 35.35% 31.18% MICROSOFT CORP 15.02% 29.25% INTEL CORP 29.72% 21.24% Company APPLE INC 22.41% 21.2294 ALPHABET INC 22.46% 12.22% IBM 10.97% 4.13% AMAZON 4.33% 0% 595 10. 30% 35% 40% 15% 20% 2595 2019 Profit Margin and 2018 Profit Margin Comparison of 2018 & 2019 Gross profit 2019 Gross profit 2018 Gross Profit Y 52 .. 65.90% MICROSOFT CORP 65.25% 63.71% TEXAS INSTRUMENTS 65.11% 58.56% INTEL CORP 61.73% 55.58 Company ALPHABET INC 56.4896 47.30% IBM 46.41% 40.99% AMAZON 40.25% 37.82% APPLE INC 38.34 09. 10% 60% 70% 20% 30% 4096 50% 2019 Gross profit and 2018 Gross Profit Comparison of 2018 & 2019 Return on Total Assets 2019 Return on Total Assets 2018 Return on Total Assets 19.51% TEXAS INSTRUMENTS 21.98% 11.28% APPLE INC 11.34% 10.74% INTEL CORP 11.35% 10.08% Company MICROSOFT CORP 5.03% ALPHABET INC 8.78% 9.31% 5.04% IBM 5.08% 4.30% AMAZON 5.03% 20% 5% 10% 15% 2019 Return on Total Assets and 2018 Return on Total Assets 2019 Return on Owner's Equity 2018 Return on Owner's Equity 38.36% APPLE INC 34.18% 37.43% TEXAS INSTRUMENTS 39.40% 32.02% IBM 33.84% 27.31% Company MICROSOFT CORP 13.09% 1834% INTEL CORP 19.30% 13.82% AMAZON 17.55% 11.83% ALPHABET INC 12.11% 5% 359 40% 10% 15% 20% 25% 30% 2019 Return on Owner's Equity and 2018 Return on Owner's Equity Comparison of 2018 & 2019 Inventory turnover .2019 Inventory tumover 2018 Inventory Turnover 46.31 ALPHABET INC 40.20 26.59 APPLE INC 25.65 16.53 IBM 17.24 12.64 Company MICROSOFT CORP 10.22 5.69 AMAZON 5.52 241 INTEL CORP 2.52 1.68 TEXAS INSTRUMENTS 1.72 0 50 10 20 30 40 2019 Inventory turnover and 2018 Inventory Turnover Comparison of 2018 & 2019 Number of Days in Selling Period .2019 Number of Days in Selling Period 2018 Number of Days in Selling Period 21747 TEXAS INSTRUMENTS 211.80 151.39 INTEL CORP 144.66 64.13 AMAZON 66.09 28.87 Company MICROSOFT CORP 35.71 22.08 IBM 21.17 13.73 APPLE INC 14.23 7.88 ALPHABET INC 9.08 0 50 100 150 200 Comparison of 2018 & 2019 Accounts Receivable Turnover 2019 Accounts Receivable Tumover 2018 Accounts Receivable Turnover 1496 AMAZON 10.01 12.61 TEXAS INSTRUMENTS 8.55 11.28 APPLE INC 10.08 Company IBM 6.69 10.01 INTEL CORP 744 7.01 ALPHABET INC 4.56 4.49 MICROSOFT CORP 2.93 0 2 14 16 6 8 10 12 2019 Accounts Receivable Turnover and 2018 Accounts Receivable Turnover Comparison of 2018 & 2019 Number of Days in Collection period 2019 Number of Days in Collection period 2018 Number of Days in Collection Period Y E2 ... MICROSOFT CORP ALPHABET INC INTEL CORP Company IBM APPLE INC TEXAS INSTRUMENTS AMAZON 0 20 15 60 80 100 120 140 1 ? Comparison of 2018 & 2019 Current Ratios Y 62 2019 Current Ratio 2018 Current Ratio 4.13 TEXAS INSTRUMENTS 3.27 3.37 ALPHABET INC 3.92 2.53 MICROSOFT CORP 2.90 1.54 Company APPLE INC 1.12 1.40 INTEL CORP 1.73 1.10 AMAZON 1.10 1.02 IBM 1.29 Comparison of 2018 & 2019 Quick Ratios 2019 Quick Ratio 2018 Quick Ratio 3.21 ALPHABET INC 3.75 3.04 TEXAS INSTRUMENTS 2.20 2.35 MICROSOFT CORP 2.74 1.17 Company APPLE INC 0.77 0.86 AMAZON 0.85 0.82 IBM 1.09 0.58 INTEL CORP 0.75 0.0 0.5 1.0 3.0 3.5 40 1.5 2.0 2.5 2019 Quick Ratio and 2018 Quick Ratio Comparison of 2018 & 2019 Debt Ratios .2019 Debt Ratio 2018 Debt Ratio IBM 86.21% 3628% APPLE INC 73.27% 70.70% AMAZON 7245% 73.23% 64 29 Company MICROSOFT CORP 68,04% TEXAS INSTRUMENTS 50.57% 47.52% 43.12% INTEL CORP 41.40% 26.99% ALPHABET INC 23.70% 09 10% 20% 70% 80% 90% 30% 40% 50% 60% 2019 Debt Ratio and 2018 Debt Ratio Comparison of 2018 & 2019 Interest Coverage ratios 2019 Interest Coverage 2018 Interest Coverage 316.07 ALPHABET INC 270.61 INTEL CORP 45.99 30.51 TEXAS INSTRUMENTS 45.64 16.45 Company APPLE INC 19.37 1561 MICROSOFT CORP 7.00 AMAZON 8:24 8.11 802 IBM 13.07 0 50 300 350 100 150 200 250 2019 Interest Coverage and 2018 Interest Coverage Comparison of 2018 & 2019 Sales % Increase 2019 Sales % Increase 2018 Sales % Increase 20.45% AMAZON 30.93% 18.30% ALPHABET INC 23.42% 14.03% MICROSOFT CORP 14.28% 1.58% Company INTEL CORP 12.89% -2.04% APPLE INC 15.86% -3.07% IBM 0.57% -8.88% TEXAS INSTRUMENTS 5.50% -10% -5% 0% 25% 30% 35% 5% 10% 15% 20% 2019 Sales % Increase and 2018 Sales % IncreaseStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started