Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Write a single function that takes the hours worked, and hourly rate of pay and returns the amount of regular pay, and overtime pay.

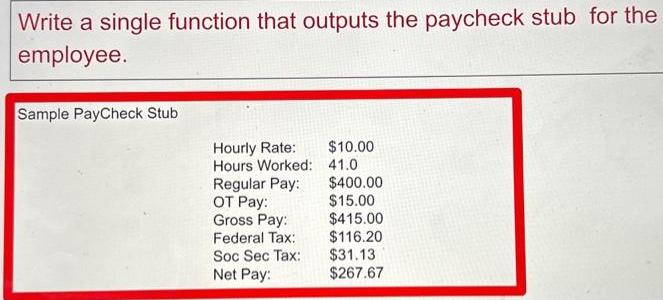

Write a single function that takes the hours worked, and hourly rate of pay and returns the amount of regular pay, and overtime pay. Assume that all federal labor laws and rules apply. If you do not know these laws and rules then research them. If an employee works more than 40 hours then the employee gets paid 1.5 or time and a half for all work above 40 hours. Write a single function that calculates a deduction for Federal Income Taxes. You can assume all employees pay 28% of their income to the Federal government Federal Taxes equals the gross pay times the Federal Tax Rate Write a single function that calculates a deduction for Social Security Taxes. You can assume all employees pay 7.5% of their income towards Social Security Taxes. Social Security Taxes equals the gross pay times the Social Security Tax Rate Write a single function that calculates the net pay for the employee. Net Pay equals the gross pay minus the taxes. Write a single function that outputs the paycheck stub for the employee. Sample PayCheck Stub Hourly Rate: Hours Worked: Regular Pay: OT Pay: Gross Pay: Federal Tax: Soc Sec Tax: Net Pay: $10.00 41.0 $400.00 $15.00 $415.00 $116.20 $31.13 $267.67

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1def calculatepayhoursworked hourlyrate if hoursworked 40 regularhours 40 overtimehours ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started