Answered step by step

Verified Expert Solution

Question

1 Approved Answer

write out the work please! solved example of this problem for reference: For example, assume that Isiah purchased a $100,000 participating ordinary life policy at

write out the work please!

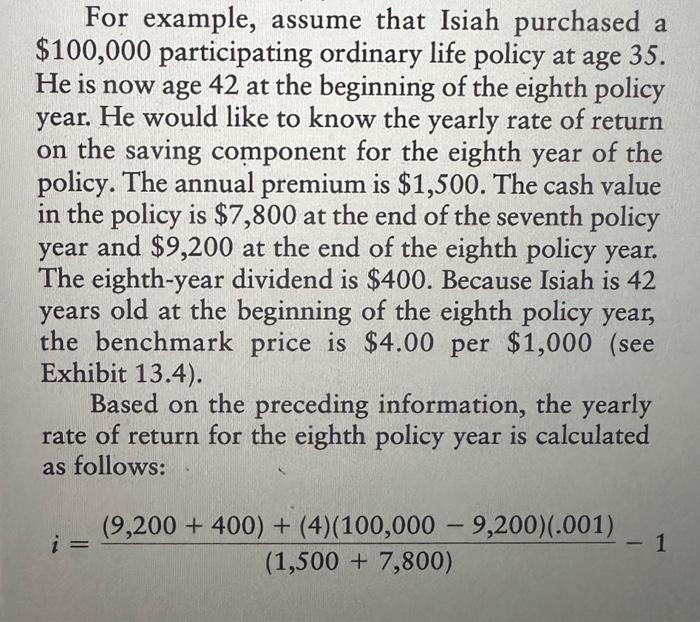

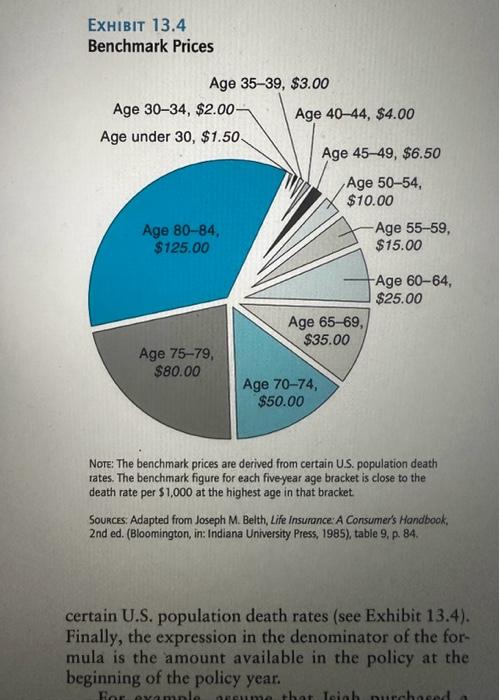

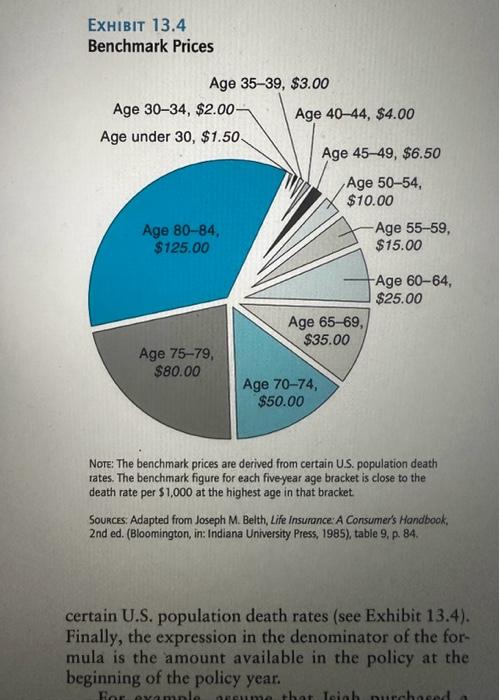

For example, assume that Isiah purchased a $100,000 participating ordinary life policy at age 35 . He is now age 42 at the beginning of the eighth policy year. He would like to know the yearly rate of return on the saving component for the eighth year of the policy. The annual premium is $1,500. The cash value in the policy is $7,800 at the end of the seventh policy year and $9,200 at the end of the eighth policy year. The eighth-year dividend is $400. Because Isiah is 42 years old at the beginning of the eighth policy year, the benchmark price is $4.00 per $1,000 (see Exhibit 13.4). Based on the preceding information, the yearly rate of return for the eighth policy year is calculated as follows: i=(1,500+7,800)(9,200+400)+(4)(100,0009,200)(.001)1 David purchased a $100,000 participating whole life policy. The annual premium is $2,280. Projected dividends for the first 20 years are $15,624. The cash value after 20 years will be $35,260. If the premiums were invested at 5 percent interest for 20 years, the premiums would grow to $79,156. If the dividends were accumulated at 5 percent interest for 20 years, they would grow to be $24,400. The amount to which $1 deposited annually will accumulate in 20 years at 5 percent interest is $34.719. Based on this information, what is the traditional net cost per thousand per year of David's policy over the 20 -year period? =(9,300)(9,600)+(4)(90,800)(.001)1=9,3009,600+3631=9,3009,9631=1.0711=0.71=7.1% The yearly rate of return for the eighth policy year is 7.1 percent, assuming that the yearly price per $1,000 of protection is $4. The major advantage of Belth's method is simplicity-you do not need a computer. The information needed can be obtained by referring to your policy and premium notice, or by contacting your agent or insurer. IIT 13.4 NOTE: Ine Denchmark prices are derived from certain U.S. population death rates. The benchmark figure for each fiveyear age bracket is close to the death rate per $1,000 at the highest age in that bracket. Sources: Adapted from Joseph M. Belth, Life Insurance: A Consumer's Handbook, 2nd ed. (Bloomington, in: Indiana University Press, 1985), table 9, p. 84. certain U.S. population death rates (see Exhibit 13.4). Finally, the expression in the denominator of the formula is the amount available in the policy at the beginning of the policy year

solved example of this problem for reference:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started