Question

WRITE T as TRUE of F as False MAX TIME: 20 MINS The market value of any real or financial asset, including stocks, bonds, or

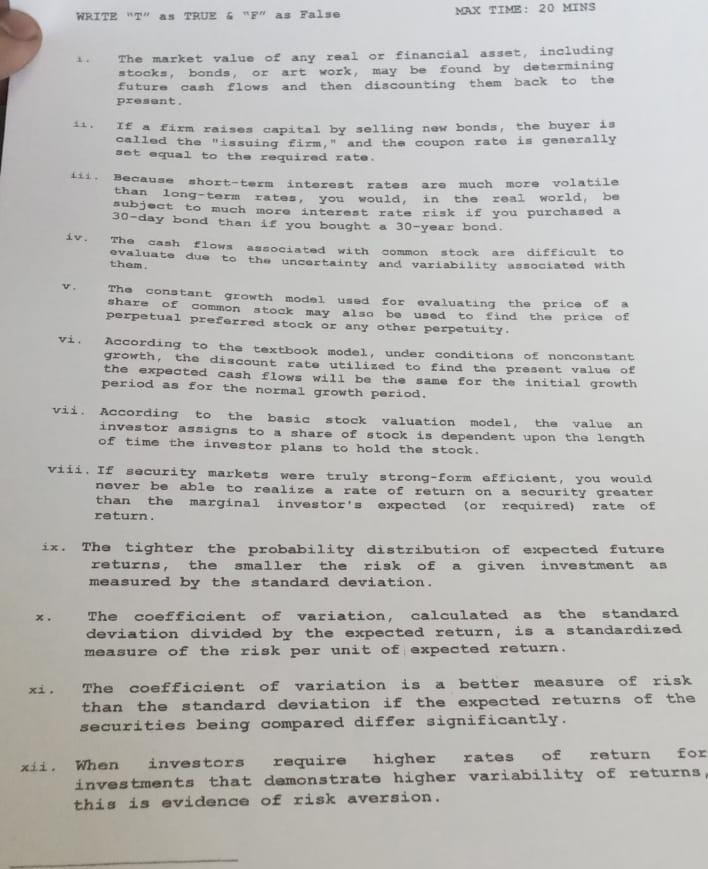

WRITE "T" as TRUE of "F" as False\ MAX TIME: 20 MINS\ The market value of any real or financial asset, including stocks, bonds, or art work, may be found by determining future cash flows and then discounting them back to the presant.\ If a firm raises capital by selling new bonds, the buyer is called the "issuing firm," and the coupon rate is generally sot equal to the required rate.\ 1i1. Because short-term interest rates are much more volatile than long-term rates, you would, in the real world, be subject to much more interest rate riak if you purchased a 30-day bond than if you bought a 30-year bond.\ iv. The dash flows associated with gommon stock are difficult to evaluate due to the uncertainty and variability associated with them.\ v. The constant growth model, used for evaluating the price of a share of common stook may also bo used to find the price of perpetual preferred stock or any other perpetuity.\ vi. According to the textbook model, under conditions of nonconstant growth, the discount rate utilized to find the present value of the expected cash flows will be the same for the initial growth period as for the normal growth period.\ vii. According to the basic stock valuation model, the value an investor assigns to a share of stock is dependent upon the length of time the investor plans to hold the stock.\ viil. If security markets were truly strong-form efficient, you would nover be able to realize a rate of return on a security greater than the marginal investor's expected (or required) rate of return.\ ix. The tighter the probability distribution of expected future returns, the smallex the risk of a given investment as measured by the standard deviation.\ x. The coefficient of variation, calculated as the standard deviation divided by the expected return, is a standardized measure of the risk per unit of expected return.\ xi. The coefficient of variation is a better measure of risk than the standard deviation if the expected returns of the securities being compared differ significantly.\ xii. When investors require higher rates of return for investments that demonstrate higher variability of returns this is evidence of risk aversion.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started