Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Old Winery is an Italian company operating in the wine sector and it is considered as one of the top Italian player worldwide. Old

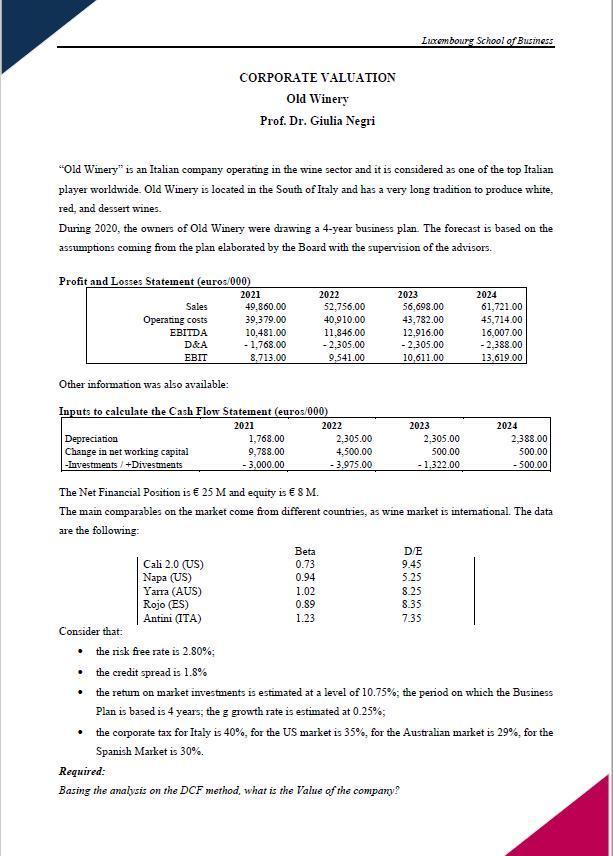

"Old Winery" is an Italian company operating in the wine sector and it is considered as one of the top Italian player worldwide. Old Winery is located in the South of Italy and has a very long tradition to produce white, red, and dessert wines. During 2020, the owners of Old Winery were drawing a 4-year business plan. The forecast is based on the assumptions coming from the plan elaborated by the Board with the supervision of the advisors. Profit and Losses Statement (euros/000) Depreciation Change in net working capital -Investments /+Divestments Consider that: Sales Operating costs EBITDA . CORPORATE VALUATION Old Winery Prof. Dr. Giulia Negri D&A EBIT . Other information was also available: Inputs to calculate the Cash Flow Statement (euros/000) 2021 . 2021 49,860.00 39,379.00 10,481.00 - 1,768.00 8,713.00 Cali 2.0 (US) Napa (US) Yarra (AUS) Rojo (ES) Antini (ITA) 1,768.00 9,788.00 - 3,000.00 2022 52,756.00 40,910.00 Beta 0.73 0.94 11,346.00 -2,305.00 9,541.00 1.02 0.89 1.23 2022 2,305.00 4,500.00 -3,975.00 Luxembourg School of Business 2023 The Net Financial Position is 25 M and equity is 8 M. The main comparables on the market come from different countries, as wine market is international. The data are the following: 56,698.00 43,782.00 12,916.00 -2,305.00 10,611.00 Required: Basing the analysis on the DCF method, what is the Value of the company? 2023 2,305.00 500.00 - 1,322.00 D/E 9.45 5.25 2024 8.25 8.35 7.35 61,721.00 45,714.00 16,007.00 -2,388.00 13,619.00 2024 2,388.00 500.00 - 500.00 the risk free rate is 2.80%; the credit spread is 1.8% the return on market investments is estimated at a level of 10.75%; the period on which the Business Plan is based is 4 years; the g growth rate is estimated at 0.25%; the corporate tax for Italy is 40%, for the US market is 35%, for the Australian market is 29%, for the Spanish Market is 30%.

Step by Step Solution

★★★★★

3.46 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Answer Calculating the Value of Old Winery Using the DCF Method The Discounted Cash Flow DCF method is a widely used and accepted way of valuing a com...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started