Answered step by step

Verified Expert Solution

Question

1 Approved Answer

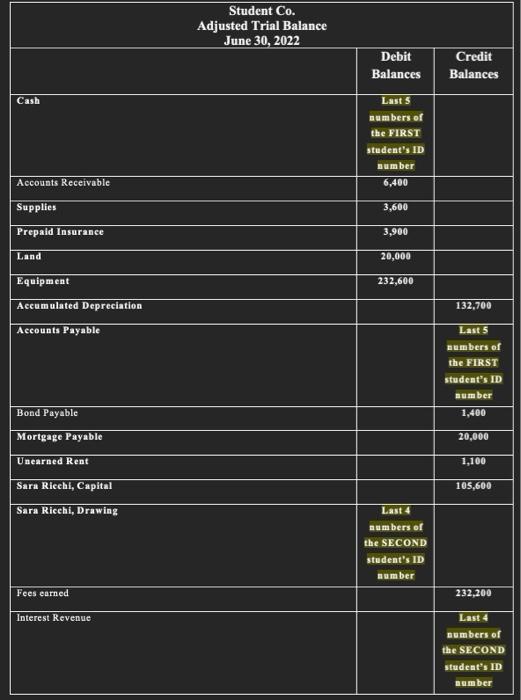

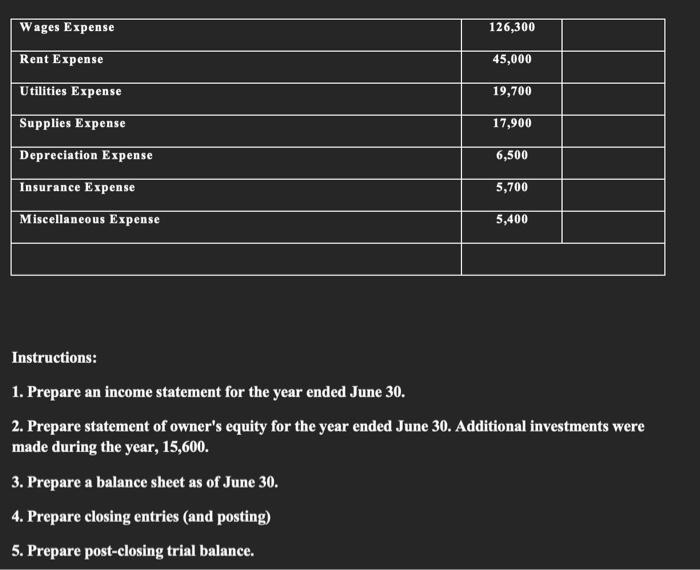

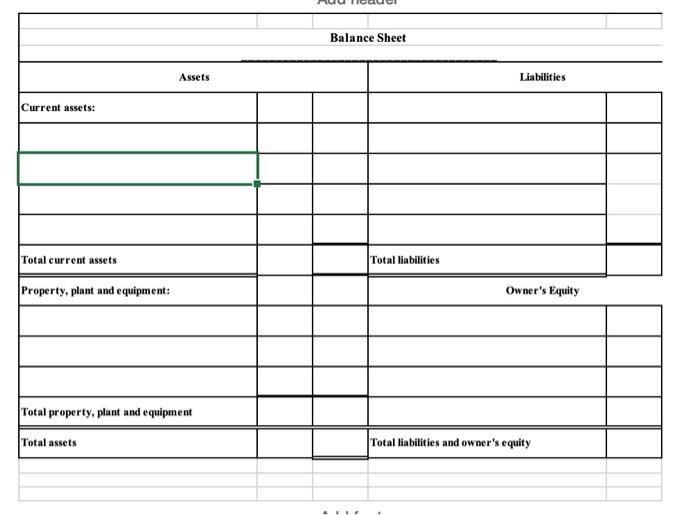

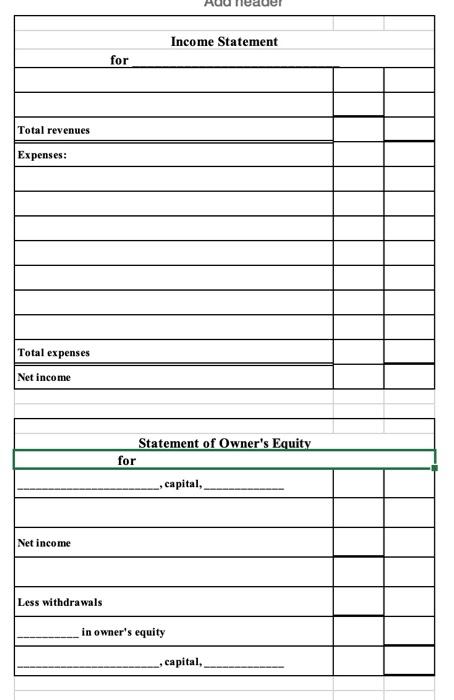

write the yellow highlighted text as zeros please. And solve as given in the white sheets. Cash Accounts Receivable Supplies Prepaid Insurance Land Equipment Accumulated

write the yellow highlighted text as zeros please. And solve as given in the white sheets.

Cash Accounts Receivable Supplies Prepaid Insurance Land Equipment Accumulated Depreciation Accounts Payable Bond Payable Mortgage Payable Unearned Rent Sara Ricchi, Capital Sara Ricchi, Drawing Fees earned Interest Revenue Student Co. Adjusted Trial Balance June 30, 2022 Debit Balances Last 5 numbers of the FIRST student's ID number 6,400 3,600 3,900 20,000 232,600 Last 4 numbers of the SECOND student's ID number Credit Balances 132,700 Last 5 numbers of the FIRST student's ID number 1,400 20,000 1,100 105,600 232,200 Last 4 numbers of the SECOND student's ID number

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started