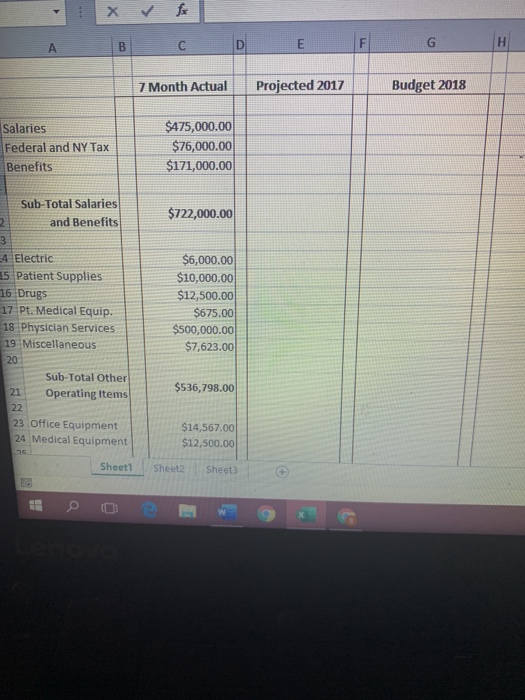

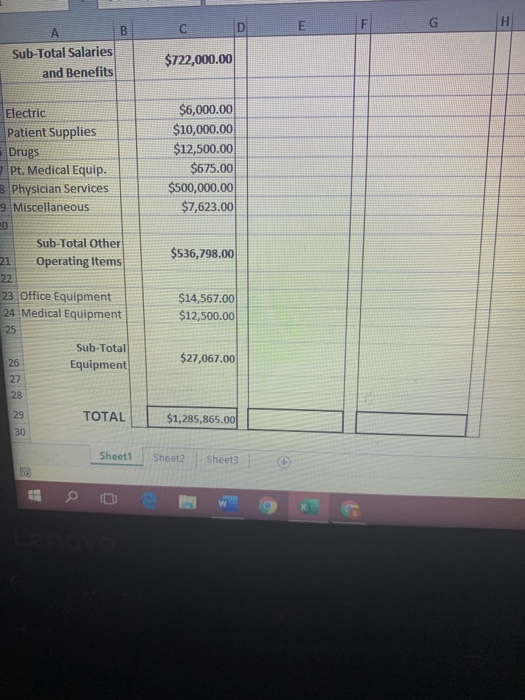

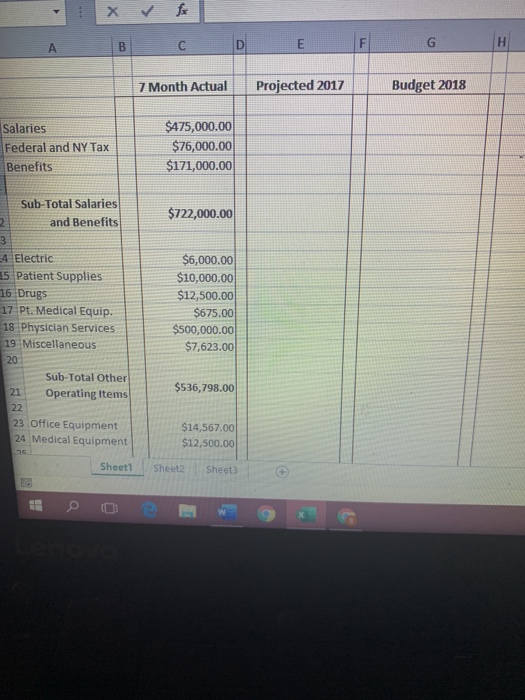

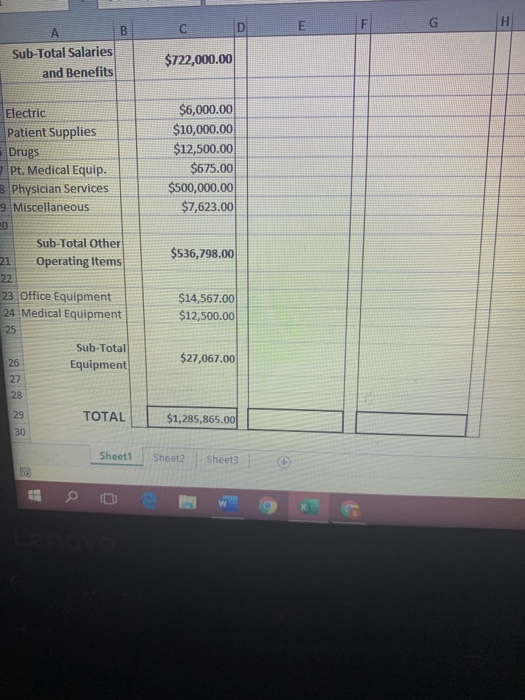

Written Assignment As the Manager of the Greenpoint location of the Metropolitan Clinic, you have been assigned to complete the 2018 operating expense budget. This clinic provides primary care to patients of all ages. It has contracts in place with all of the major payers as well as all of the Medicaid Managed Care providers currently licensed in NY State. In preparing your budget for next year you have been given several assumptions, as follows: Salaries and benefits will increase in 2018 by 2.2% with no adjustment for volume changes. Budgeted amounts for physician services are fixed by contract and in 2018 will equal 2017 levels. In 2018 Drugs are expected to increase by 5.9% Other items in the category "Other Operating Items" are expected to increase by 4% in 2018. No more money is available in 2017 to spend on office equipment, but an additional $6,000 in medical equipment will be spent in the remainder of 2017. Equipment cost is expected to increase by 4% in 2018. The data you have been provided for the current year, 2017, is actual expense thru July. Your assignment is to complete the excel sheet found in this Homework file, and upload it using the ATTACHMENTS button in the Dropbox. In completing this sheet, you must project 2017 final actual expenses and then project the budget amounts for 2018. If you choose to insert numbers into the various cells, and not use formulas to do your calculations, your grade on this assignment will be lowered by 15 points. C D E F G 7 Month Actual Projected 2017 Budget 2018 Salaries Federal and NY Tax Benefits $475,000.00 $76,000.00 $171,000.00 Sub-Total Salaries and Benefits $722,000.00 $6,000.00 $10,000.00 A Electric 15 Patient Supplies 15 Drugs 17 Pt. Medical Equip. 18 Physician Services 19 Miscellaneous $12,500.00 $675.00 $500,000.00 $7,623.00 Sub-Total Other Operating Items $536,798.00 23 Office Equipment 24 Medical Equipment Sheet1 $14,567.00 $12,500.00 Sheet2 Sheet Sub-Total Salaries and Benefits $722,000.00 Electric Patient Supplies Drugs Pt. Medical Equip. B Physician Services 9 Miscellaneous $6,000.00 $10,000.00 $12,500.00 $675.00 $500,000.00 $7,623.00 Sub-Total Other Operating Items $536,798.00 23 Office Equipment 24 Medical Equipment $14,567.00 $12,500.00 Sub-Total Equipment $27,067.00 TOTAL $1,285,865.00 Sheet1 Sheet2 Sheet3