Question

W&S Partners commenced the risk assessment phase of the Cloud 9 audit with procedures to gain an understanding of the clients structure and its business

W&S Partners commenced the risk assessment phase of the Cloud 9 audit with procedures to gain an understanding of the clients structure and its business environment. You have completed your research on the key market forces as they relate to Cloud 9s operations. The topics you researched included the general and industry-specific economic trends and conditions; the competitive environment; product, customer, and supplier information; technological advances and the effect of the Internet; and laws and regulatory requirements. The purpose of this research is to identify the inherent risks. The auditor needs to identify which financial statement assertions may be affected by these inherent risks. Identifying the risks will help determine the nature of the audit procedures to be performed. Management implicitly or explicitly makes assertions regarding the recognition, measurement, presentation, and disclosure of the various elements of the financial statements. Auditors use assertions for account balances to form a basis for the assessment of risks of material misstatement. That is, assertions are used to identify the types of errors that could occur in transactions that result in the account balance. Consequently, further breaking down the account into these assertions will direct the audit effort to those areas of higher risk. The auditors broadly classify assertions as existence or occurrence; completeness; valuation or allocation; rights and obligations; and presentation and disclosure. An additional task during the risk assessment phase is to consider the concept of materiality as it applies to the client. The auditor will design procedures in order to identify and correct errors or irregularities that would have a material effect on the financial statements and affect the decision-making of the users of the financial statements. Materiality is used in determining audit procedures and sample selections, and in evaluating differences between client records and audit results. It is the maximum amount of misstatement, individually or in aggregate, that can be accepted in the financial statements. In selecting the base figure to be used to calculate materiality, an auditor should consider the key drivers of the business and ask, What are the end users (that is, shareholders, banks, and so on) of the accounts going to be looking at? For example, will shareholders be interested in profit figures that can be used to pay dividends and increase share price? W&S Partners audit methodology dictates that one planning materiality (PM) amount is to be used for the financial statements as a whole. Further, only one basis should be selecteda blended approach or average should not be used. The basis selected is the one determined to be the key driver of the business. W&S Partners uses the percentages in table 4.12 as starting points for the various bases. These starting points can be increased or decreased by taking into account qualitative client factors, such as: the nature of the clients business and industry (for example, rapidly changing through growth or downsizing, or because of an unstable environment) whether the client is a public company (or subsidiary of one) that is subject to regulations the knowledge of or high risk of fraud Typically, profit before tax is used; however, it cannot be used if reporting a loss for the year or if profitability is not consistent. When calculating PM based on interim figures, it may be necessary to annualize the results. This allows the auditor to plan the audit properly based on an approximate projected year-end balance. Then, at year end, the figure is adjusted, if necessary, to reflect the actual results.

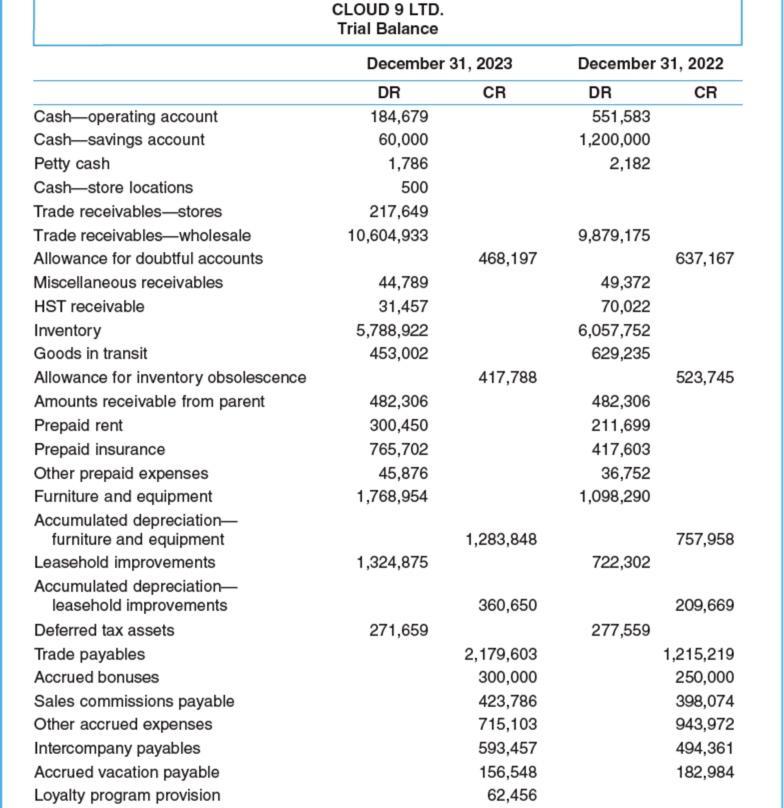

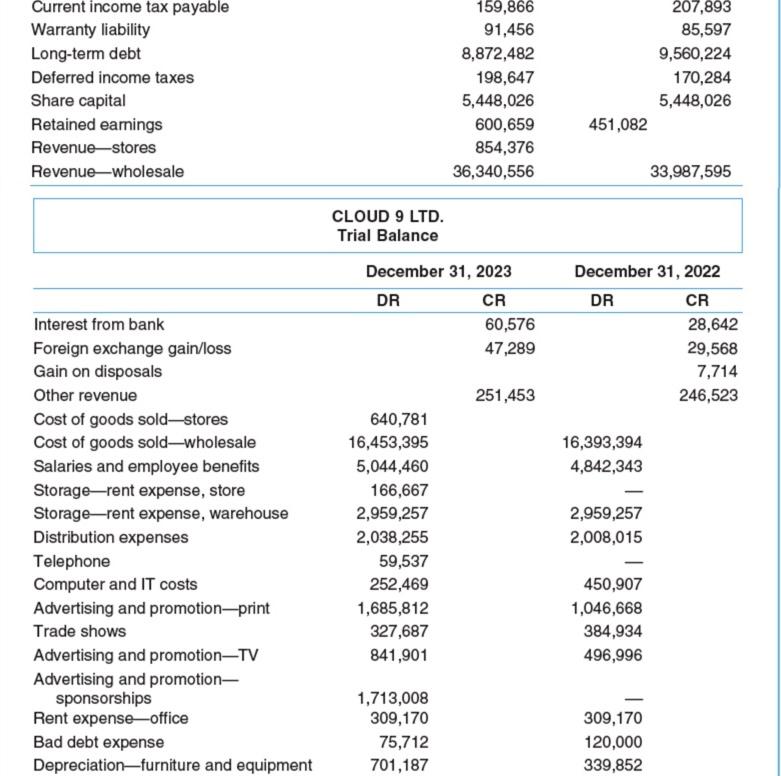

Using the December 31, 2023, trial balance (in Appendix A), calculate planning materiality and include the justification for the basis that you have used for your calculation.

Based on your knowledge of the client and its industry, discuss the inherent risks in the audit of Cloud 9. Identify the associated financial accounts that would be affected and provide an assessment of high, medium, or low in relation to the likelihood and materiality of the risk occurring.

TABLE 4.12 Starting percentages for materiality bases Base Profit before tax Revenues Total assets Equity Threshold (%) 5.0 1.0 1.0 3.0 December 31, 2022 DR CR 551,583 1,200,000 2,182 9,879,175 CLOUD 9 LTD. Trial Balance December 31, 2023 DR CR 184,679 60,000 1,786 500 217,649 10,604,933 468,197 44,789 31,457 5,788,922 453,002 417,788 482,306 300,450 765,702 45,876 1,768,954 637,167 49,372 70,022 6,057,752 629,235 Cash-operating account Cash-savings account Petty cash Cash-store locations Trade receivables-stores Trade receivables-wholesale Allowance for doubtful accounts Miscellaneous receivables HST receivable Inventory Goods in transit Allowance for inventory obsolescence Amounts receivable from parent Prepaid rent Prepaid insurance Other prepaid expenses Furniture and equipment Accumulated depreciation- furniture and equipment Leasehold improvements Accumulated depreciation- leasehold improvements Deferred tax assets Trade payables Accrued bonuses Sales commissions payable Other accrued expenses Intercompany payables Accrued vacation payable Loyalty program provision 523,745 482,306 211,699 417,603 36,752 1,098,290 1,283,848 757,958 1,324,875 722,302 360,650 209,669 271,659 277,559 2,179,603 300,000 423,786 715,103 593,457 156,548 62,456 1,215,219 250,000 398,074 943,972 494,361 182,984 Current income tax payable Warranty liability Long-term debt Deferred income taxes Share capital Retained earnings Revenue-stores Revenue-wholesale 159,866 91,456 8,872,482 198,647 5,448,026 600,659 854,376 36,340,556 207,893 85,597 9,560,224 170,284 5,448,026 451,082 33,987,595 CLOUD 9 LTD. Trial Balance December 31, 2023 DR CR 60,576 47,289 December 31, 2022 DR CR 28,642 29,568 7,714 246,523 251,453 16,393,394 4,842,343 Interest from bank Foreign exchange gain/loss Gain on disposals Other revenue Cost of goods sold-stores Cost of goods soldwholesale Salaries and employee benefits Storagerent expense, store Storage-rent expense, warehouse Distribution expenses Telephone Computer and IT costs Advertising and promotion-print Trade shows Advertising and promotion-TV Advertising and promotion- sponsorships Rent expense-office Bad debt expense Depreciationfurniture and equipment 640,781 16,453,395 5,044,460 166,667 2,959,257 2,038,255 59,537 252,469 1,685,812 327,687 841,901 2,959,257 2,008,015 450,907 1,046,668 384,934 496,996 1,713,008 309,170 75,712 701,187 309,170 120,000 339,852 TABLE 4.12 Starting percentages for materiality bases Base Profit before tax Revenues Total assets Equity Threshold (%) 5.0 1.0 1.0 3.0 December 31, 2022 DR CR 551,583 1,200,000 2,182 9,879,175 CLOUD 9 LTD. Trial Balance December 31, 2023 DR CR 184,679 60,000 1,786 500 217,649 10,604,933 468,197 44,789 31,457 5,788,922 453,002 417,788 482,306 300,450 765,702 45,876 1,768,954 637,167 49,372 70,022 6,057,752 629,235 Cash-operating account Cash-savings account Petty cash Cash-store locations Trade receivables-stores Trade receivables-wholesale Allowance for doubtful accounts Miscellaneous receivables HST receivable Inventory Goods in transit Allowance for inventory obsolescence Amounts receivable from parent Prepaid rent Prepaid insurance Other prepaid expenses Furniture and equipment Accumulated depreciation- furniture and equipment Leasehold improvements Accumulated depreciation- leasehold improvements Deferred tax assets Trade payables Accrued bonuses Sales commissions payable Other accrued expenses Intercompany payables Accrued vacation payable Loyalty program provision 523,745 482,306 211,699 417,603 36,752 1,098,290 1,283,848 757,958 1,324,875 722,302 360,650 209,669 271,659 277,559 2,179,603 300,000 423,786 715,103 593,457 156,548 62,456 1,215,219 250,000 398,074 943,972 494,361 182,984 Current income tax payable Warranty liability Long-term debt Deferred income taxes Share capital Retained earnings Revenue-stores Revenue-wholesale 159,866 91,456 8,872,482 198,647 5,448,026 600,659 854,376 36,340,556 207,893 85,597 9,560,224 170,284 5,448,026 451,082 33,987,595 CLOUD 9 LTD. Trial Balance December 31, 2023 DR CR 60,576 47,289 December 31, 2022 DR CR 28,642 29,568 7,714 246,523 251,453 16,393,394 4,842,343 Interest from bank Foreign exchange gain/loss Gain on disposals Other revenue Cost of goods sold-stores Cost of goods soldwholesale Salaries and employee benefits Storagerent expense, store Storage-rent expense, warehouse Distribution expenses Telephone Computer and IT costs Advertising and promotion-print Trade shows Advertising and promotion-TV Advertising and promotion- sponsorships Rent expense-office Bad debt expense Depreciationfurniture and equipment 640,781 16,453,395 5,044,460 166,667 2,959,257 2,038,255 59,537 252,469 1,685,812 327,687 841,901 2,959,257 2,008,015 450,907 1,046,668 384,934 496,996 1,713,008 309,170 75,712 701,187 309,170 120,000 339,852Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started