Answered step by step

Verified Expert Solution

Question

1 Approved Answer

WSTWY Net profit + All standing charges But the claim in respect of increased cost of working must not exceed the sum produced by applying

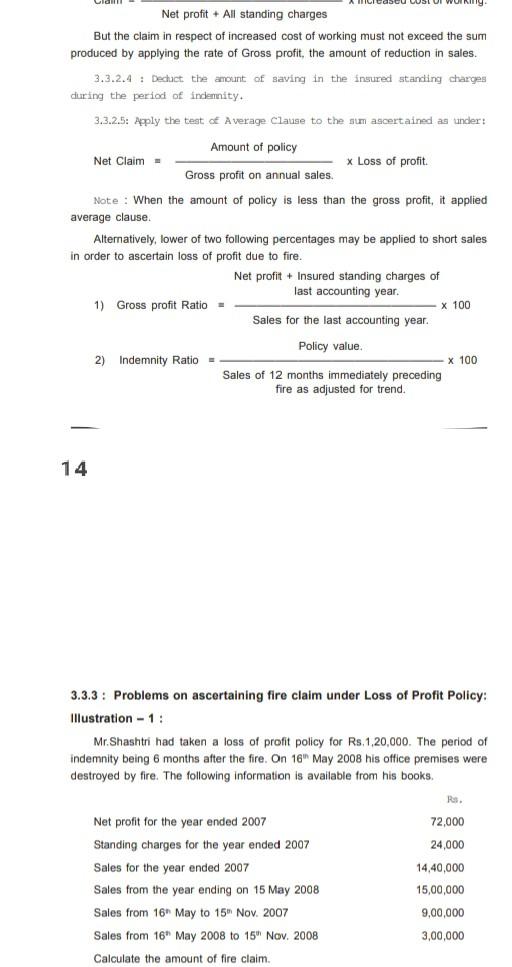

WSTWY Net profit + All standing charges But the claim in respect of increased cost of working must not exceed the sum produced by applying the rate of Gross profit, the amount of reduction in sales. 3.3.2.4 : Declect the amount of saving in the insured standing charges during the period of indemnity. 3.3.2.5: Apply the test of Average Clause to the sum ascertained as under: Amount of policy Net Claim = * Loss of profit. Gross profit on annual sales. Note: When the amount of policy is less than the gross profit, it applied average clause. Alternatively, lower of two following percentages may be applied to short sales in order to ascertain loss of profit due to fire. Net profit + Insured standing charges of last accounting year, 1) Gross profit Ratio - x 100 Sales for the last accounting year. Policy value 2) Indemnity Ratio - x 100 Sales of 12 months immediately preceding fire as adjusted for trend. 14 3.3.3: Problems on ascertaining fire claim under Loss of Profit Policy: Illustration - 1: Mr.Shashtri had taken a loss of profit policy for Rs.1,20,000. The period of indemnity being 6 months after the fire. On 16 May 2008 his office premises were destroyed by fire. The following information is available from his books. RS. 72,000 24,000 Net profit for the year ended 2007 Standing charges for the year ended 2007 Sales for the year ended 2007 Sales from the year ending on 15 May 2008 Sales from 16" May to 15" Nov. 2007 Sales from 16" May 2008 to 15" Nov. 2008 14,40,000 15,00,000 9,00,000 3,00,000 Calculate the amount of fire claim

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started