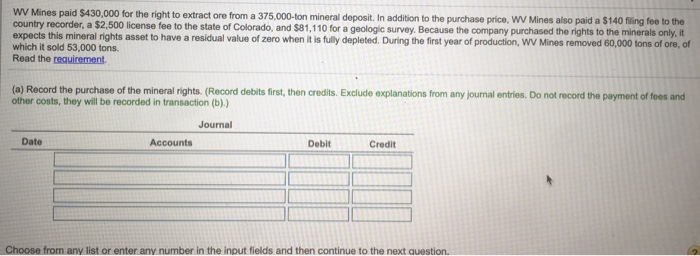

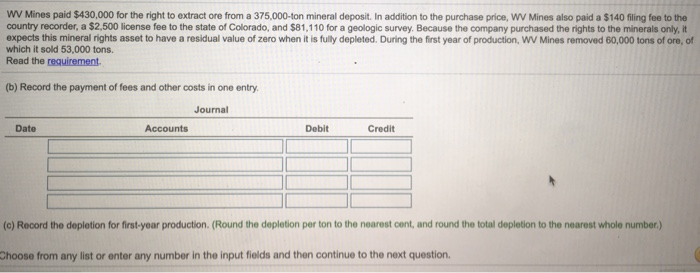

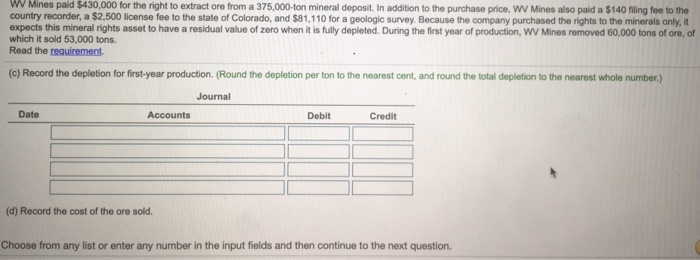

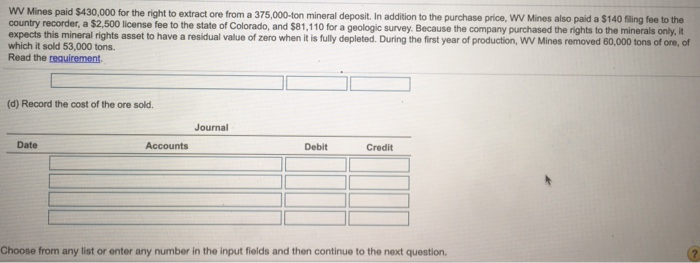

WV Mines paid $430,000 for the right to extract ore from a 375,000-ton mineral deposit. In addition to the purchase price, WV Mines also paid a $140 filing fee to the country recorder, a $2,500 license fee to the state of Colorado, and $81,110 for a geologic survey. Because the company purchased the rights to the minerals only, it expects this mineral rights asset to have a residual value of zero when it is fully depleted. During the first year of production, WV Mines removed 60,000 tons of ore, of which it sold 53,000 tons. Read the requirement (b) Record the payment of fees and other costs in one entry Journal Date Accounts Debit Credit c) Record he depletion for first-year production. Round the depletion per ton to the nearest cent, and round the total depletion to the nearest whole nu er Choose from any list or enter any number in the input fields and then continue to the next question. WW Mines paid $430,000 for the right to extract ore from a 375,000-ton mineral deposit. In addition to the purchase price, WV Mines also paid a $140 fling fee to the country recorder, a $2,500 license fee to the state of Colorado, and $81,110 for a geologic survey. Because the company purchased the rights to the minerals only, it expects this mineral rights asset to have a residual value of zero when it is fully depleted. During the first year of production, WV Mines removed 60,000 tons of ore, of which it sold 53,000 tons Read the requirement (c) Record the depletion for first-year production. (Round the depletion per ton to the nearest cent, and round the total depletion to the nearest whole number.) Journal Date Accounts Debit Credit (d) Record the cost of the ore sold Choose from any list or enter any number in the input fields and then continue to the next question. WW Mines paid $430,000 for the right to extract ore from a 375,000-ton mineral deposit. In addition to the purchase price, WV Mines also paid a $140 fling fee to the country recorder, a $2,500 license fee to the state of Colorado, and $81,110 for a geologic survey. Because the company purchased the rights to the minerals only,i expects this mineral rights asset to have a residual value of zero when it is fully depleted. During the first year of production, WV Mines removed 60,000 tons of ore, of which it sold 53,000 tons. Read the requirement (d) Record the cost of the ore sold Journal Date Accounts Debit Credit Choose from any list or enter any number in the input fields and then continue to the next