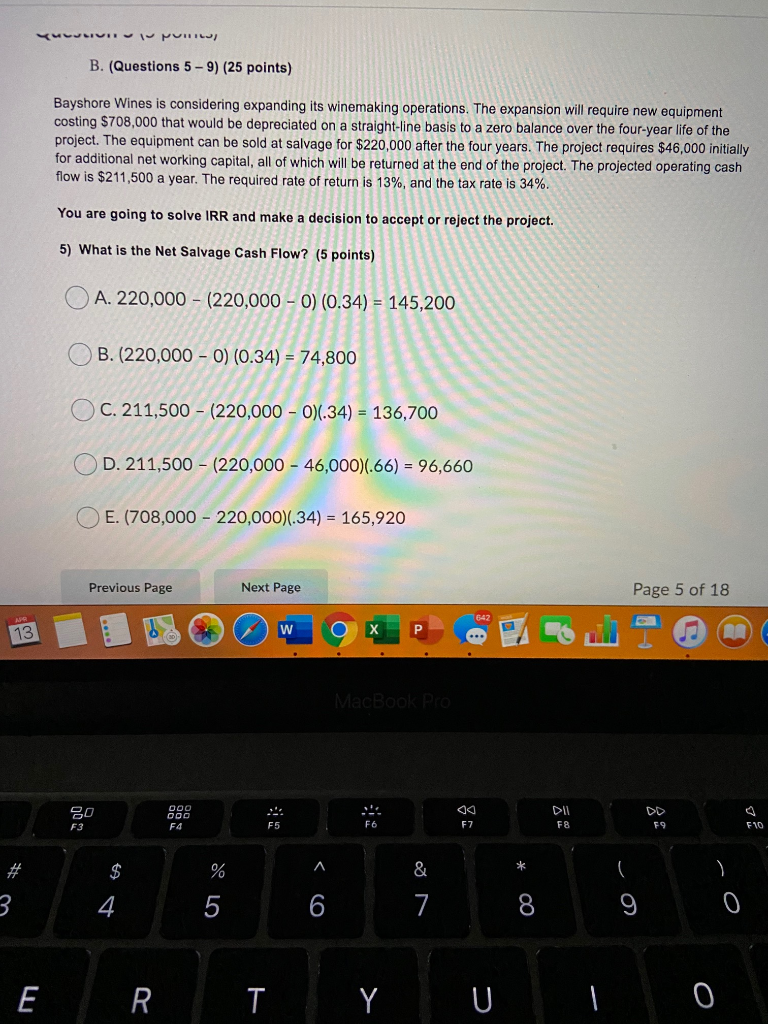

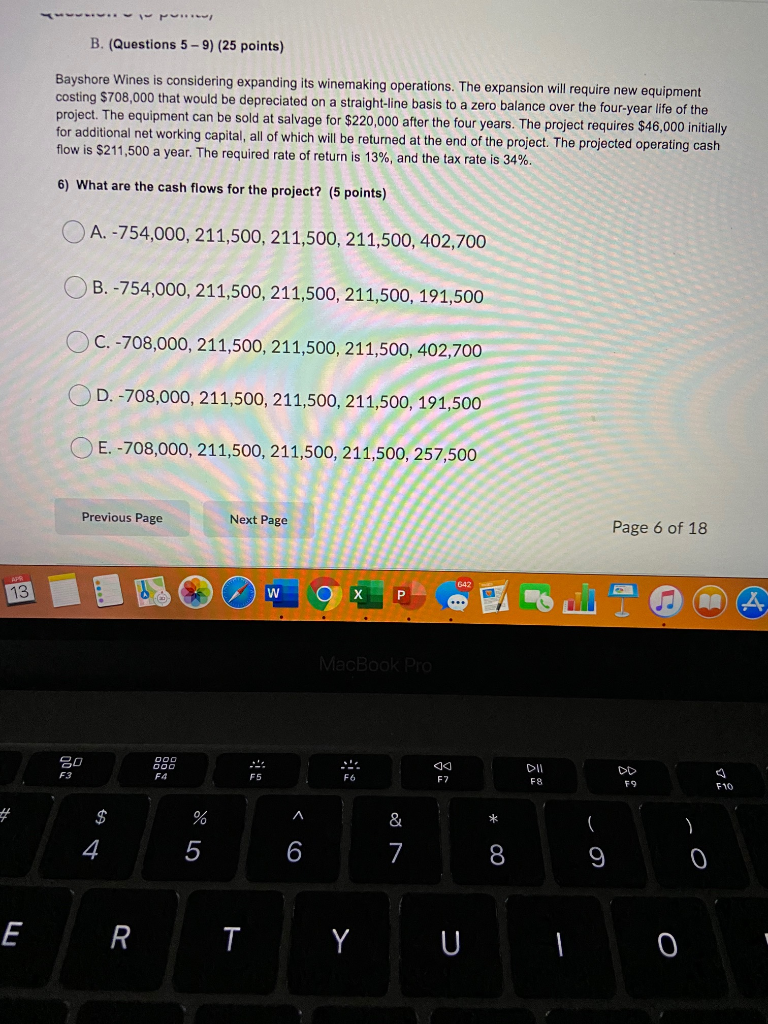

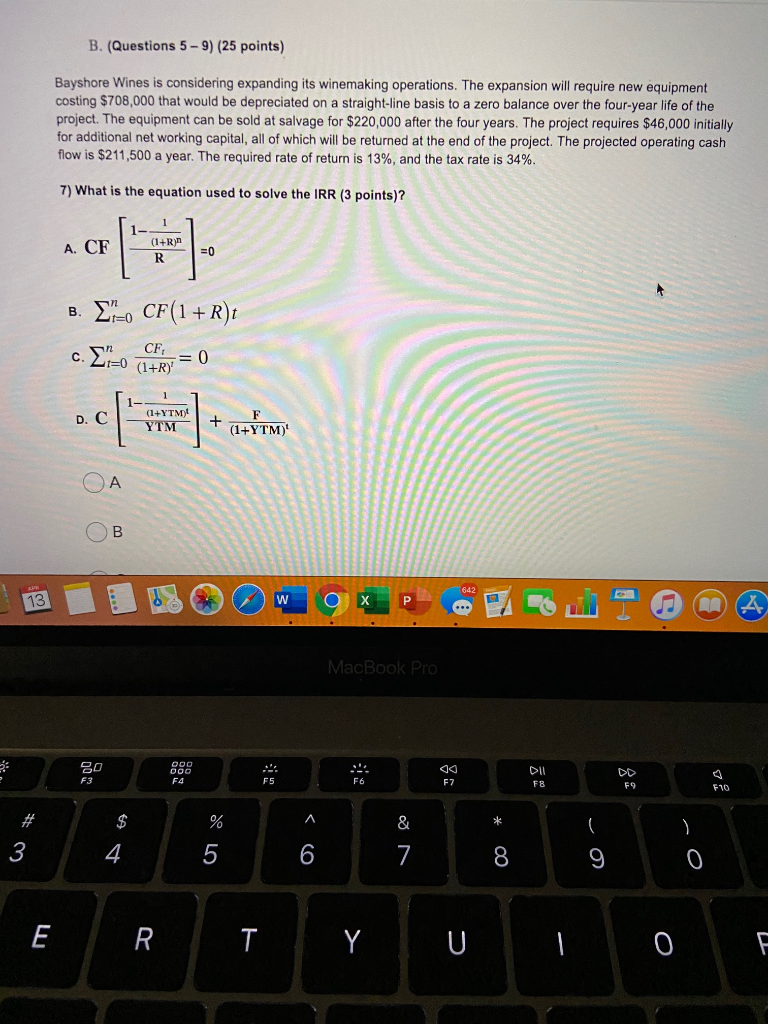

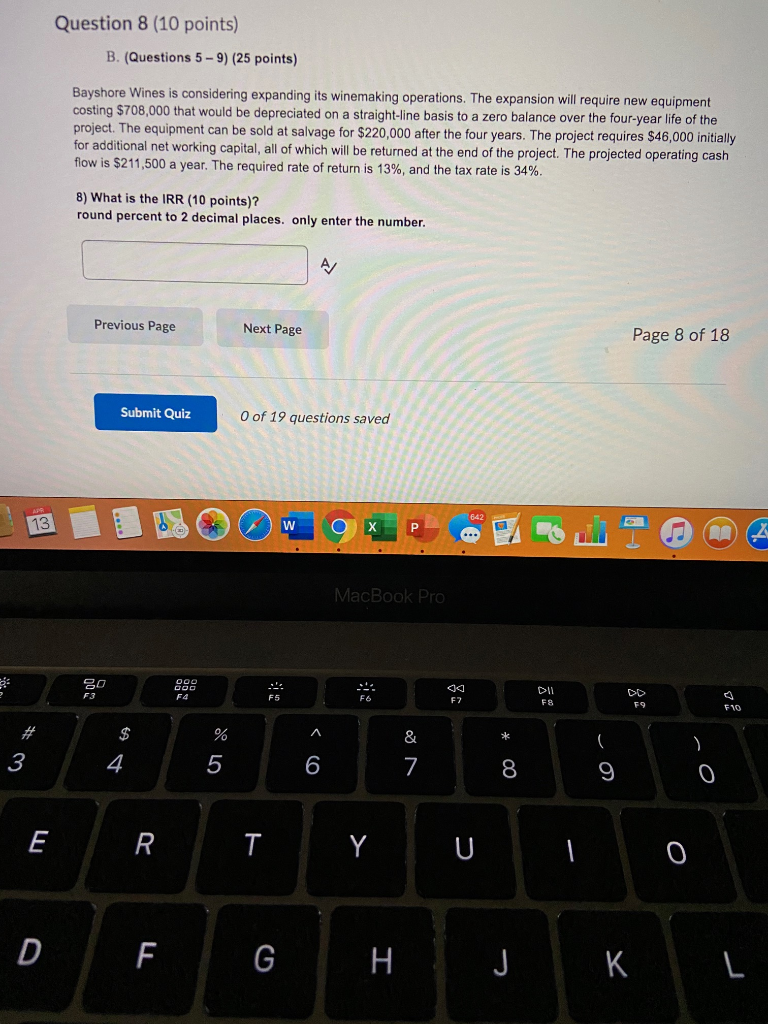

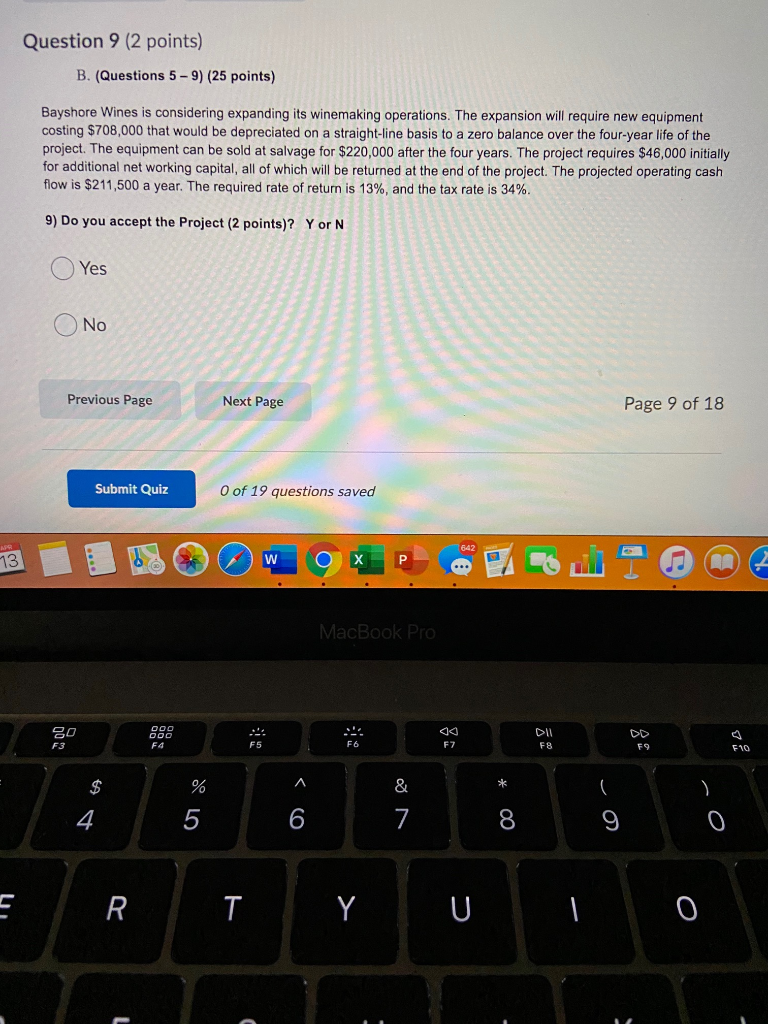

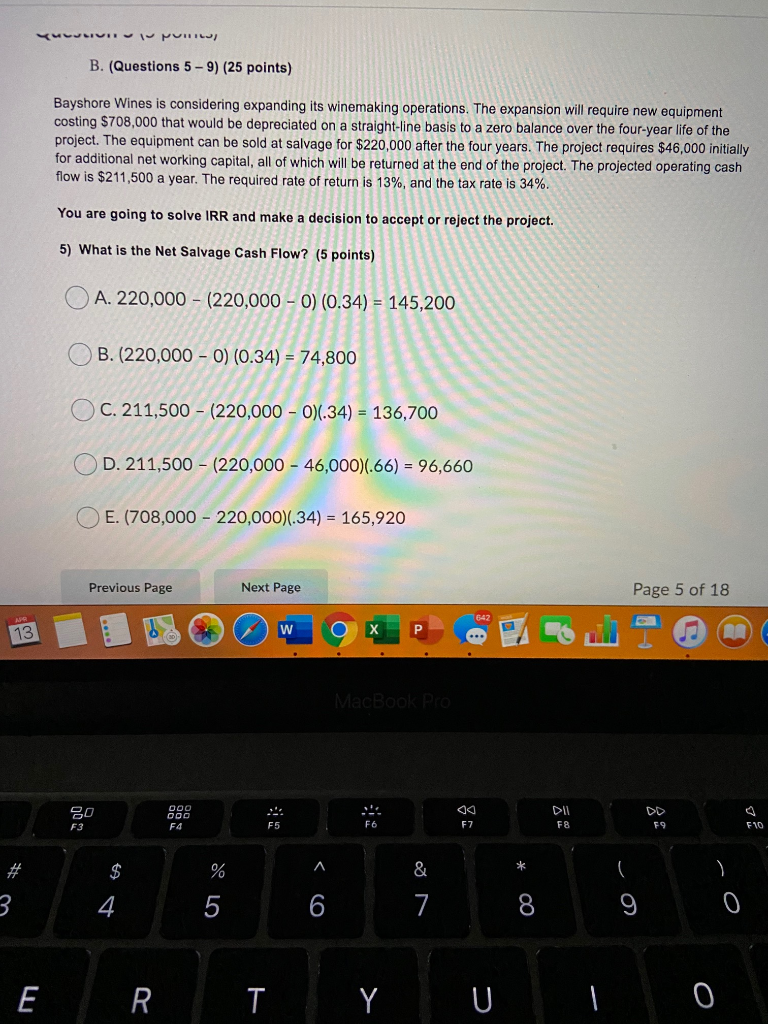

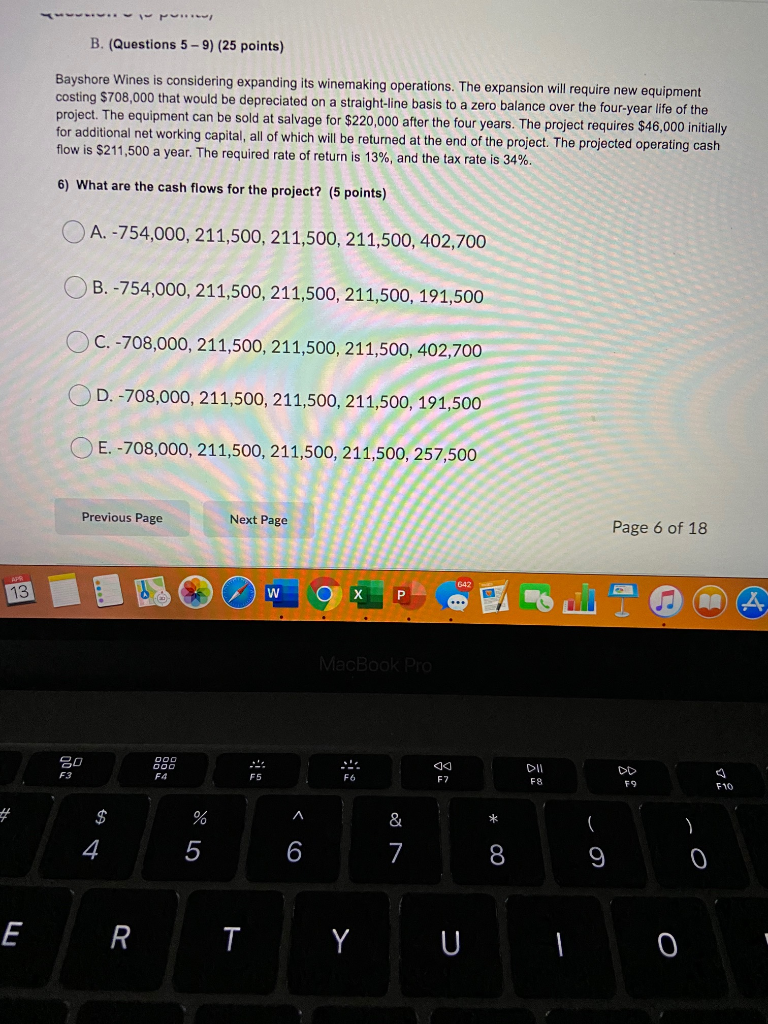

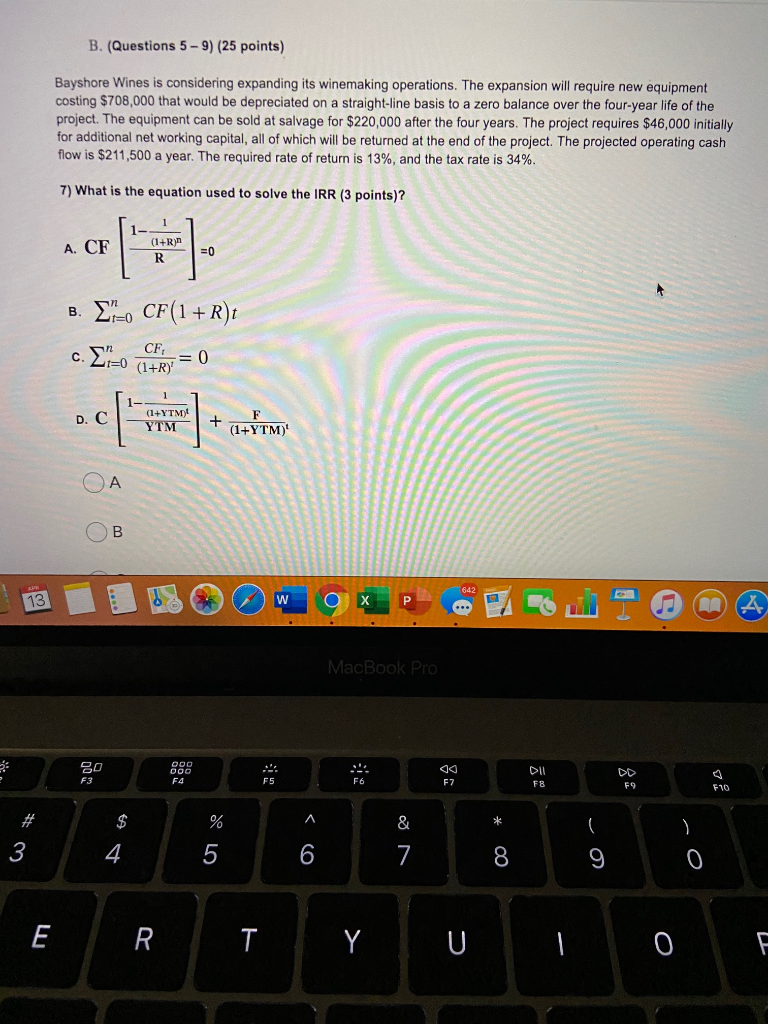

www lu pulli B. (Questions 5-9) (25 points) Bayshore Wines is considering expanding its winemaking operations. The expansion will require new equipment costing $708,000 that would be depreciated on a straight-line basis to a zero balance over the four-year life of the project. The equipment can be sold at salvage for $220,000 after the four years. The project requires $46,000 initially for additional networking capital, all of which will be returned at the end of the project. The projected operating cash flow is $211,500 a year. The required rate of return is 13%, and the tax rate is 34%. You are going to solve IRR and make a decision to accept or reject the project. 5) What is the Net Salvage Cash Flow? (5 points) A. 220,000 - (220,000 - 0) (0.34) = 145,200 OB. (220,000 - 0) (0.34) = 74,800 OC. 211,500 - (220,000 - 0).34) = 136,700 OD. 211,500 - (220,000 - 46,000)(.66) = 96,660 O E. (708,000 - 220,000)(.34) = 165,920 Previous Page Next Page Page 5 of 18 KIMI B. (Questions 5 - 9) (25 points) Bayshore Wines is considering expanding its winemaking operations. The expansion will require new equipment costing $708,000 that would be depreciated on a straight-line basis to a zero balance over the four-year life of the project. The equipment can be sold at salvage for $220,000 after the four years. The project requires $46,000 initially for additional net working capital, all of which will be returned at the end of the project. The projected operating cash flow is $211,500 a year. The required rate of return is 13%, and the tax rate is 34%. 6) What are the cash flows for the project? (5 points) A. -754,000, 211,500, 211,500, 211,500, 402,700 OB. -754,000, 211,500, 211,500, 211,500, 191,500 C. -708,000, 211,500, 211,500, 211,500, 402,700 OD. -708,000, 211,500, 211,500, 211,500, 191,500 O E. -708,000, 211,500, 211,500, 211,500, 257,500 Previous Page Next Page Page 6 of 18 & ' 4 5 ^ 6 9 RT YUTTO B. (Questions 5 - 9) (25 points) Bayshore Wines is considering expanding its winemaking operations. The expansion will require new equipment costing $708,000 that would be depreciated on a straight-line basis to a zero balance over the four-year life of the project. The equipment can be sold at salvage for $220,000 after the four years. The project requires $46,000 initially for additional net working capital, all of which will be returned at the end of the project. The projected operating cash flow is $211,500 a year. The required rate of return is 13%, and the tax rate is 34%. 7) What is the equation used to solve the IRR (3 points)? B. X10 CF(1 + R) OB MacBook Pro F4 10 * '6 7 8 9 10 YUTTO Question 8 (10 points) B. (Questions 5 - 9) (25 points) Bayshore Wines is considering expanding its winemaking operations. The expansion will require new equipment costing $708,000 that would be depreciated on a straight-line basis to a zero balance over the four-year life of the project. The equipment can be sold at salvage for $220,000 after the four years. The project requires $46,000 initially for additional networking capital, all of which will be returned at the end of the project. The projected operating cash flow is $211,500 a year. The required rate of return is 13%, and the tax rate is 34%. 8) What is the IRR (10 points)? round percent to 2 decimal places. only enter the number. Previous Page Next Page Page 8 of 18 Submit Quiz O of 19 questions saved MacBook Pro F4 FB F10 de on 8 9 0 R. Question 9 (2 points) B. (Questions 5 - 9) (25 points) Bayshore Wines is considering expanding its winemaking operations. The expansion will require new equipment costing $708,000 that would be depreciated on a straight-line basis to a zero balance over the four-year life of the project. The equipment can be sold at salvage for $220,000 after the four years. The project requires $46,000 initially for additional net working capital, all of which will be returned at the end of the project. The projected operating cash flow is $211,500 a year. The required rate of return is 13%, and the tax rate is 34%. 9) Do you accept the Project (2 points)? Y or N Yes O No Previous Page Next Page Page 9 of 18 Submit Quiz O of 19 questions saved w oxe PA @ OA MacBook Pro % 5 VII Y IU U