Question

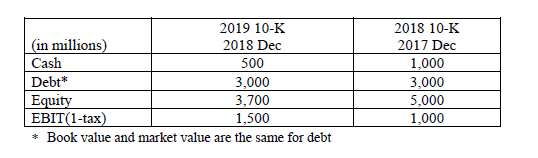

WY co. reported a book value of $5 billion in equity, the book value of $3 billion in debt, and $1 billion as a cash

WY co. reported a book value of $5 billion in equity, the book value of $3 billion in debt, and $1 billion as a cash balance. The company generated $1.5 billion in after-tax operating income last year is expected to maintain its current return on capital in perpetuity. Also, the company is expected to grow its operating income 10% a year for the next four years and 2.75% a year thereafter in perpetuity. The cost of capital is assumed to be 7.4% in perpetuity.

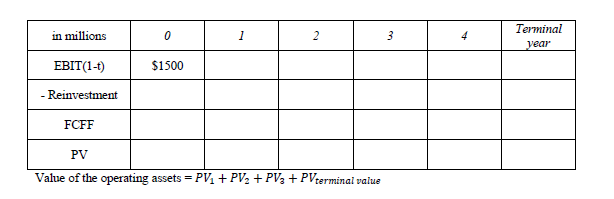

Estimate the value of the operating assets of the firm today. (you can use the given table)

$31,792 MM $35,190 MM $39,510 MM $43,672 MM $46,334 MM

2019 10-K 2018 Dec 500 3,000 3,700 1,500 2018 10-K 2017 Dec 1,000 3,000 5,000 1,000 (in millions) Cash Debt* Equity EBIT(1-tax Book value and market value are the same for debt Terminal in millions EBIT (1-t) Reinvestment FCFF PV $1500 Value of the operating assets-PV + PV -+ PV, Pherminal value 2019 10-K 2018 Dec 500 3,000 3,700 1,500 2018 10-K 2017 Dec 1,000 3,000 5,000 1,000 (in millions) Cash Debt* Equity EBIT(1-tax Book value and market value are the same for debt Terminal in millions EBIT (1-t) Reinvestment FCFF PV $1500 Value of the operating assets-PV + PV -+ PV, Pherminal valueStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started