Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, 2022, Eunice Company purchased a 4-year, P5,000,000 face value 10% debt instruments for P5,350,000. The debt instruments pay interest every December

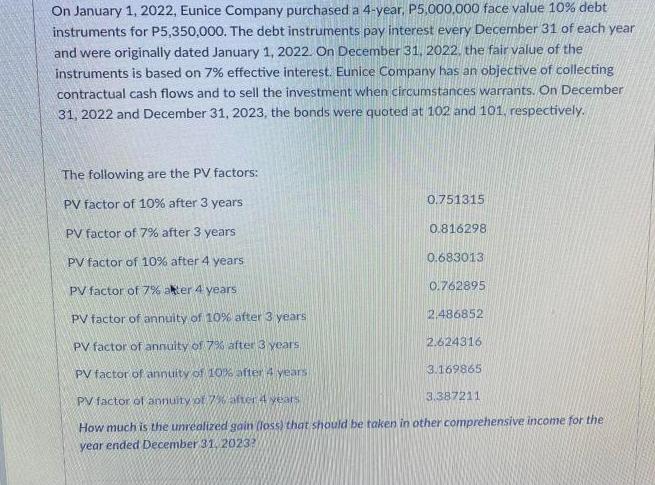

On January 1, 2022, Eunice Company purchased a 4-year, P5,000,000 face value 10% debt instruments for P5,350,000. The debt instruments pay interest every December 31 of each year and were originally dated January 1, 2022. On December 31, 2022. the fair value of the instruments is based on 7% effective interest. Eunice Company has an objective of collecting contractual cash flows and to sell the investment when circumstances warrants. On December 31, 2022 and December 31, 2023, the bonds were quoted at 102 and 101, respectively. The following are the PV factors: PV factor of 10% after 3 years PV factor of 7% after 3 years PV factor of 10% after 4 years PV factor of 7% after 4 years PV factor of annuity of 10% after 3 years PV factor of annuity of 7% after 3 years PV factor of annuity of 10% after 4 years PV factor of annuity of 7% after 4 years How much is the unrealized gain (loss) that should be taken in other comprehensive income for the year ended December 31, 2023? 0.751315 0.816298 0.683013 0.762895 2.486852 2.624316 3.169865 3.387211

Step by Step Solution

★★★★★

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Answer The unreal ized gain loss that should be taken in other comprehensive income for th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started