Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Wyoming Co. is a nonprofit educational institution that wants to import educational software products from Hong Kong and sell them in the United States.

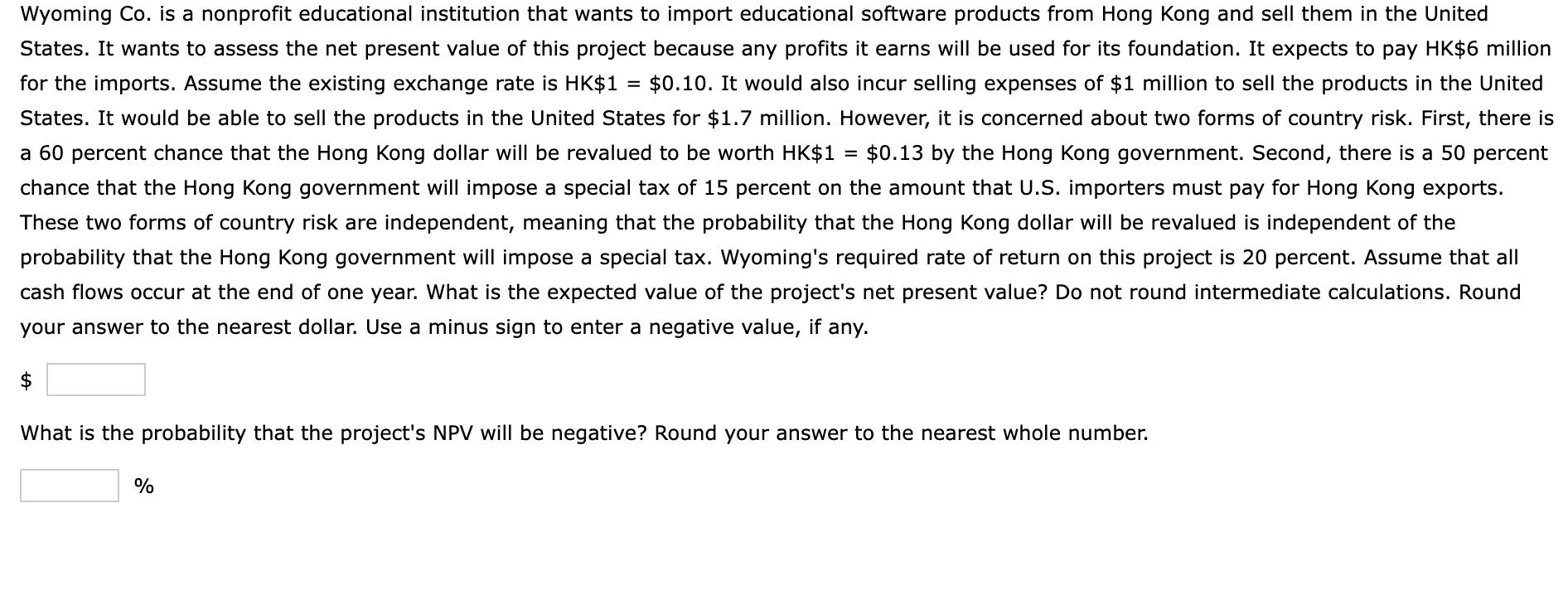

Wyoming Co. is a nonprofit educational institution that wants to import educational software products from Hong Kong and sell them in the United States. It wants to assess the net present value of this project because any profits it earns will be used for its foundation. It expects to pay HK$6 million for the imports. Assume the existing exchange rate is HK$1 = $0.10. It would also incur selling expenses of $1 million to sell the products in the United States. It would be able to sell the products in the United States for $1.7 million. However, it is concerned about two forms of country risk. First, there is a 60 percent chance that the Hong Kong dollar will be revalued to be worth HK$1 = $0.13 by the Hong Kong government. Second, there is a 50 percent chance that the Hong Kong government will impose a special tax of 15 percent on the amount that U.S. importers must pay for Hong Kong exports. These two forms of country risk are independent, meaning that the probability that the Hong Kong dollar will be revalued is independent of the probability that the Hong Kong government will impose a special tax. Wyoming's required rate of return on this project is 20 percent. Assume that all cash flows occur at the end of one year. What is the expected value of the project's net present value? Do not round intermediate calculations. Round your answer to the nearest dollar. Use a minus sign to enter a negative value, if any. $ What is the probability that the project's NPV will be negative? Round your answer to the nearest whole number. %

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Expected Value of Net Present Value NPV Scenario 1 No Revaluation No Tax 40 chance Cost of Imports H...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started