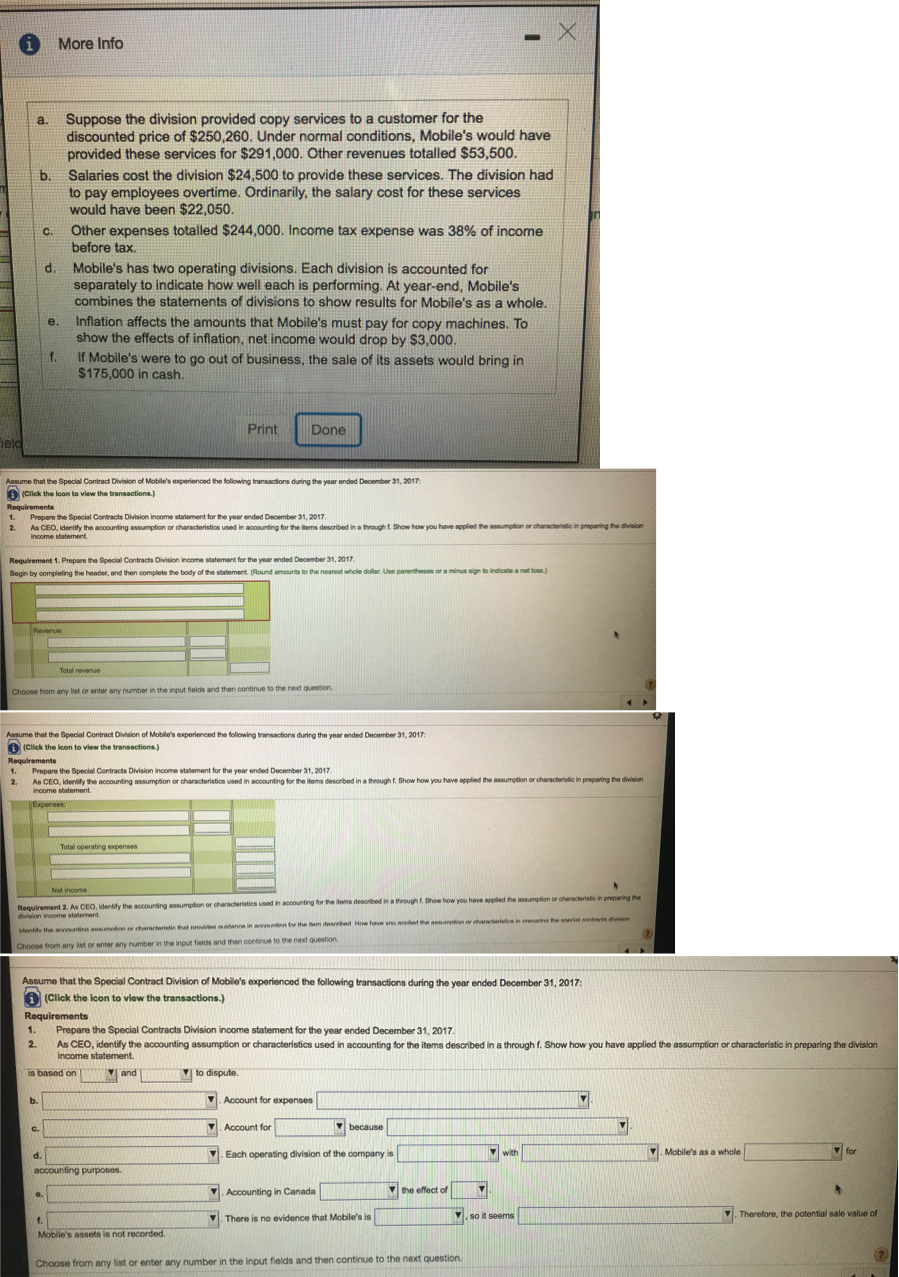

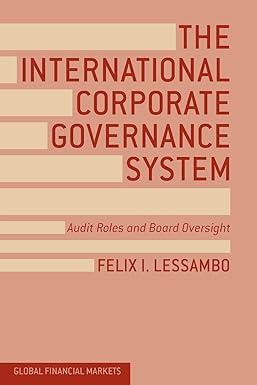

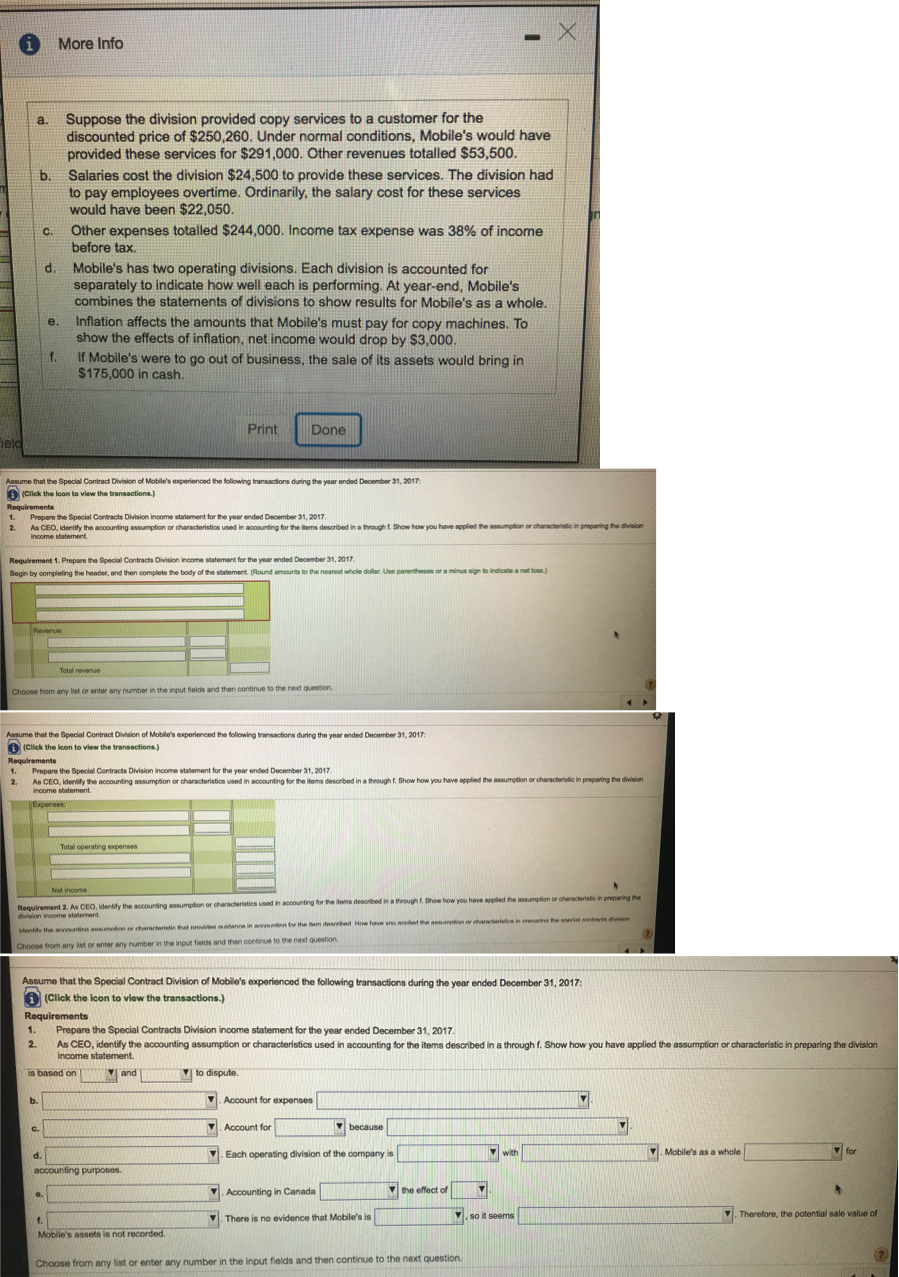

- X 1 More Info a. b. C Suppose the division provided copy services to a customer for the discounted price of $250,260. Under normal conditions, Mobile's would have provided these services for $291,000. Other revenues totalled $53,500. Salaries cost the division $24,500 to provide these services. The division had to pay employees overtime. Ordinarily, the salary cost for these services would have been $22,050. Other expenses totalled $244,000. Income tax expense was 38% of income before tax. Mobile's has two operating divisions. Each division is accounted for separately to indicate how well each is performing. At year-end, Mobile's combines the statements of divisions to show results for Mobile's as a whole. Inflation affects the amounts that Mobile's must pay for copy machines. To show the effects of inflation, net income would drop by $3,000. If Mobile's were to go out of business, the sale of its assets would bring in $175.000 in cash. d. e. f. Print Done held Assume that the Special Contract Division of Mobile's experienced the following transactions during the year ended December 31, 2017: (Click the loon to view the transactions) Requirements Prepare the Special Contracts Division income statement for the year ended December 31, 2017 As CEO, Identify the accounting assumption or characteristics used in accounting for the terms described in a through to show how you have applied the assumption or characteristic in preparing the division Income statement Requirement 1. Prepare the Special Contracts Division income Matement for the year ended December 31, 2017 Begin by completing the header, and then complete the body of the watement. (Round mounts to the nearest whole dollar Use parentheses or a minus sign to indicate a new) Revenue Total revenue Choose from any list or enter any number in the input fields and then continue to the next question Assume that the Special Contract Division of Mobile's experienced the following transactions during the year ended December 31, 2017 (Click the len to view the transactions.) Requirements 1. Prepare the Special Contracts Division income statement for the year ended December 31, 2017 As CEO, identify the accounting assumption or characteristics used in accounting for the terms described in a through t. show how you have applied the assumption or characteristic in preparing the division Income statement Expert 2. Total operating expenses Net Income Requirement 2. As CEO, Identity the accounting assumption or characteristics used in accounting for the one described in a tough Show how you have applied the assumption or characteristio in preparing the division income statement want the www shararterist that in the mid Hrwhen he was in this Choose from any lot or enter any number in the input fields and then continue to the next question Assume that the Special Contract Division of Mobile's experienced the following transactions during the year ended December 31, 2017: (Click the icon to view the transactions.) Requirements 1. Prepare the Special Contracts Division income statement for the year ended December 31, 2017. 2. As CEO, identify the accounting assumption or characteristics used in accounting for the items described in a through f. Show how you have applied the assumption or characteristic in preparing the division income statement is based on and to dispute b. Account for expenses M C Account for because M d. Each operating division of the company is V with Mobile's as a whole for accounting purposes. o. Accounting in Canada the effect of so it seems There is no evidence that Mobile's is . Therefore, the potential sale value of Mobile's assets is not recorded Choose from any list or enter any number in the input fields and then continue to the next