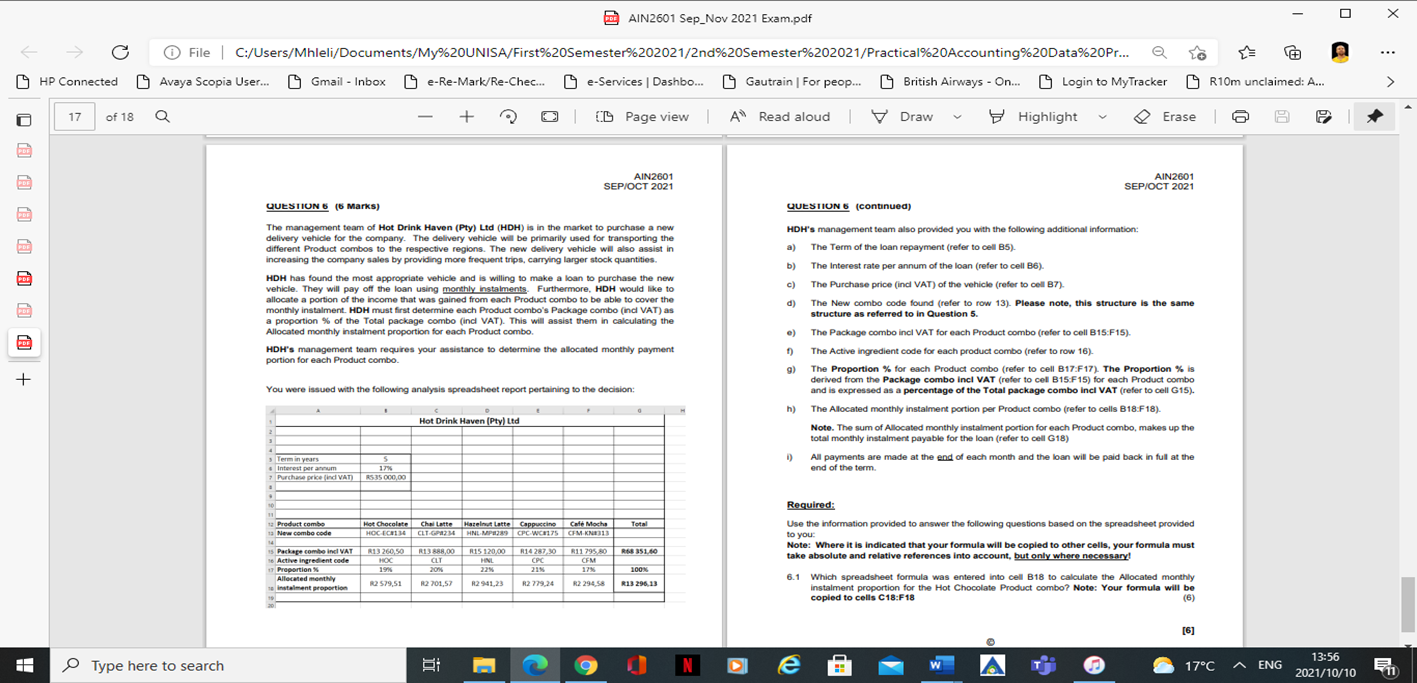

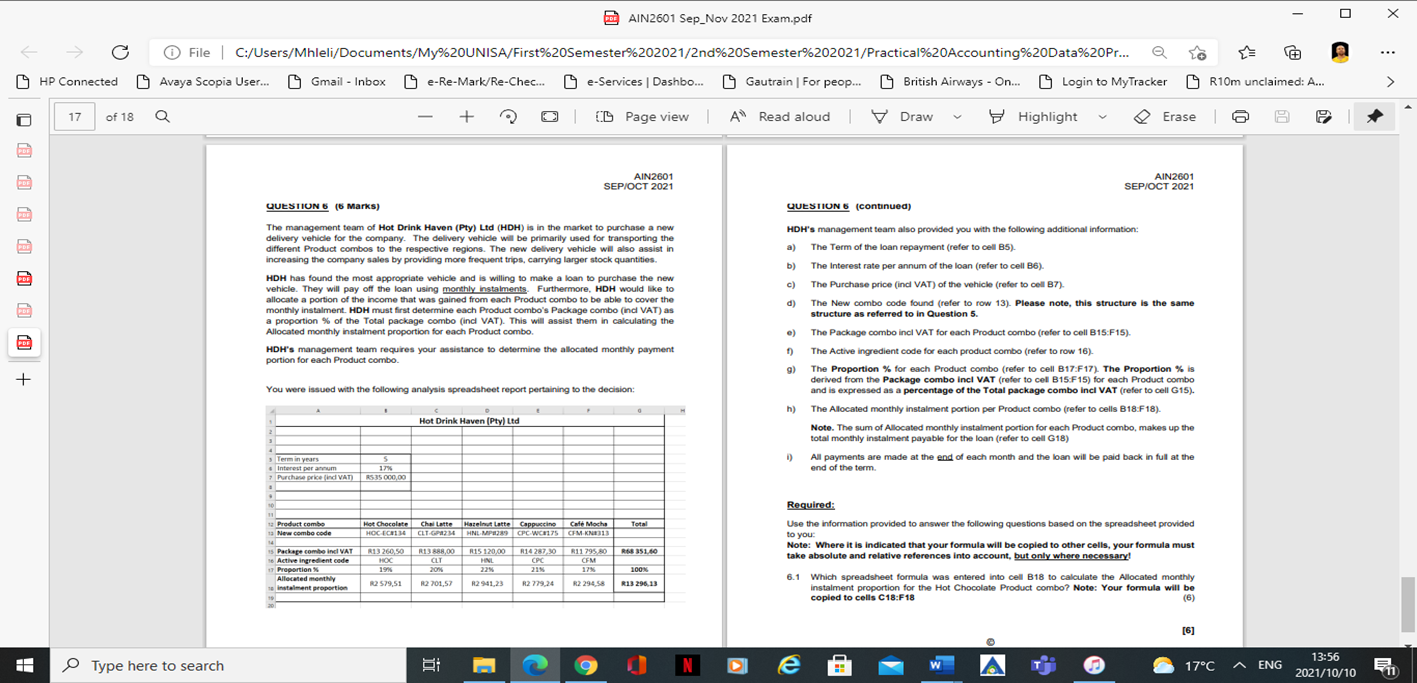

x 1 PAIN2601 Sep Nov 2021 Exam.pdf o ... File C:/Users/Mhleli/Documents/My%20UNISA/First%20Semester%202021/2nd%20Semester%202021/Practical%20Accounting%20Data%20Pr... Avaya Scopia User... Gmail - Inbox e-Re-Mark/Re-Chec... e-Services Dashbo... O Gautrain For peop... British Airways - On... Login to MyTracker R10m unclaimed: A... 19 HP Connected > 17 of 18 Q Q + | D Page view A Read aloud IV Draw Highlight Erasel AIN2601 SEPIOCT 2021 AIN2601 SEP OCT 2021 QUESTION 6 (6 Marks) QUESTION 6 (continued) + a) PDF The management team of Hot Drink Haven (Pty) Ltd (HDH) is in the market to purchase a new delivery vehicle for the company. The delivery vehicle will be primarily used for transporting the different Product combos to the respective regions. The new delivery vehicle will also assist in increasing the company sales by providing more frequent trips, carrying larger stock quantities. HDH has found the most appropriate vehicle and is willing to make a loan to purchase the new vehicle. They will pay off the loan using monthly instalments. Furthermore, HDH would like to allocate a portion of the income that was gained from each Product combo to be able to cover the monthly instalment. HDH must first determine each Product combo's Package combo (ind VAT) as a proportion % of the Total package combo (ind VAT). This will assist them in calculating the Allocated monthly instalment proportion for each Product combo HDH's management team requires your assistance to determine the allocated monthly payment portion for each Product combo. PDF PDF HDH's management team also provided you with the following additional information: The Term of the loan repayment (refer to cell B5). b) The Interest rate per annum of the loan (refer to cell B6). c) The Purchase price (ind VAT) of the vehicle (refer to cell B7). ) ). d) The New combo code found (refer to row 13). Please note, this structure is the same structure as referred to in Question 5 e) The Package combo incl VAT for each Product combo (refer to cell B15:F15). :). 1) The Active ingredient code for each product combo (refer to row 16). 9) The Proportion % for each Product combo (refer to cell B17-F17). The Proportion % is derived from the Package combo Incl VAT (refer to cell B15-F15) for each Product combo and is expressed as a percentage of the Total package combo Incl VAT (refer to cell G15). h) The Allocated monthly instalment portion per Product combo (refer to cells B18:F18). Note. The sum of Allocated monthly instalment portion for each Product combo, makes up the total monthly instalment payable for the loan (refer to cell G18) All payments are made at the end of each month and the loan will be paid back in ful at the end of the term. You were issued with the following analysis spreadsheet report pertaining to the decision: Hot Drink Haven (Pty) Ltd 2 Termin years Interest per annum 7 Purchase price and VAT) 17% R5 35 000,00 Total R$ 351.60 Product combe Chocolate Chai Latte Cappuccino Newcombe code HOC ECB130 CLT-CPAZMAINE-MPA289 CPCWCH175 CM. KNE313 Package combo Incl VAT R13 260,50 R13888,00 R15 120,00 R14 287,30 R11 795,80 Active ingredient code HOC HNL CPC CFM Proportion 1994 20% 17% Allocated monthly R2 579,51 R2 701,57 R294123 R2 779.24 Instalment proportion R2 29456 294 Required: Use the information provided to answer the following questions based on the spreadsheet provided to you: Note: Where it is indicated that your formula will be copied to other cells, your formula must take absolute and relative references into account, but only where necessary! 6.1 Which spreadsheet formula was entered into cell B18 to calculate the Allocated monthly instalment proportion for the Hot Chocolate Product combo? Note: Your formula will be copied to cells C18:F18 (6) OLT 100% R13 296,13 [6] 1 Type here to search gi N e W 17C A ENG 13:56 2021/10/10 11 x 1 PAIN2601 Sep Nov 2021 Exam.pdf o ... File C:/Users/Mhleli/Documents/My%20UNISA/First%20Semester%202021/2nd%20Semester%202021/Practical%20Accounting%20Data%20Pr... Avaya Scopia User... Gmail - Inbox e-Re-Mark/Re-Chec... e-Services Dashbo... O Gautrain For peop... British Airways - On... Login to MyTracker R10m unclaimed: A... 19 HP Connected > 17 of 18 Q Q + | D Page view A Read aloud IV Draw Highlight Erasel AIN2601 SEPIOCT 2021 AIN2601 SEP OCT 2021 QUESTION 6 (6 Marks) QUESTION 6 (continued) + a) PDF The management team of Hot Drink Haven (Pty) Ltd (HDH) is in the market to purchase a new delivery vehicle for the company. The delivery vehicle will be primarily used for transporting the different Product combos to the respective regions. The new delivery vehicle will also assist in increasing the company sales by providing more frequent trips, carrying larger stock quantities. HDH has found the most appropriate vehicle and is willing to make a loan to purchase the new vehicle. They will pay off the loan using monthly instalments. Furthermore, HDH would like to allocate a portion of the income that was gained from each Product combo to be able to cover the monthly instalment. HDH must first determine each Product combo's Package combo (ind VAT) as a proportion % of the Total package combo (ind VAT). This will assist them in calculating the Allocated monthly instalment proportion for each Product combo HDH's management team requires your assistance to determine the allocated monthly payment portion for each Product combo. PDF PDF HDH's management team also provided you with the following additional information: The Term of the loan repayment (refer to cell B5). b) The Interest rate per annum of the loan (refer to cell B6). c) The Purchase price (ind VAT) of the vehicle (refer to cell B7). ) ). d) The New combo code found (refer to row 13). Please note, this structure is the same structure as referred to in Question 5 e) The Package combo incl VAT for each Product combo (refer to cell B15:F15). :). 1) The Active ingredient code for each product combo (refer to row 16). 9) The Proportion % for each Product combo (refer to cell B17-F17). The Proportion % is derived from the Package combo Incl VAT (refer to cell B15-F15) for each Product combo and is expressed as a percentage of the Total package combo Incl VAT (refer to cell G15). h) The Allocated monthly instalment portion per Product combo (refer to cells B18:F18). Note. The sum of Allocated monthly instalment portion for each Product combo, makes up the total monthly instalment payable for the loan (refer to cell G18) All payments are made at the end of each month and the loan will be paid back in ful at the end of the term. You were issued with the following analysis spreadsheet report pertaining to the decision: Hot Drink Haven (Pty) Ltd 2 Termin years Interest per annum 7 Purchase price and VAT) 17% R5 35 000,00 Total R$ 351.60 Product combe Chocolate Chai Latte Cappuccino Newcombe code HOC ECB130 CLT-CPAZMAINE-MPA289 CPCWCH175 CM. KNE313 Package combo Incl VAT R13 260,50 R13888,00 R15 120,00 R14 287,30 R11 795,80 Active ingredient code HOC HNL CPC CFM Proportion 1994 20% 17% Allocated monthly R2 579,51 R2 701,57 R294123 R2 779.24 Instalment proportion R2 29456 294 Required: Use the information provided to answer the following questions based on the spreadsheet provided to you: Note: Where it is indicated that your formula will be copied to other cells, your formula must take absolute and relative references into account, but only where necessary! 6.1 Which spreadsheet formula was entered into cell B18 to calculate the Allocated monthly instalment proportion for the Hot Chocolate Product combo? Note: Your formula will be copied to cells C18:F18 (6) OLT 100% R13 296,13 [6] 1 Type here to search gi N e W 17C A ENG 13:56 2021/10/10 11