Answered step by step

Verified Expert Solution

Question

1 Approved Answer

x= $5 compute only the new shares Use $X = $5 napon 8. The Ewing Distribution Company is planning a $100 million expansion of its

x= $5

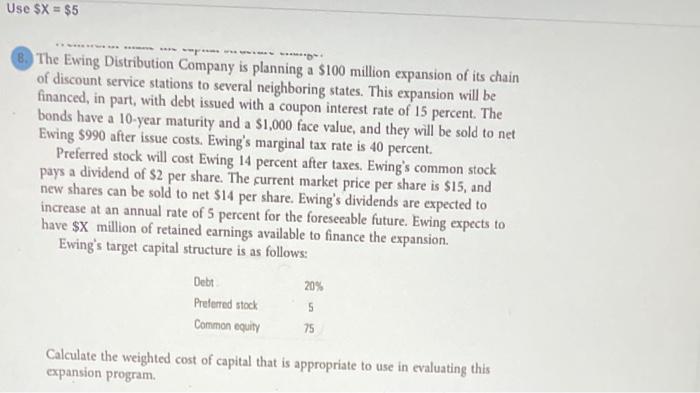

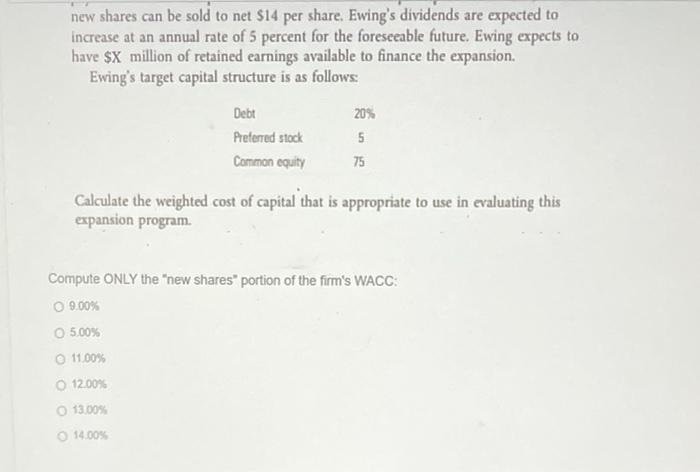

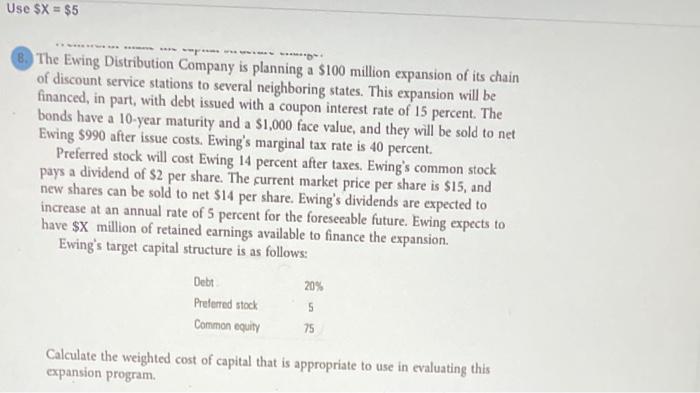

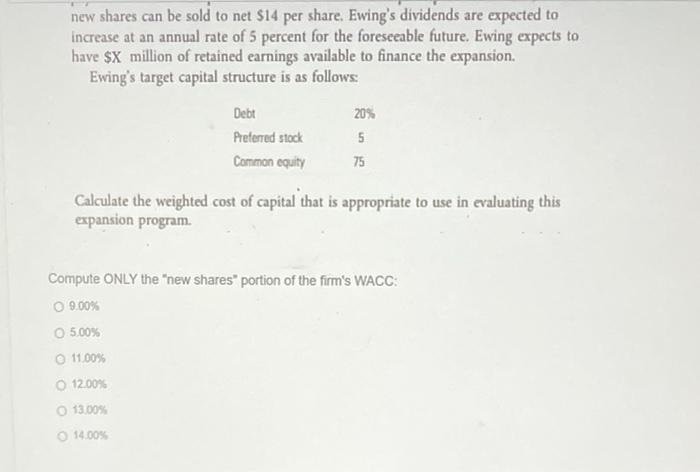

Use $X = $5 napon 8. The Ewing Distribution Company is planning a $100 million expansion of its chain of discount service stations to several neighboring states. This expansion will be financed, in part, with debt issued with a coupon interest rate of 15 percent. The bonds have a 10-year maturity and a $1,000 face value, and they will be sold to net Ewing $990 after issue costs. Ewing's marginal tax rate is 40 percent. Preferred stock will cost Ewing 14 percent after taxes. Ewing's common stock pays a dividend of $2 per share. The current market price per share is $15, and new shares can be sold to net $14 per share. Ewing's dividends are expected to increase at an annual rate of 5 percent for the foreseeable future. Ewing expects to have $X million of retained earnings available to finance the expansion. Ewing's target capital structure is as follows: Debt Preferred stock Common equity 20% 5 75 Calculate the weighted cost of capital that is appropriate to use in evaluating this expansion program. new shares can be sold to net $14 per share. Ewing's dividends are expected to increase at an annual rate of 5 percent for the foreseeable future. Ewing expects to have $X million of retained earnings available to finance the expansion. Ewing's target capital structure is as follows: Debt Preferred stock Common equity 20% 5 75 Calculate the weighted cost of capital that is appropriate to use in evaluating this expansion program. Compute ONLY the "new shares" portion of the firm's WACC: 09.00% O 5.00% O 11.00% O 12.00% O 13.00% O 14.00% compute only the "new shares"

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started