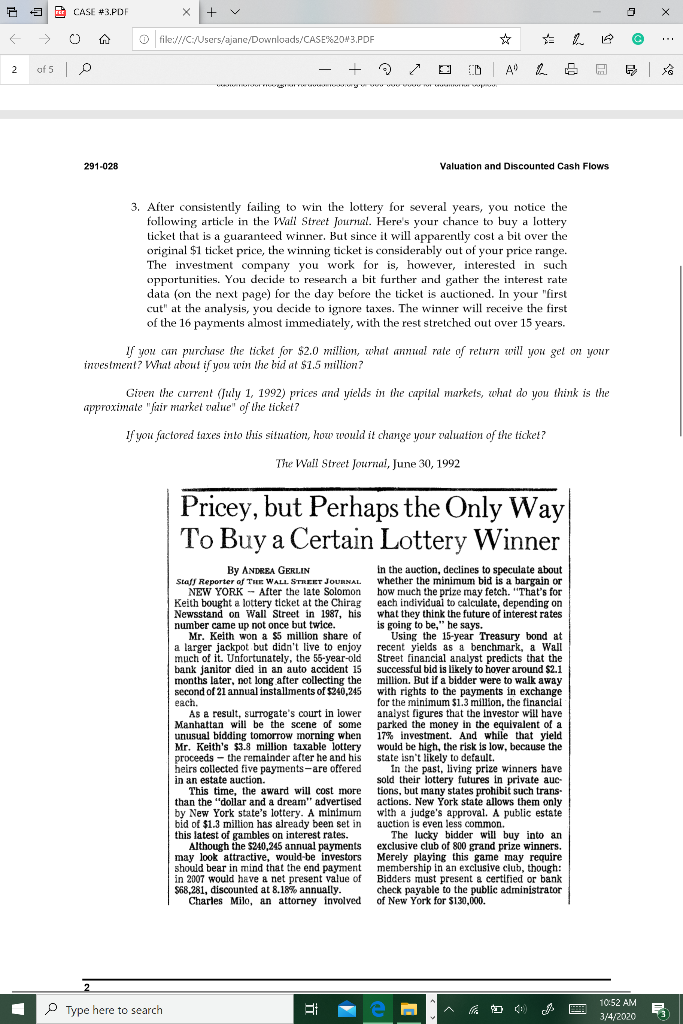

x a CASE #3.PDF E 0 | 2 ofs lo x + v - 0 file:///C:/Users/ajane/Downloads/CASE%2043.PDF - + ID A' L6 & 291-028 Valuation and Discounted Cash Flows 3. After consistently failing to win the lottery for several years, you notice the following article in the Wall Street Journal. Here's your chance to buy a lottery tickel that is a guaranteed winner. But since it will apparently cost a bit over the original $1 ticket price, the winning ticket is considerably out of your price range. The investment company you work for is, however, interested in such opportunities. You decide to research a bit further and gather the interest rate data (on the next page) for the day before the ticket is auctioned. In your first cut" at the analysis, you decide to ignore taxes. The winner will receive the first of the 16 payments almost immediately, with the rest stretched out over 15 years. If you can purchase the ticket for $2.0 million, what annual rale of return will you gel on your investment? Wiral about if you win the bid at $1.5 million? Given the current (July 1, 1992) prices and yields in the capital markets, what do you think is the approximate "fair market value of the ticket? If you factored faxes into this situation, how would it change your valuation of the ticket? The Wall Street Journal, June 30, 1992 Pricey, but Perhaps the Only Way To Buy a Certain Lottery Winner By ANDREA GERLIN Staff Reporter of THE WALL STREET JOURNAL NEW YORK - After the late Solomon Keith bought a lottery ticket at the Chirag Newsstand on Wall Street in 1987, his number came up not once but twice. Mr. Keith won a $5 million share of a larger jackpot but didn't live to enjoy much of it. Unfortunately, the 56-year-old bank janitor died in an auto accident 15 months later, not long after collecting the second of 21 annual installments of $240,245 egch. As a result, surrogate's court in lower Manhattan will be the scene of some unusual bidding tomorrow morning when Mr. Keith's $3.8 million taxable lottery proceeds - the remainder after he and his heirs collected five payments-are offered in an estate auction. This time, the award will cost more than the "dollar and a dream" advertised by New York state's lottery. A minimum bid of $1.3 million has already been set in this latest of gambles on interest rates. Although the $240,245 annual payments may look attractive, would-be investors should bear in mind that the end payment in 2007 would have a net present value of $68,281, discounted at 8.18% annually. Charles Milo, an attorney involved in the auction, declines to speculate about whether the minimum bid is a bargain or how much the prize may fetch. "That's for each individual to calculate, depending on what they think the future of interest rates is going to be," he says. Using the 15-year Treasury bond at recent yields as a benchmark, a Wall Street financial analyst predicts that the successful bid is likely to hover around $2.1 million. But if a bidder were to walk away with rights to the payments in exchange for the minimum $1.3 million, the financial analyst figures that the investor will have parked the money in the equivalent of a 17% investment. And while that yield would be high, the risk is low, because the state isn't likely to default. in the past, living prize winners have sold their lottery futures in private auc tions, but many states prohibit such trans- actions. New York state allows them only with a judge's approval. A public estate auction is even less common. The lucky bidder will buy into an exclusive club of 800 grand prize winners. Merely playing this game may require membership in an exclusive club, though: Bidders must present & certified or bank check payable to the public administrator of New York for $130,000. Type here to search 10:52 AM P 3/4/2020 23 x a CASE #3.PDF E 0 | 2 ofs lo x + v - 0 file:///C:/Users/ajane/Downloads/CASE%2043.PDF - + ID A' L6 & 291-028 Valuation and Discounted Cash Flows 3. After consistently failing to win the lottery for several years, you notice the following article in the Wall Street Journal. Here's your chance to buy a lottery tickel that is a guaranteed winner. But since it will apparently cost a bit over the original $1 ticket price, the winning ticket is considerably out of your price range. The investment company you work for is, however, interested in such opportunities. You decide to research a bit further and gather the interest rate data (on the next page) for the day before the ticket is auctioned. In your first cut" at the analysis, you decide to ignore taxes. The winner will receive the first of the 16 payments almost immediately, with the rest stretched out over 15 years. If you can purchase the ticket for $2.0 million, what annual rale of return will you gel on your investment? Wiral about if you win the bid at $1.5 million? Given the current (July 1, 1992) prices and yields in the capital markets, what do you think is the approximate "fair market value of the ticket? If you factored faxes into this situation, how would it change your valuation of the ticket? The Wall Street Journal, June 30, 1992 Pricey, but Perhaps the Only Way To Buy a Certain Lottery Winner By ANDREA GERLIN Staff Reporter of THE WALL STREET JOURNAL NEW YORK - After the late Solomon Keith bought a lottery ticket at the Chirag Newsstand on Wall Street in 1987, his number came up not once but twice. Mr. Keith won a $5 million share of a larger jackpot but didn't live to enjoy much of it. Unfortunately, the 56-year-old bank janitor died in an auto accident 15 months later, not long after collecting the second of 21 annual installments of $240,245 egch. As a result, surrogate's court in lower Manhattan will be the scene of some unusual bidding tomorrow morning when Mr. Keith's $3.8 million taxable lottery proceeds - the remainder after he and his heirs collected five payments-are offered in an estate auction. This time, the award will cost more than the "dollar and a dream" advertised by New York state's lottery. A minimum bid of $1.3 million has already been set in this latest of gambles on interest rates. Although the $240,245 annual payments may look attractive, would-be investors should bear in mind that the end payment in 2007 would have a net present value of $68,281, discounted at 8.18% annually. Charles Milo, an attorney involved in the auction, declines to speculate about whether the minimum bid is a bargain or how much the prize may fetch. "That's for each individual to calculate, depending on what they think the future of interest rates is going to be," he says. Using the 15-year Treasury bond at recent yields as a benchmark, a Wall Street financial analyst predicts that the successful bid is likely to hover around $2.1 million. But if a bidder were to walk away with rights to the payments in exchange for the minimum $1.3 million, the financial analyst figures that the investor will have parked the money in the equivalent of a 17% investment. And while that yield would be high, the risk is low, because the state isn't likely to default. in the past, living prize winners have sold their lottery futures in private auc tions, but many states prohibit such trans- actions. New York state allows them only with a judge's approval. A public estate auction is even less common. The lucky bidder will buy into an exclusive club of 800 grand prize winners. Merely playing this game may require membership in an exclusive club, though: Bidders must present & certified or bank check payable to the public administrator of New York for $130,000. Type here to search 10:52 AM P 3/4/2020 23