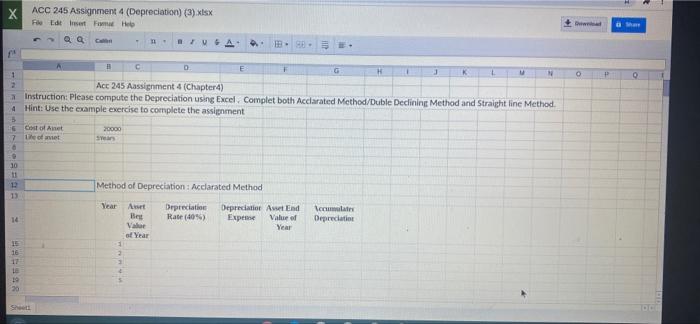

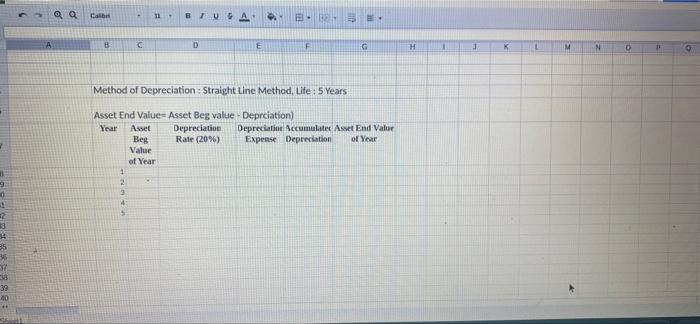

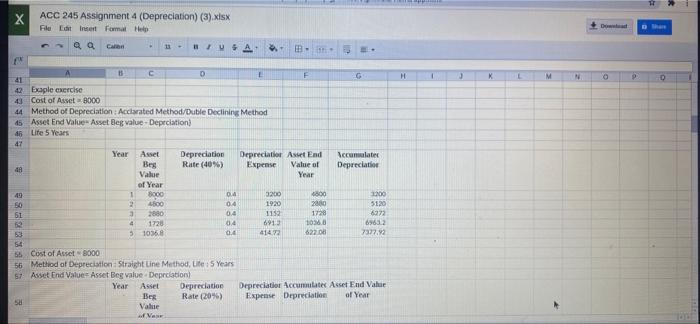

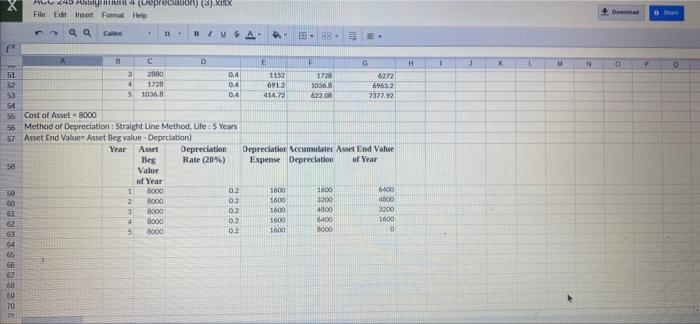

X ACC 245 Assignment 4 (Depreciation) (3).xlsx File Edit reset Hele Qa w har B D F G H O P Q 1 2 Acc 245 Aassignment 4 (Chapter 4) Instruction: Please compute the Depreciation using Excel. Complet both Acclarated Method/Duble Declining Method and Straight line Method Hint: Use the example exercise to complete the assignment 3 Cost of Ainet The one 20000 Sear 7 10 11 12 13 Method of Depreciation : Acclarated Method Depreciation Rate (409) Iccumulate Depreciation 14 Year Awit Be Value of Year 1 2 Depreciatior At End Exp Value of Year 15 16 17 19 20 Q Call 11 BTU B C D E IF G H 1 K 4 M N Method of Depreciation : Straight Line Method, Life: 5 Years . Asset End Value Asset Beg value - Deprciation) Year Asset Depreciation Depreciation Accumulate Asset End Value Beg Rate (20%) Expense Depreciation of Year Valur of Year 1 2 3 4 9 0 1 2 13 es 36 37 39 89: X ACC 245 Assignment 4 (Depreciation) (3).xlsx File tinert Format Help Qa Cara #5 D. - G H 1 K M P D 0 41 F 42 Eple exercise 4 Cost of Asset-8000 44 Method of Depreciation Acclarated Method/Duble Declining Method 45 Asset End Value Asset Beg value-Depeciation) 46 Lite 5 Years 47 Year Asset Depreciation Depreciati Aset End Beg Rate (40%) AA Expense Value of Value Year of Year 40 1 8000 04 3200 6800 50 2 4.500 04 1920 2010 3 2880 0.4 1152 1728 4 1720 04 6913 10360 5 1036 0.4 4142 6220 Sccumulate Depreciation SENS 1200 5120 8272 69652 7377.92 5 Cost of Asset - 8000 56 Method of Depreciation Straight Line Method, Lite: 5 Years 57 Asset End Values Asset Beg value Deprclation Year Asset Depreciation BER Rate (20%) 50 Value Depreciation Accurate Asset End Value Expense Depreciation of Year De ALL 25 Astuepreciation (3) XSX File Edt trent Form aa C 11 USA - - 5 H 1 3 1 N o 818 a A 8 C D F G 51 3 2880 0.4 1152 1728 6272 1728 0.4 6912 10368 69603 53 5 10363 0.4 414.72 622.00 7377.92 54 56 Cost of Asset - 8000 56 Method of Depreciation : Straight Line Method, Life: 5 Years 57 Asset End Value Asset Beg value-Deprclation) Year Asset Depreciation Depreciation Accumulatex Asset End Value Rate (20%) Expense Depreciation of Year Value of Year 1 Bood 0.2 1600 1600 4400 60 2 B000 02 1600 3200 4800 3 Boo 0.2 1600 4800 3200 4 B000 D 1600 400 1600 5 Booo 02 1600 1000 Bes 8 $ S8833980er