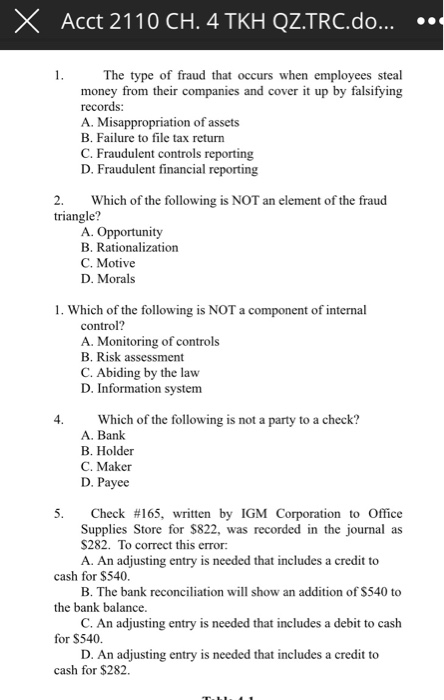

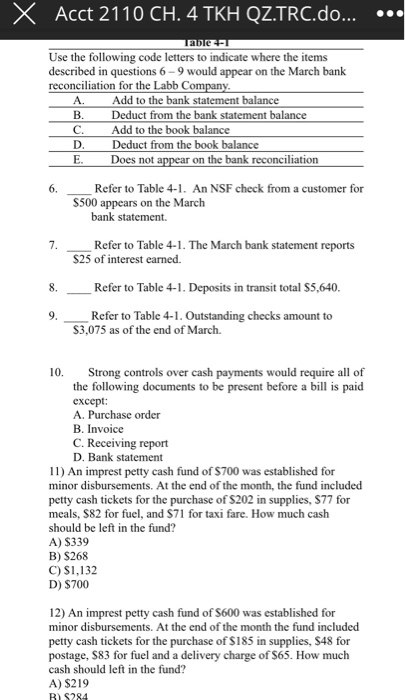

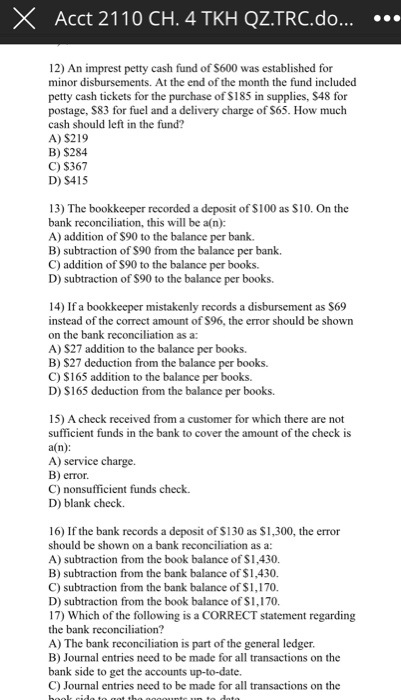

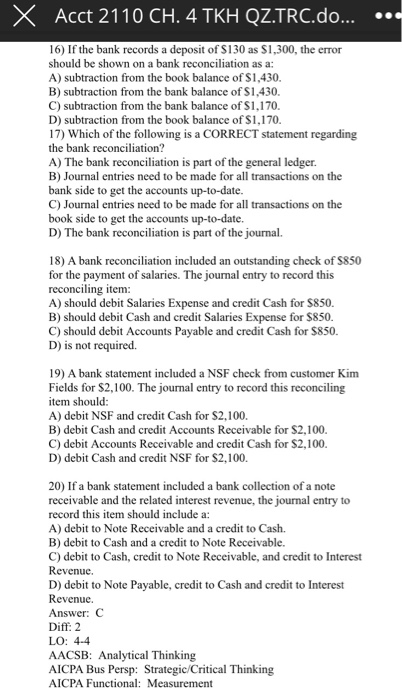

x Acct 2110 CH. 4 TKH QZ.TRC.do... The type of fraud that occurs when employees steal money from their companies and cover it up by falsifying records: A. Misappropriation of assets B. Failure to file tax return C. Fraudulent controls reporting D. Fraudulent financial reporting 2. Which of the following is NOT an element of the fraud triangle? A. Opportunity B. Rationalization C. Motive D. Morals 1. Which of the following is NOT a component of internal control? A. Monitoring of controls B. Risk assessment C. Abiding by the law D. Information system Which of the following is not a party to a check? A. Bank B. Holder C. Maker D. Payee 5. Check #165, written by IGM Corporation to Office Supplies Store for $822, was recorded in the journal as $282. To correct this error: A. An adjusting entry is needed that includes a credit to cash for $540. B. The bank reconciliation will show an addition of $540 to the bank balance. C. An adjusting entry is needed that includes a debit to cash for $540. D. An adjusting entry is needed that includes a credit to cash for $282. x Acct 2110 CH. 4 TKH QZ.TRC.do... ... FDE Use the following code letters to indicate where the items described in questions 6-9 would appear on the March bank reconciliation for the Labb Company A. Add to the bank statement balance B. Deduct from the bank statement balance C. Add to the book balance D. Deduct from the book balance E. Does not appear on the bank reconciliation 6. Refer to Table 4-1. An NSF check from a customer for S500 appears on the March bank statement. Refer to Table 4-1. The March bank statement reports $25 of interest earned. Refer to Table 4-1. Deposits in transit total $5,640. Refer to Table 4-1. Outstanding checks amount to $3,075 as of the end of March 10. Stron Strong controls over cash payments would require all of the following documents to be present before a bill is paid except: A. Purchase order B. Invoice C. Receiving report D. Bank statement 11) An imprest petty cash fund of $700 was established for minor disbursements. At the end of the month, the fund included petty cash tickets for the purchase of S202 in supplies, S77 for meals, $82 for fuel, and $71 for taxi fare. How much cash should be left in the fund? A) S339 B) S268 C) $1,132 D) $700 12) An imprest petty cash fund of S600 was established for minor disbursements. At the end of the month the fund included petty cash tickets for the purchase of $185 in supplies, $48 for postage, S83 for fuel and a delivery charge of $65. How much cash should left in the fund? A) $219 B) $284 X Acct 2110 CH. 4 TKH QZ.TRC.do... 12) An imprest petty cash fund of $600 was established for minor disbursements. At the end of the month the fund included petty cash tickets for the purchase of $185 in supplies, S48 for postage, S83 for fuel and a delivery charge of $65. How much cash should left in the fund? A) S219 B) S284 C) $367 D) $415 13) The bookkeeper recorded a deposit of $100 as $10. On the bank reconciliation, this will be a(n): A) addition of $90 to the balance per bank. B) subtraction of $90 from the balance per bank. C) addition of S90 to the balance per books. D) subtraction of $90 to the balance per books. 14) If a bookkeeper mistakenly records a disbursement as $69 instead of the correct amount of $96, the error should be shown on the bank reconciliation as a: A) S27 addition to the balance per books. B) $27 deduction from the balance per books. C) $165 addition to the balance per books. D) $165 deduction from the balance per books. 15) A check received from a customer for which there are not sufficient funds in the bank to cover the amount of the check is an): A) service charge. B) error. C) nonsufficient funds check. D) blank check. 16) If the bank records a deposit of $130 as $1,300, the error should be shown on a bank reconciliation as a: A) subtraction from the book balance of $1,430. B) subtraction from the bank balance of $1,430. C) subtraction from the bank balance of $1,170. D) subtraction from the book balance of S1,170. 17) Which of the following is a CORRECT statement regarding the bank reconciliation? A) The bank reconciliation is part of the general ledger. B) Journal entries need to be made for all transactions on the bank side to get the accounts up-to-date. C) Journal entries need to be made for all transactions on the dat het date X Acct 2110 CH. 4 TKH QZ.TRC.do... ... 16) If the bank records a deposit of $130 as $1,300, the error should be shown on a bank reconciliation as a: A) subtraction from the book balance of $1,430. B) subtraction from the bank balance of $1,430. C) subtraction from the bank balance of $1,170. D) subtraction from the book balance of $1,170. 17) Which of the following is a CORRECT statement regarding the bank reconciliation? A) The bank reconciliation is part of the general ledger. B) Journal entries need to be made for all transactions on the bank side to get the accounts up-to-date. C) Journal entries need to be made for all transactions on the book side to get the accounts up-to-date. D) The bank reconciliation is part of the journal. 18) A bank reconciliation included an outstanding check of 5850 for the payment of salaries. The journal entry to record this reconciling item: A) should debit Salaries Expense and credit Cash for $850. B) should debit Cash and credit Salaries Expense for $850. C) should debit Accounts Payable and credit Cash for $850. D) is not required. 19) A bank statement included a NSF check from customer Kim Fields for $2,100. The journal entry to record this reconciling item should: A) debit NSF and credit Cash for S2.100. B) debit Cash and credit Accounts Receivable for $2,100. C) debit Accounts Receivable and credit Cash for $2,100. D) debit Cash and credit NSF for $2,100. 20) If a bank statement included a bank collection of a note receivable and the related interest revenue, the journal entry to record this item should include a: A) debit to Note Receivable and a credit to Cash, B) debit to Cash and a credit to Note Receivable. C) debit to Cash, credit to Note Receivable, and credit to Interest Revenue. D) debit to Note Payable, credit to Cash and credit to Interest Revenue. Answer: C Diff: 2 LO: 4-4 AACSB: Analytical Thinking AICPA Bus Persp: Strategic/Critical Thinking AICPA Functional: Measurement X Acct 2110 CH. 4 TKH QZ.TRC.do... ... 19) A bank statement included a NSF check from customer Kim Fields for S2,100. The journal entry to record this reconciling item should: A) debit NSF and credit Cash for $2,100. B) debit Cash and credit Accounts Receivable for S2,100. C) debit Accounts Receivable and credit Cash for S2,100. D) debit Cash and credit NSF for $2,100. 20) If a bank statement included a bank collection of a note receivable and the related interest revenue, the journal entry to record this item should include a: A) debit to Note Receivable and a credit to Cash. B) debit to Cash and a credit to Note Receivable. C) debit to Cash, credit to Note Receivable, and credit to Interest Revenue. D) debit to Note Payable, credit to Cash and credit to Interest Revenue. Answer: C Diff: 2 LO: 4-4 AACSB: Analytical Thinking AICPA Bus Persp: Strategic Critical Thinking AICPA Functional: Measurement 21) If a bank statement includes an EFT receipt of $200 for interest, the journal entry to record this reconciling item should include a: A) debit to Cash for $200 and a credit to Interest Revenue for $200. B) debit to Accounts Receivable for $200 and a credit to Interest Revenue for $200. C) debit to Interest Revenue for $200 and credit to Cash for $200. D) debit to Interest Expense for $200 and credit to Prepaid Interest for $200. 22) The book side of a bank reconciliation includes: A) deposits in transit, bank collections and NSF checks. B) NSF checks, bank collections of notes receivable and interest earned on the checking account. C) outstanding checks and deposits in transit. D) outstanding checks, NSF checks and cost of printed checks. ...l Verizon 3:51 AM 30%O x Acct 2110 CH. 4 TKH QZ.TRC.do... ... 19) A bank statement included a NSF check from customer Kim Fields for $2,100. The journal entry to record this reconciling item should: A) debit NSF and credit Cash for S2,100. B) debit Cash and credit Accounts Receivable for $2,100. C) debit Accounts Receivable and credit Cash for $2,100. D) debit Cash and credit NSF for $2,100. 20) If a bank statement included a bank collection of a note receivable and the related interest revenue, the journal entry to record this item should include a: A) debit to Note Receivable and a credit to Cash. B) debit to Cash and a credit to Note Receivable. C) debit to Cash, credit to Note Receivable, and credit to Interest Revenue. D) debit to Note Payable, credit to Cash and credit to Interest Revenue. Answer: C Diff: 2 LO: 4-4 AACSB: Analytical Thinking AICPA Bus Persp: Strategic/Critical Thinking AICPA Functional: Measurement 21) If a bank statement includes an EFT receipt of $200 for interest, the journal entry to record this reconciling item should include a: A) debit to Cash for S200 and a credit to Interest Revenue for $200. B) debit to Accounts Receivable for $200 and a credit to Interest Revenue for $200. C) debit to Interest Revenue for $200 and credit to Cash for $200 D) debit to Interest Expense for $200 and credit to Prepaid Interest for $200. 22) The book side of a bank reconciliation includes: A) deposits in transit, bank collections and NSF checks. B) NSF checks, bank collections of notes receivable and interest cared on the checking account. C) outstanding checks and deposits in transit. D) outstanding checks, NSF checks and cost of printed checks