Answered step by step

Verified Expert Solution

Question

1 Approved Answer

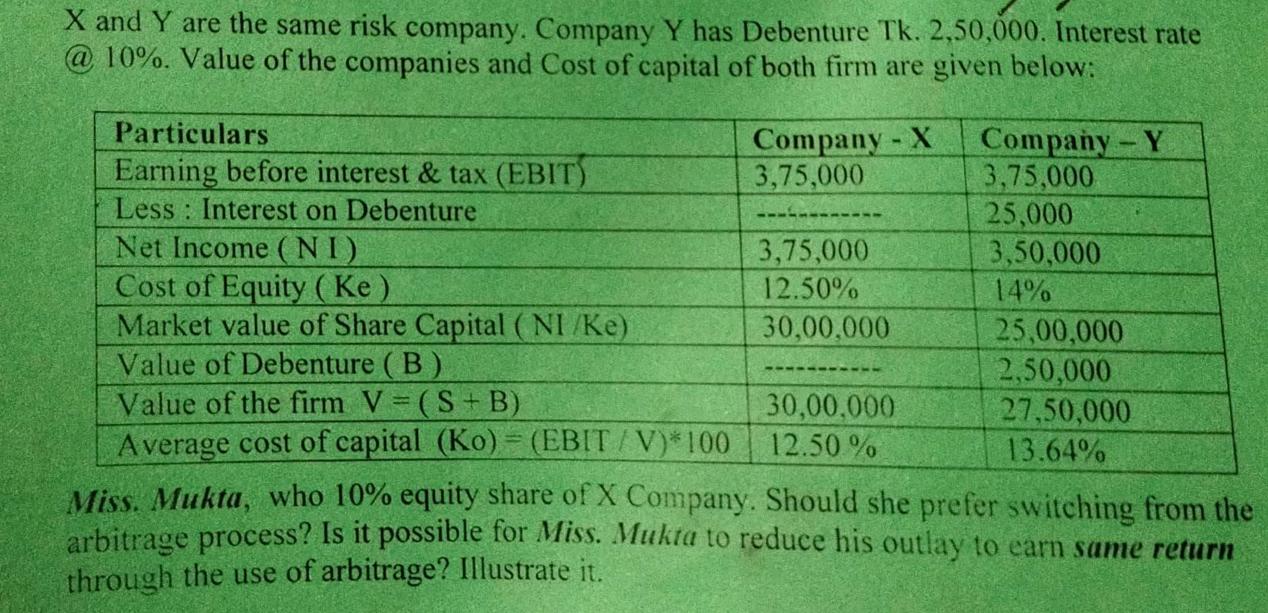

X and Y are the same risk company. Company Y has Debenture Tk. 2,50,000. Interest rate @10%. Value of the companies and Cost of

X and Y are the same risk company. Company Y has Debenture Tk. 2,50,000. Interest rate @10%. Value of the companies and Cost of capital of both firm are given below: Particulars Earning before interest & tax (EBIT) Less Interest on Debenture Net Income (NI) Cost of Equity (Ke) Market value of Share Capital (NI/Ke) Value of Debenture (B) Value of the firm V = (S+ B) Average cost of capital (Ko) = (EBIT/V)*100 Company - X 3,75,000 3,75,000 12.50% 30,00,000 30,00,000 12.50 % Company - Y 3,75,000 25,000 3,50,000 14% 25,00,000 2,50,000 27,50,000 13.64% Miss. Mukta, who 10% equity share of X Company. Should she prefer switching from the arbitrage process? Is it possible for Miss. Mukta to reduce his outlay to earn same return through the use of arbitrage? Illustrate it.

Step by Step Solution

★★★★★

3.46 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

The detailed ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started