Answered step by step

Verified Expert Solution

Question

1 Approved Answer

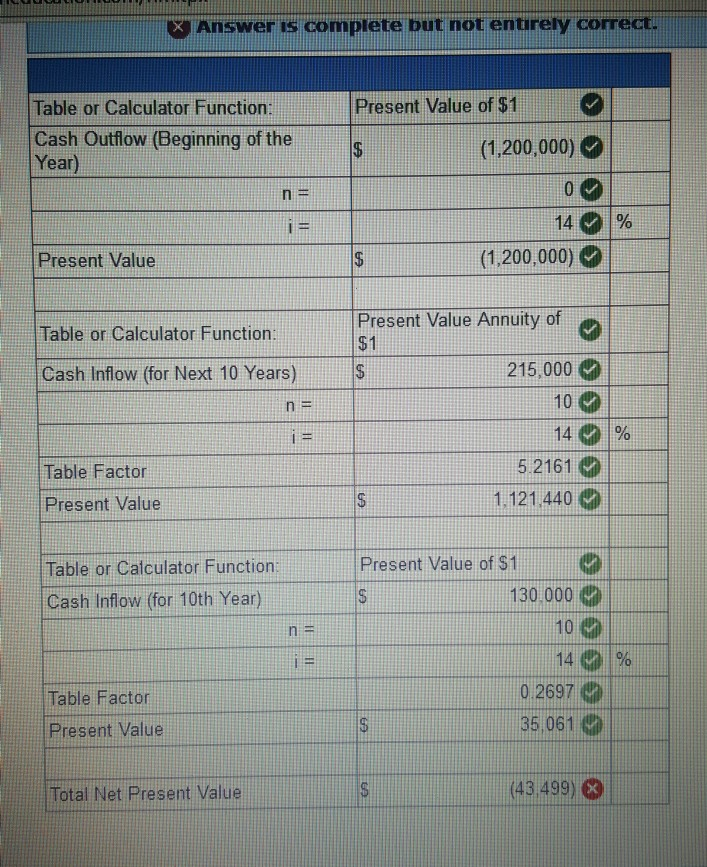

X AnSWer is complete but not entirely correct Table or Calculator Function: Present Value of $1 Cash Outflow (Beginning of the Year) (1,200,000) 141 %

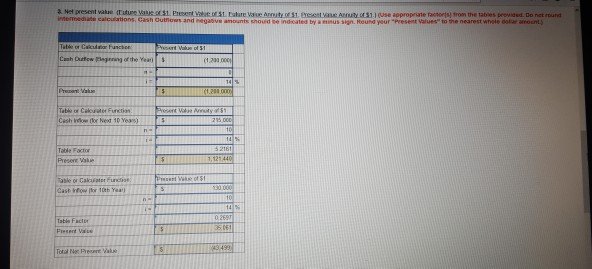

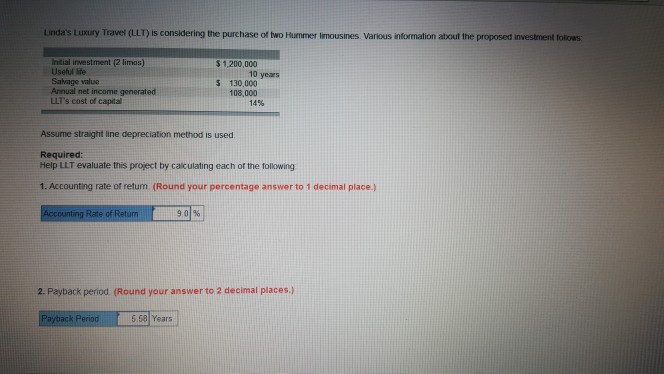

X AnSWer is complete but not entirely correct Table or Calculator Function: Present Value of $1 Cash Outflow (Beginning of the Year) (1,200,000) 141 % (1.200,000) Present Value Present Value Annuity of $1 Table or Calculator Function Cash Inflow (for Next 10 Years)S 215,000 14 | 96 5.2161 1.121.440 Table Factor Present Value iculator FunctionPresent Value of S1 130.000 0 Cash infow (for 10th Year) 10 0 n= 141 % 0.2697 35 061 Table Factor Present Value 43 499) 6 Total Net Present Value i a Net present vakue iTuture Vaue or s1 Eresent ue of St Etare Vaue ty S ARTy 1. use appropriate acrots trom the tabies peovided. Do net round outnows and negaove amounts shoud se indcated by a minus sign. Round your "Present Values" to the nearest whole ostar ount Table Factor abke or Cakasster Funciot Luinda's Luxury Traver (LLT) is considering the purchase of two Hunmer limousines. Various information about the proposed investment follows Intial investment (2 limos) Useful ife Sahage value Annual net income generated LLT's cost of capital $ 1,200,000 10 years 5 130,000 108,000 14% Assume straight line depreciation method is used Required Help LIT evaluate this project by caliculating each of the tollowing 1. Accounting rate of retum (Round your percentage answer to 1 decimal place.) 2. Payback period (Round your answer to 2 decimal places.) Payback Perio658 Years

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started