Answered step by step

Verified Expert Solution

Question

1 Approved Answer

X Company must decide whether to continue using its current equipment or replace it with new, more efficient equipment. The following information is available for

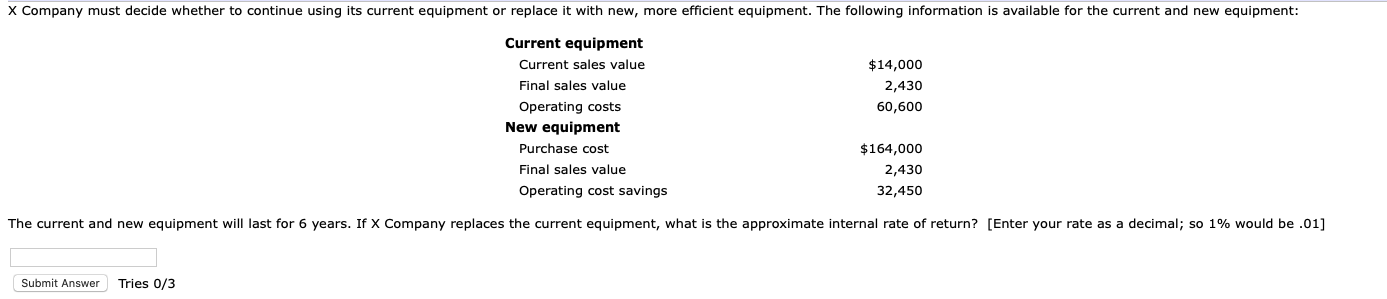

X Company must decide whether to continue using its current equipment or replace it with new, more efficient equipment. The following information is available for the current and new equipment:

| Current equipment | |

| Current sales value | $14,000 |

| Final sales value | 2,430 |

| Operating costs | 60,600 |

| New equipment | |

| Purchase cost | $164,000 |

| Final sales value | 2,430 |

| Operating cost savings | 32,450 |

The current and new equipment will last for 6 years. If X Company replaces the current equipment, what is the approximate internal rate of return? [Enter your rate as a decimal; so 1% would be .01]

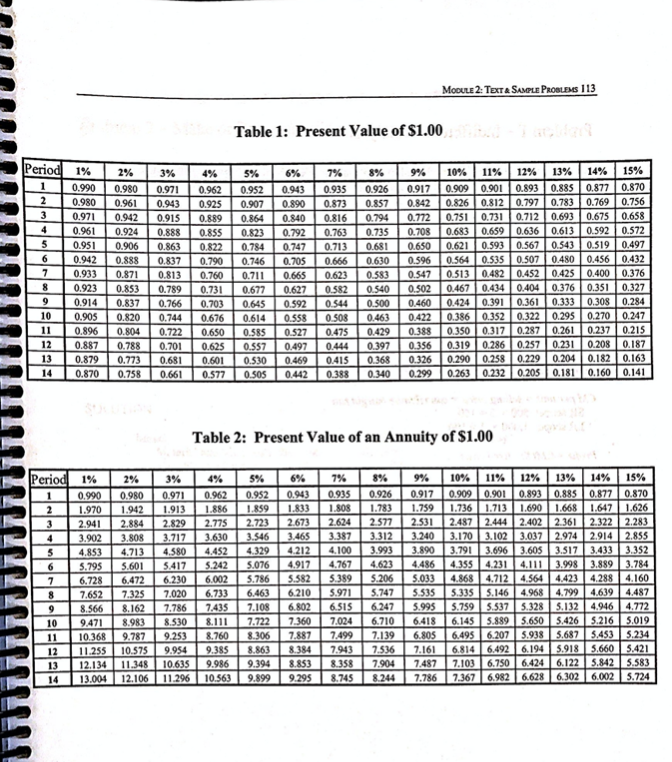

X Company must decide whether to continue using its current equipment or replace it with new, more efficient equipment. The following information is available for the current and new equipment: $14,000 2,430 60,600 Current equipment Current sales value Final sales value Operating costs New equipment Purchase cost Final sales value Operating cost savings $164,000 2,430 32,450 The current and new equipment will last for 6 years. If X Company replaces the current equipment, what is the approximate internal rate of return? [Enter your rate as a decimal; so 1% would be .01] Submit Answer Tries 0/3 Moouu 2: TexTa SAMPLE PROBLEMS 113 Table 1: Present Value of $1.00 4% 6% UPHE 11 Period 1% 1 0.990 2 0.980 3 0.971 4 0.961 5 0.951 6 0.942 7 0.933 8 0.923 9 0.914 10 0.905 11 0.896 12 0.887 13 0.879 14 0.870 E 2% 0.980 0.961 0.942 1.924 0.906 0.888 0.871 0.853 0.837 0.820 0.804 0.788 0.773 0.758 3% 0.971 0.943 0.915 0.888 0.863 0.837 0.813 0.789 0.766 0.744 0.722 0.701 0.681 0.661 0.962 0.925 0.889 0.855 0.822 0.790 0.760 0.731 0.703 0.676 0.650 0.625 0.601 0.577 JULI 5% 0.952 0.907 0.864 0.823 0.784 0.746 0.711 0.677 0.645 0.614 0.585 0.557 0.530 0.sos 0.943 0.890 0.840 0.792 0.747 0.705 0.665 0.627 0.592 0.558 0.527 0.497 0.469 0.442 7% 0.935 0.873 0.816 0.763 0.713 0.666 0.623 0.582 0.544 0.508 0.475 0.444 0.415 0.388 8% 0.926 0.857 0.794 0.735 0.681 0.630 0.583 0.540 0.500 0.463 0.429 0.397 0.368 0.340 9% 0.917 0.842 0.772 0.708 0.650 0.596 0.547 0.502 0.460 0.422 0.388 0.356 0.326 0.299 10% 11% 12% 13% 14% 15% 0.9090.901 0.893 0.885 0.877 0.870 0.826 0.812 0.797 0.783 0.769 0.756 0.751 0.731 0.712 0.693 0.675 0.658 83 0.659 0.636 0.613 0.592 0.572 0.621 0.593 0.567 0.543 0.519 0.497 0.564 0.535 0.507 0.480 0.456 0.432 0.513 0.482 0.452 0.425 0.400 0.376 0.467 0.434 0.404 0.376 0.351 0.327 0.424 0.391 0.361 0.333 0.308 0.284 0.386 0.352 0.322 0.295 0.270 0.247 0.350 0.317 0.2870.261 0.237 0.215 0.319 0.286 0.257 0.231 0.208 0.187 0.290 0.258 0.229 0.204 0.182 0.163 0.263 0.232 0.205 0.181 0.160 0.141 L IIII ID 1 Table 2: Present Value of an Annuity of $1.00 Period 1 2 3 4 5 TUE 6 7 8 1% 0.990 1.970 2.941 3.902 4.853 5.795 6.728 7.652 8.566 9.471 10.368 11.255 12.134 13.004 2% 0.980 1.942 2.884 3.808 4.713 5.601 6.472 7.325 8.162 8.983 9.787 10.575 11.348 12.106 3% 0.971 1.913 2.829 3.717 4.580 5.417 6.230 7.020 7.786 8.530 9.253 9.954 10.635 11.296 0.962 1.886 2.775 3.630 4.452 5.242 6.002 6.733 7.435 8.111 8.760 9.385 9.986 10.563 5 0.952 1.859 2.723 3.546 4.329 5.076 5.786 6.463 7.108 7.722 8.306 8.863 9.394 9.899 0.943 1.833 2.673 3.465 4.212 4.917 5.582 6.210 6.802 7.360 7.887 8.384 8.853 9.295 7% 0.935 1.808 2.624 3.387 4.100 4.767 5.389 5.971 6.515 7.024 7.499 7.943 8.358 8.745 8% 0.926 1.783 2.577 3.312 3.993 4.623 5.206 5.747 6.247 6.710 7.139 7.536 7.904 8.244 9% 0.917 1.759 2.531 3.240 3.890 4.486 5.033 5.535 5.995 6.418 6.805 7.161 7.487 7.786 10% 11% 12% 13% 14% 15% 0.909 0.901 0.893 0.885 0.877 0.870 1.736 1.713 1.690 1.668 1.647 1.626 2.487 2.444 2.402 2.361 2.322 2.283 3.170 3.102 3.037 2.974 2.914 2.855 3.791 3.696 3.605 3.517 3.433 3.352 4.355 4.231 4.111 3.998 3.889 3.784 4.8684.712 4.564 4.423 4.288 4.160 5.335 5.146 4.968 4.799 4.6394.487 5.7595.537 5.3285.132 4.9464.772 6.145 5.889 5.650 5.426 5.216 5.019 6.495 6.207 5.9385,6875,4535.234 6.814 6.492 6.1945.918 5.660 5.421 7.103 6.750 6.4246.122 5.842 5.583 7.367 6.982 6.628 6.302 6.002 5.724 H 9 10 IND 1 12 13 14

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started