Answered step by step

Verified Expert Solution

Question

1 Approved Answer

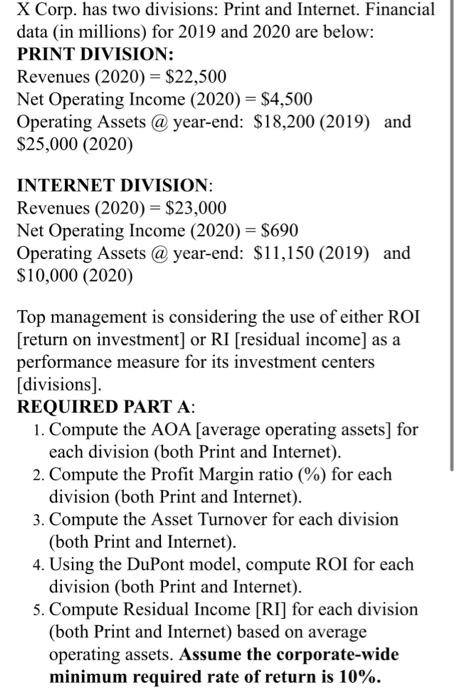

X Corp. has two divisions: Print and Internet. Financial data (in millions) for 2019 and 2020 are below: PRINT DIVISION: Revenues (2020) = $22,500

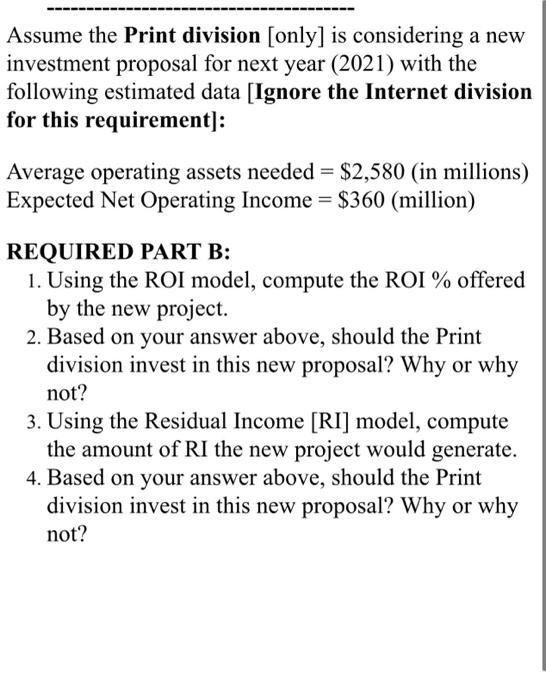

X Corp. has two divisions: Print and Internet. Financial data (in millions) for 2019 and 2020 are below: PRINT DIVISION: Revenues (2020) = $22,500 Net Operating Income (2020) = $4,500 Operating Assets @ year-end: $18,200 (2019) and $25,000 (2020) INTERNET DIVISION: Revenues (2020) = $23,000 Net Operating Income (2020) = $690 Operating Assets @ year-end: $11,150 (2019) and $10,000 (2020) Top management is considering the use of either ROI [return on investment] or RI [residual income] as a performance measure for its investment centers [divisions]. REQUIRED PART A: 1. Compute the AOA [average operating assets] for each division (both Print and Internet). 2. Compute the Profit Margin ratio (%) for each division (both Print and Internet). 3. Compute the Asset Turnover for each division (both Print and Internet). 4. Using the DuPont model, compute ROI for each division (both Print and Internet). 5. Compute Residual Income [RI] for each division (both Print and Internet) based on average operating assets. Assume the corporate-wide minimum required rate of return is 10%. Assume the Print division [only] is considering a new investment proposal for next year (2021) with the following estimated data [Ignore the Internet division for this requirement]: == Average operating assets needed = $2,580 (in millions) Expected Net Operating Income = $360 (million) REQUIRED PART B: 1. Using the ROI model, compute the ROI % offered by the new project. 2. Based on your answer above, should the Print division invest in this new proposal? Why or why not? 3. Using the Residual Income [RI] model, compute the amount of RI the new project would generate. 4. Based on your answer above, should the Print division invest in this new proposal? Why or why not?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started