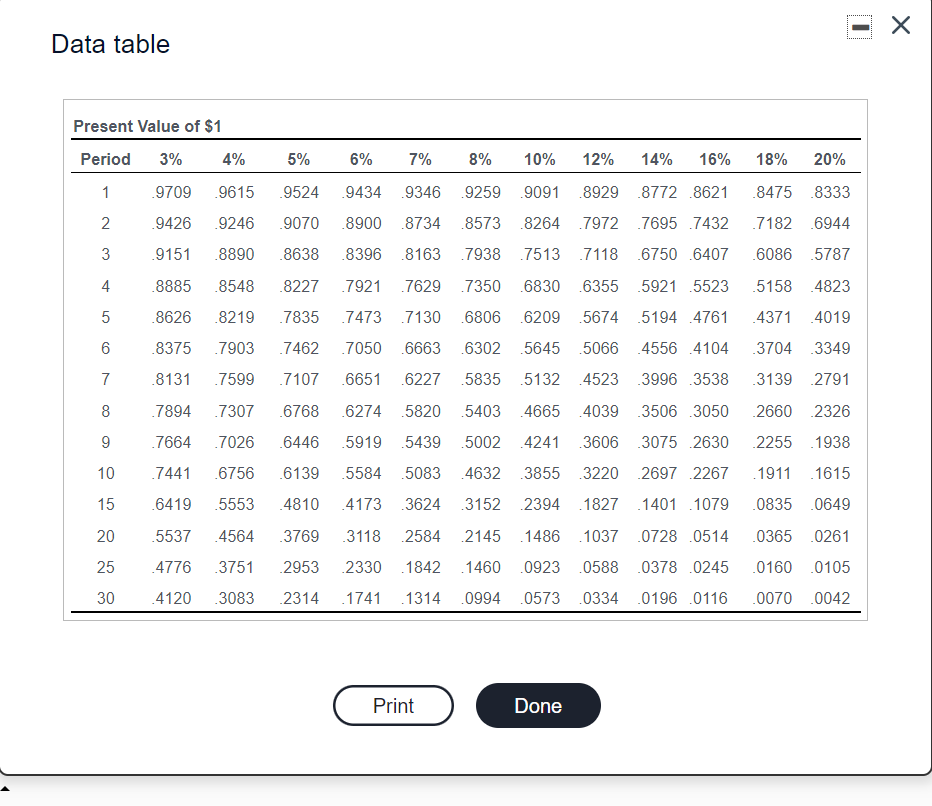

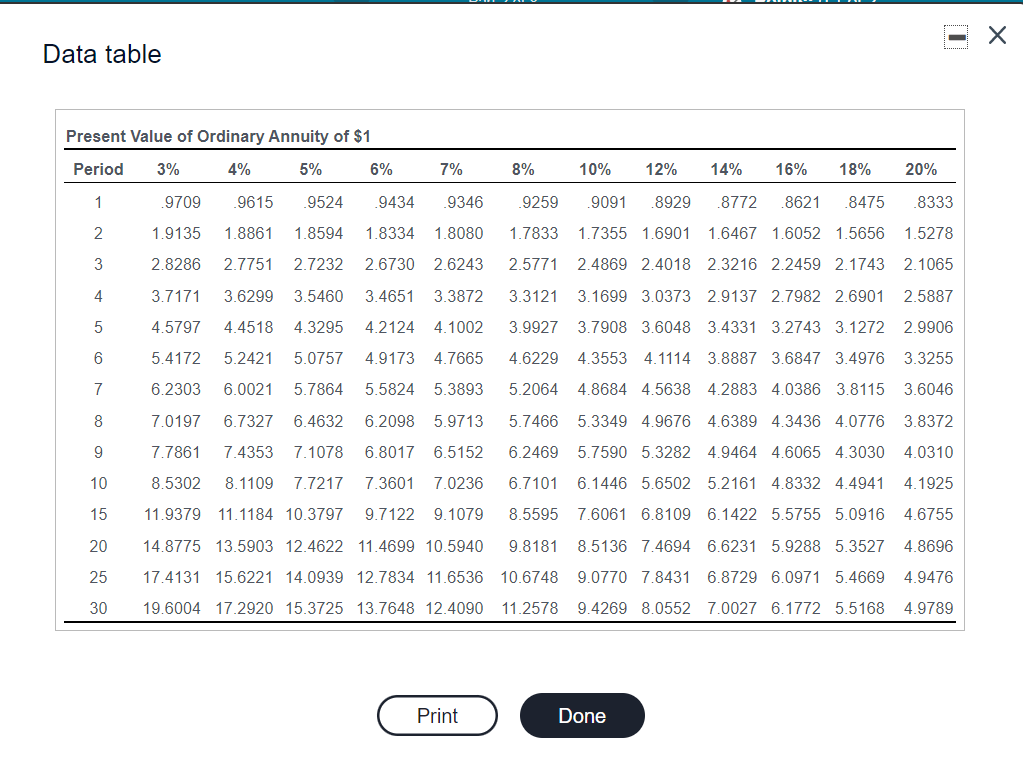

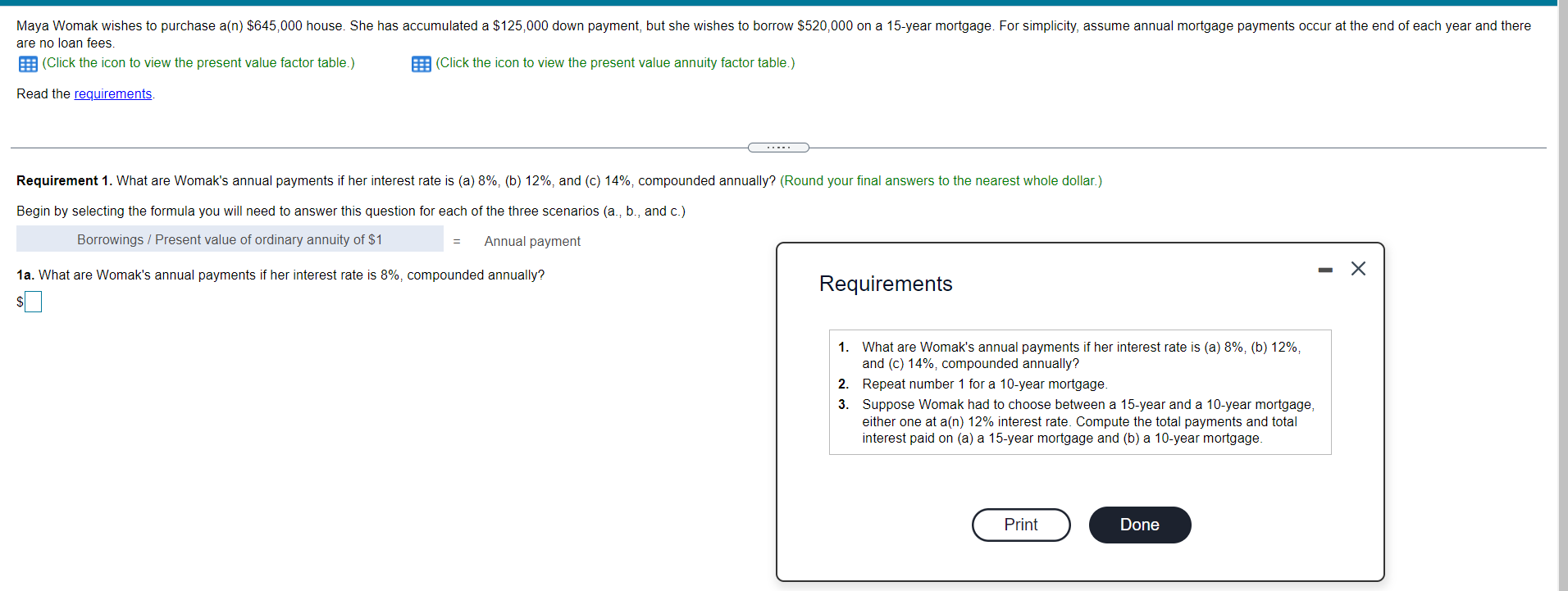

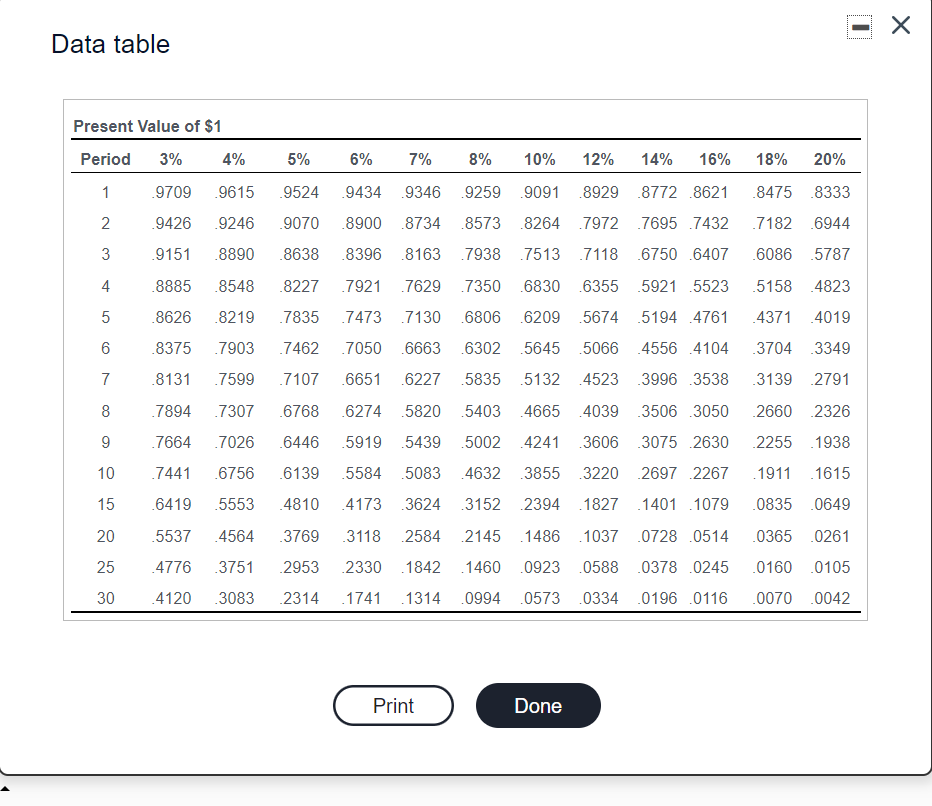

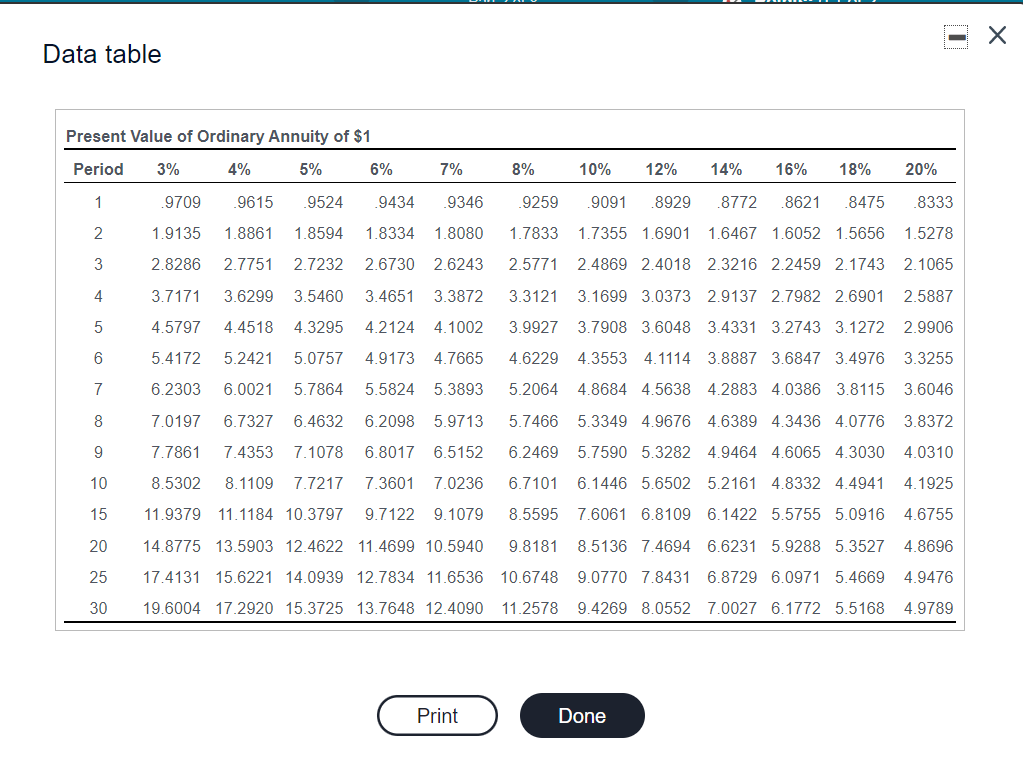

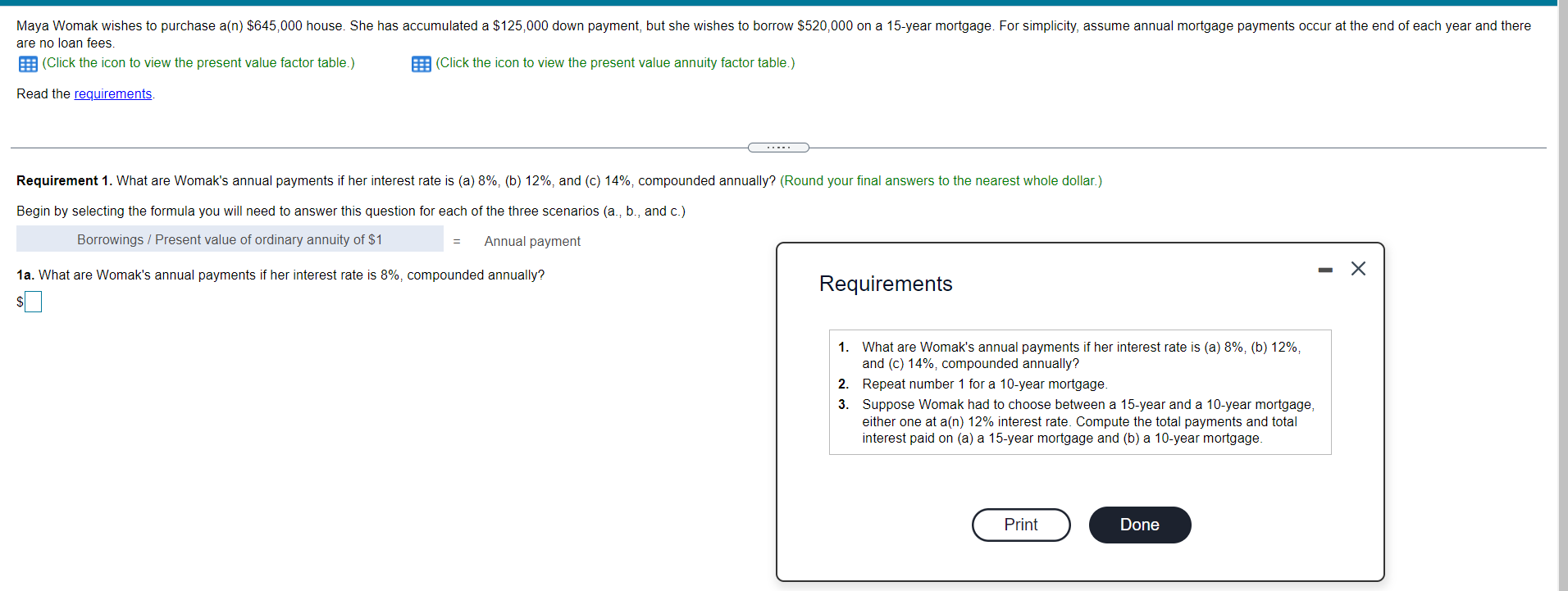

X Data table Present Value of $1 Period 3% 4% 5% 6% 7% 8% 10% 12% 14% 16% 18% 20% 1 9709 .9615 -9524 .9434 .9346 .9259 9091 .89298772 8621 .8475 8333 2 .9426 9246 .9070 .8900 .8734 .8573 .8264 .7972 .7695 7432 .7182 6944 3 .9151 .8890 .8638 .8396 8163 7938 7513 .7118 .6750 6407 .6086 5787 4 .8885 .8548 8227 .7921 7629 .7350 6830 .6355 5921 5523 5158 4823 5 .8626 .8219 .7835 .7473 .7130 6806 .6209 .5674 5194 4761 4371 4019 6 .8375 .7903 .7462 .7050 6663 6302 5645 .5066 4556 4104 3704 3349 7 .8131 .7599 .7107 .6651 .6227 5835 5132 4523 3996 3538 3139 2791 8 .7894 .7307 .6768 .6274 .5820 5403 4665 40393506 3050 2660 2326 9 .7664 .7026 .6446 .5919 .54395002 4241 3606 3075 2630 2255 1938 10 7441 .6756 .6139 .5584 5083 4632 3855 3220 2697 2267 1911 . 1615 15 .6419 5553 4810 4173 3624 3152 2394 .1827 1401 1079 .0835 0649 20 .5537 4564 3769 3118 2584 2145 1486 .1037 0728 .0514 .0365 0261 25 4776 3751 2953 .2330 1842 1460 0923 0588 0378 0245 01600105 30 4120 3083 2314 1741 1314 0994 0573 0334 0196 0116 00700042 Print Done Data table Present Value of Ordinary Annuity of $1 Period 3% 4% 5% 6% 7% 8% 10% 12% 14% 16% 18% 20% 1 .9709 9615 9524 .9434 9346 .9259 9091 .8929 .8772 8621 8475 .8333 2 1.9135 1.8861 1.8594 1.8334 1.8080 1.7833 1.7355 1.6901 1.6467 1.6052 1.5656 1.5278 3 2.8286 2.7751 2.7232 2.6730 2.6243 2.5771 2.4869 2.4018 2.3216 2.2459 2.1743 2.1065 4 3.7171 3.6299 3.5460 3.4651 3.3872 3.3121 3.1699 3.0373 2.9137 2.7982 2.6901 2.5887 5 4.5797 4.4518 4.3295 4.2124 4.1002 3.9927 3.7908 3.6048 3.4331 3.2743 3.1272 2.9906 6 5.4172 5.2421 5.0757 4.9173 4.7665 4.6229 4.3553 4.1114 3.8887 3.6847 3.4976 3.3255 7 6.2303 6.0021 5.7864 5.5824 5.3893 5.2064 4.8684 4.5638 4.2883 4.0386 3.8115 3.6046 8 7.0197 6.7327 6.4632 6.2098 5.9713 5.7466 5.3349 4.9676 4.6389 4.3436 4.0776 3.8372 9 7.7861 6.2469 5.7590 5.3282 4.9464 4.6065 4.3030 4.0310 7.4353 7.1078 6.8017 6.5152 8.11097.7217 7.3601 7.0236 10 8.5302 6.7101 6.1446 5.6502 5.2161 4.8332 4.4941 4.1925 15 11.9379 11.1184 10.3797 9.7122 9.1079 8.5595 7.6061 6.8109 6.1422 5.5755 5.0916 4.6755 20 14.8775 13.5903 12.4622 11.4699 10.5940 9.8181 8.5136 7.4694 6.6231 5.9288 5.3527 4.8696 25 17.4131 15.6221 14.0939 12.7834 11.6536 10.6748 9.0770 7.8431 6.8729 6.0971 5.4669 4.9476 19.6004 17.2920 15.3725 13.7648 12.4090 11.2578 9.4269 8.0552 7.0027 6.1772 5.5168 4.9789 30 Print Done Maya Womak wishes to purchase an) $645,000 house. She has accumulated a $125,000 down payment, but she wishes to borrow $520,000 on a 15-year mortgage. For simplicity, assume annual mortgage payments occur at the end of each year and there are no loan fees. E: (Click the icon to view the present value factor table.) E: (Click the icon to view the present value annuity factor table.) Read the requirements. Requirement 1. What are Womak's annual payments if her interest rate is (a) 8%, (b) 12%, and (c) 14%, compounded annually? (Round your final answers to the nearest whole dollar.) Begin by selecting the formula you will need to answer this question for each of the three scenarios (a., b., and C.) Borrowings / Present value of ordinary annuity of $1 Annual payment 1a. What are Womak's annual payments if her interest rate is 8%, compounded annually? Requirements 1. What are Womak's annual payments if her interest rate is (a) 8%, (b) 12%, and (c) 14%, compounded annually? 2. Repeat number 1 for a 10-year mortgage. 3. Suppose Womak had to choose between a 15-year and a 10-year mortgage, either one at a(n) 12% interest rate. Compute the total payments and total interest paid on (a) a 15-year mortgage and (b) a 10-year mortgage. Print Done