x

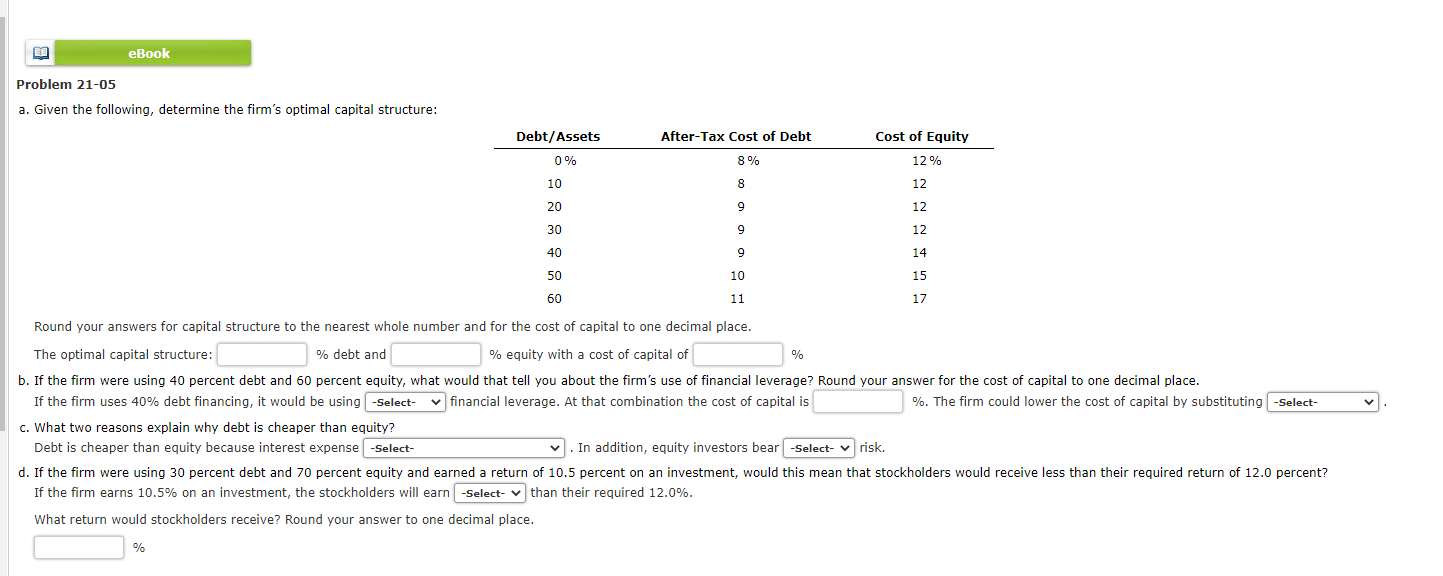

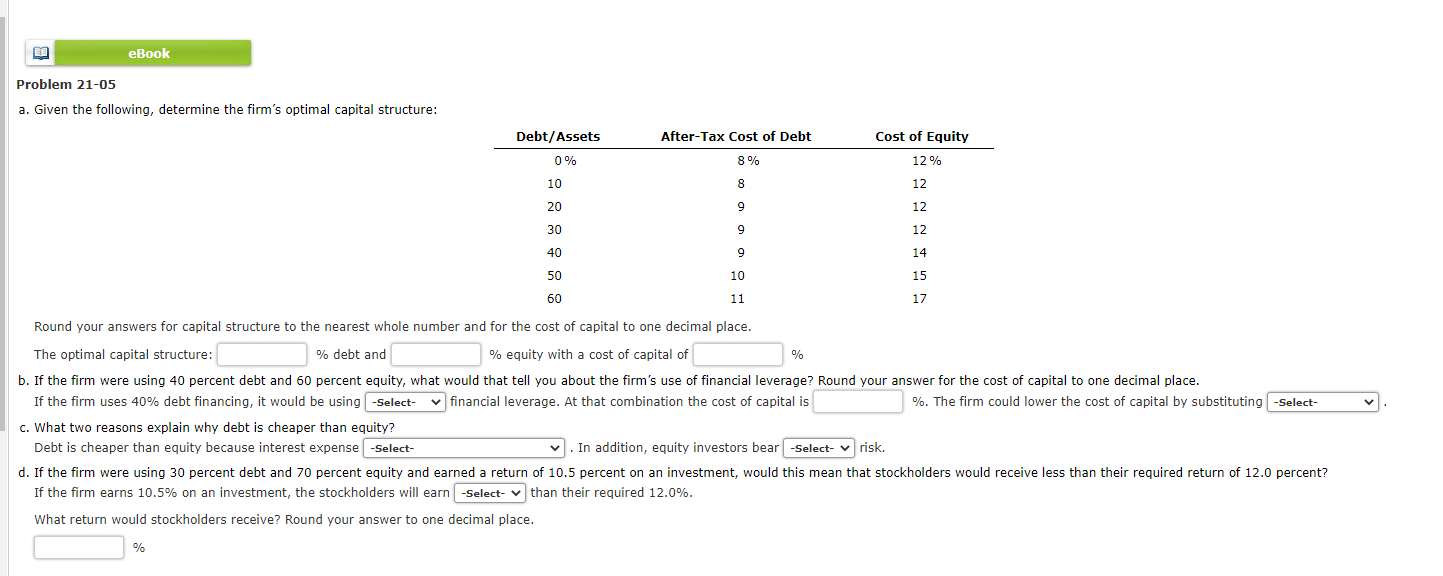

eBook Problem 21-05 a. Given the following, determine the firm's optimal capital structure: Debt/Assets 0% After-Tax Cost of Debt 8 % Cost of Equity 12% 10 8 12 20 9 12 30 9 12 40 9 14 50 10 15 60 11 17 % Round your answers for capital structure to the nearest whole number and for the cost of capital to one decimal place. The optimal capital structure: % debt and % equity with a cost of capital of b. If the firm were using 40 percent debt and 60 percent equity, what would that tell you about the firm's use of financial leverage? Round your answer for the cost of capital to one decimal place. If the firm uses 40% debt financing, it would be using -Select- financial leverage. At that combination the cost of capital is %. The firm could lower the cost of capital by substituting -Select- c. What two reasons explain why debt is cheaper than equity? Debt is cheaper than equity because interest expense -Select- In addition, equity investors bear -Select- risk. d. If the firm were using 30 percent debt and 70 percent equity and earned a return of 10.5 percent on an investment, would this mean that stockholders would receive less than their required return of 12.0 percent? If the firm earns 10.5% on an investment, the stockholders will earn -Select-than their required 12.0%. What return would stockholders receive? Round your answer to one decimal place. % eBook Problem 21-05 a. Given the following, determine the firm's optimal capital structure: Debt/Assets 0% After-Tax Cost of Debt 8 % Cost of Equity 12% 10 8 12 20 9 12 30 9 12 40 9 14 50 10 15 60 11 17 % Round your answers for capital structure to the nearest whole number and for the cost of capital to one decimal place. The optimal capital structure: % debt and % equity with a cost of capital of b. If the firm were using 40 percent debt and 60 percent equity, what would that tell you about the firm's use of financial leverage? Round your answer for the cost of capital to one decimal place. If the firm uses 40% debt financing, it would be using -Select- financial leverage. At that combination the cost of capital is %. The firm could lower the cost of capital by substituting -Select- c. What two reasons explain why debt is cheaper than equity? Debt is cheaper than equity because interest expense -Select- In addition, equity investors bear -Select- risk. d. If the firm were using 30 percent debt and 70 percent equity and earned a return of 10.5 percent on an investment, would this mean that stockholders would receive less than their required return of 12.0 percent? If the firm earns 10.5% on an investment, the stockholders will earn -Select-than their required 12.0%. What return would stockholders receive? Round your answer to one decimal place. %