Question

X File Home A1 123 t 4 56 AutoSave 7 A 8 9 10 11 12 13 14 15 16 17 18 19 20

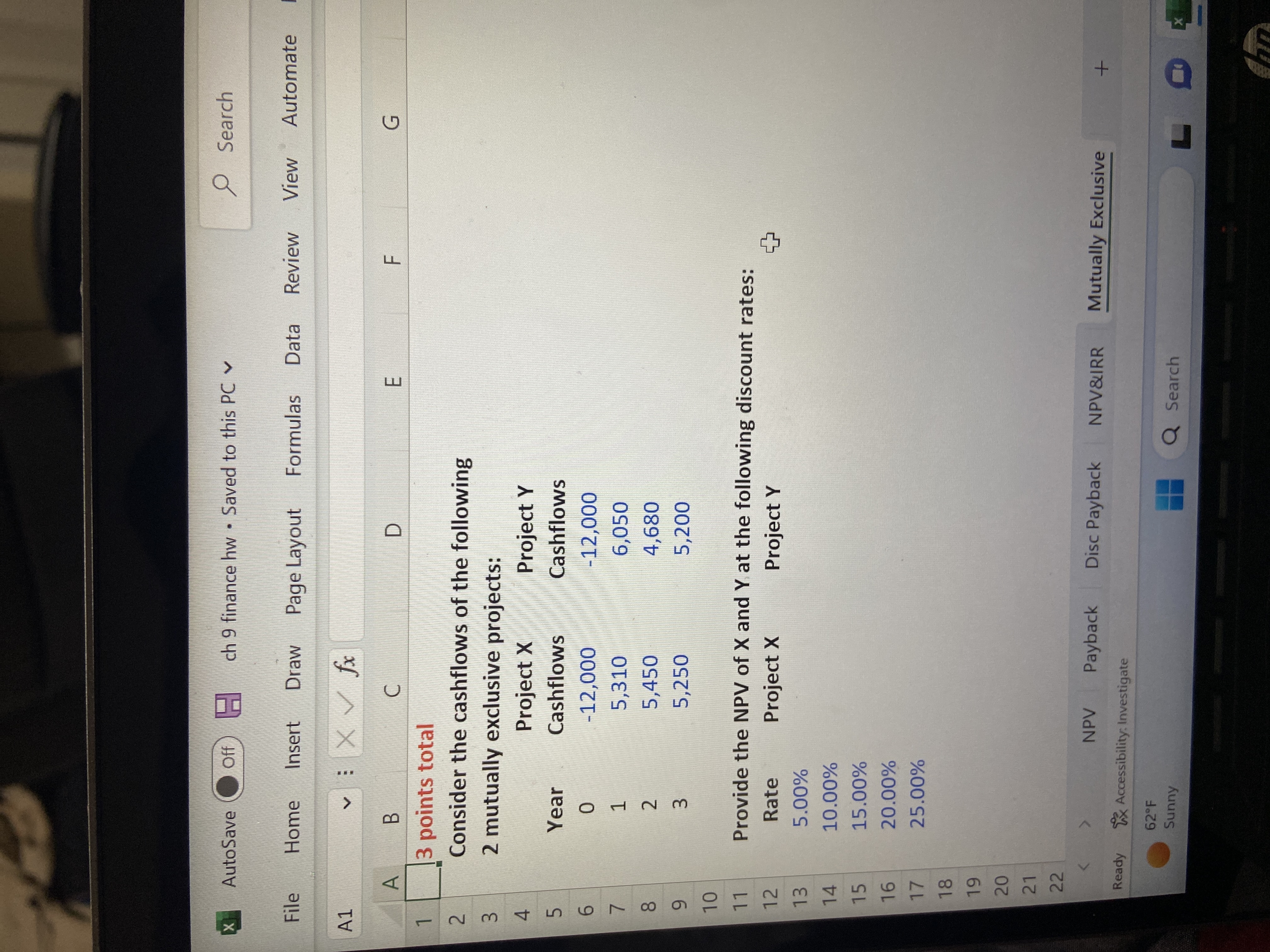

X File Home A1 123 t 4 56 AutoSave 7 A 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 Year 0 WN P > 2 3 . Hch 9 finance hw - Saved to this PC B 3 points total Consider the cashflows of the following 2 mutually exclusive projects: Project X Cashflows -12,000 5,310 5,450 5,250 Off H Insert 62F Sunny Draw X fx C Page Layout Formulas Data Review View Automate I Ready Accessibility: Investigate NPV Payback D Provide the NPV of X and Y at the following discount rates: Rate Project X Project Y 5.00% 10.00% 15.00% 20.00% 25.00% Project Y Cashflows -12,000 6,050 4,680 5,200 E Disc Payback Search F Q Search NPV&IRR Mutually Exclusive G + X

Step by Step Solution

3.33 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the NPV Net Present Value of Project X and Project Y at different d...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Operations Management

Authors: R. Dan Reid, Nada R. Sanders

4th edition

9780470556702, 470325046, 470556706, 978-0470325049

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App