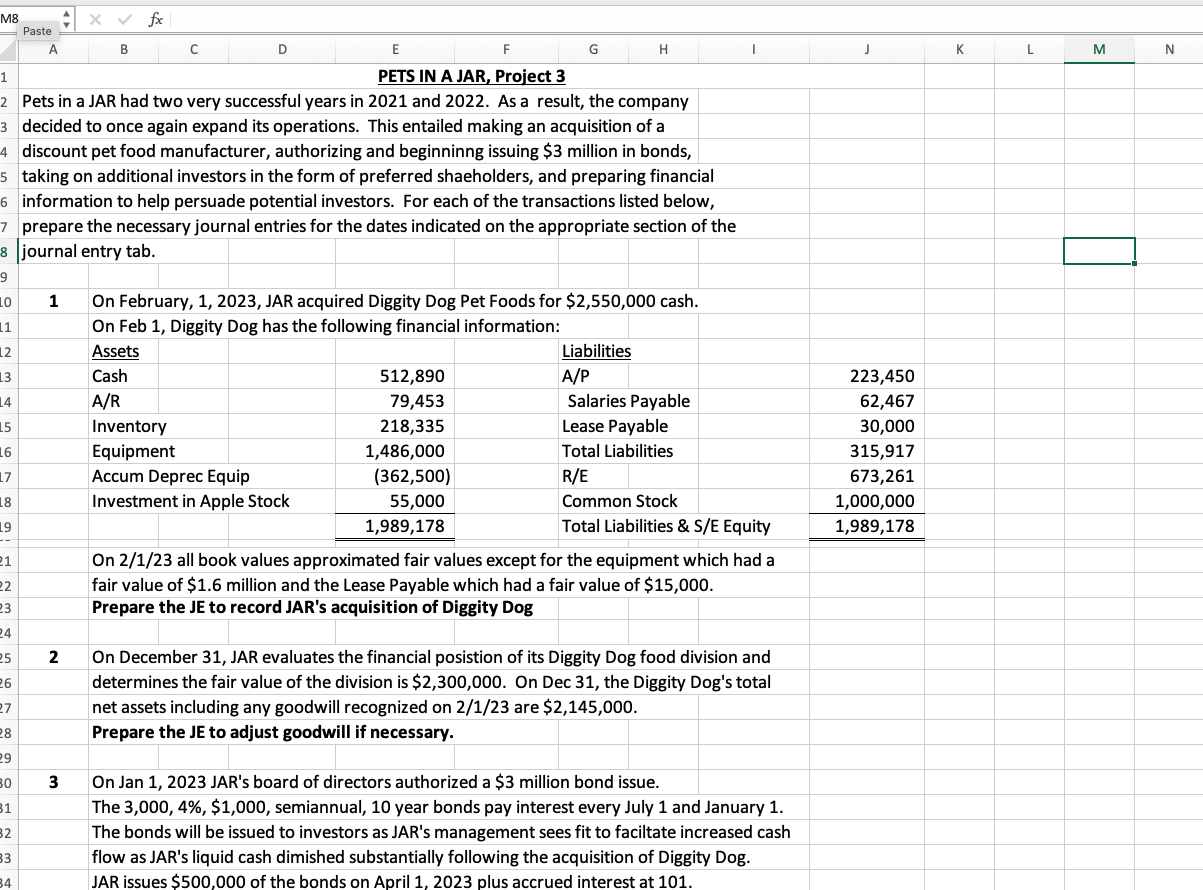

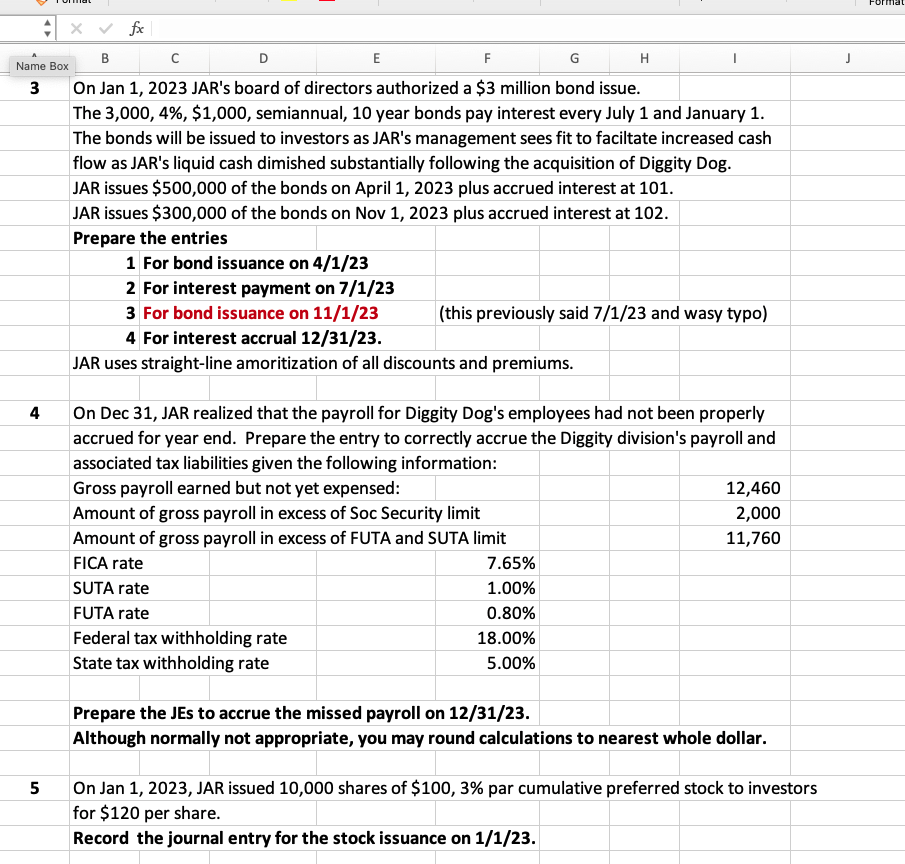

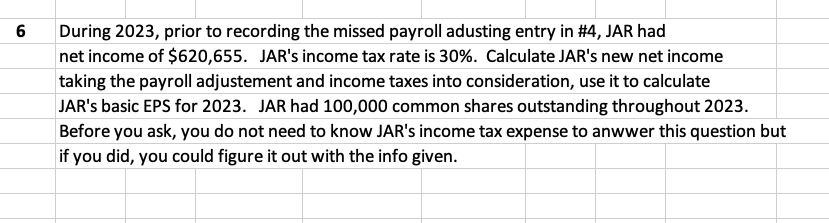

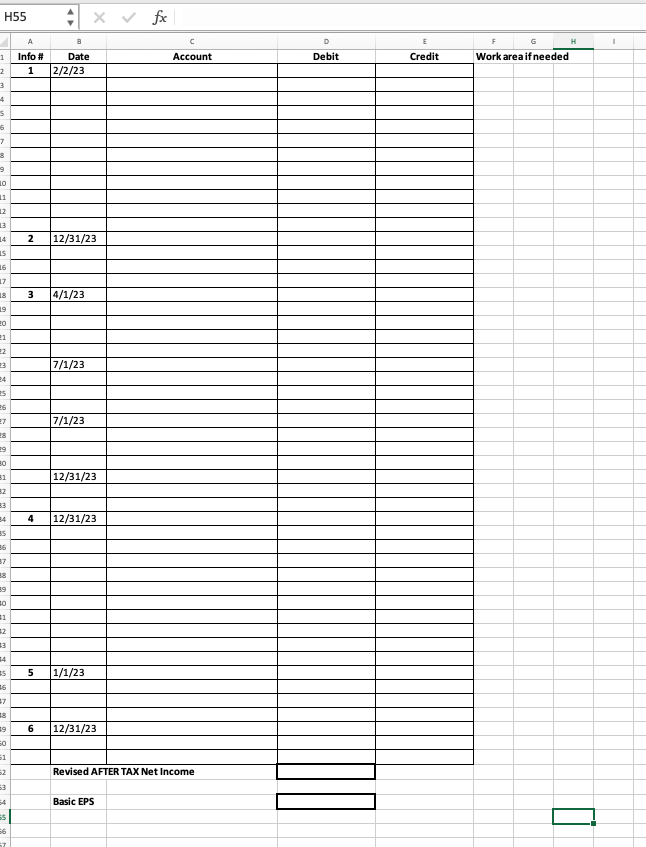

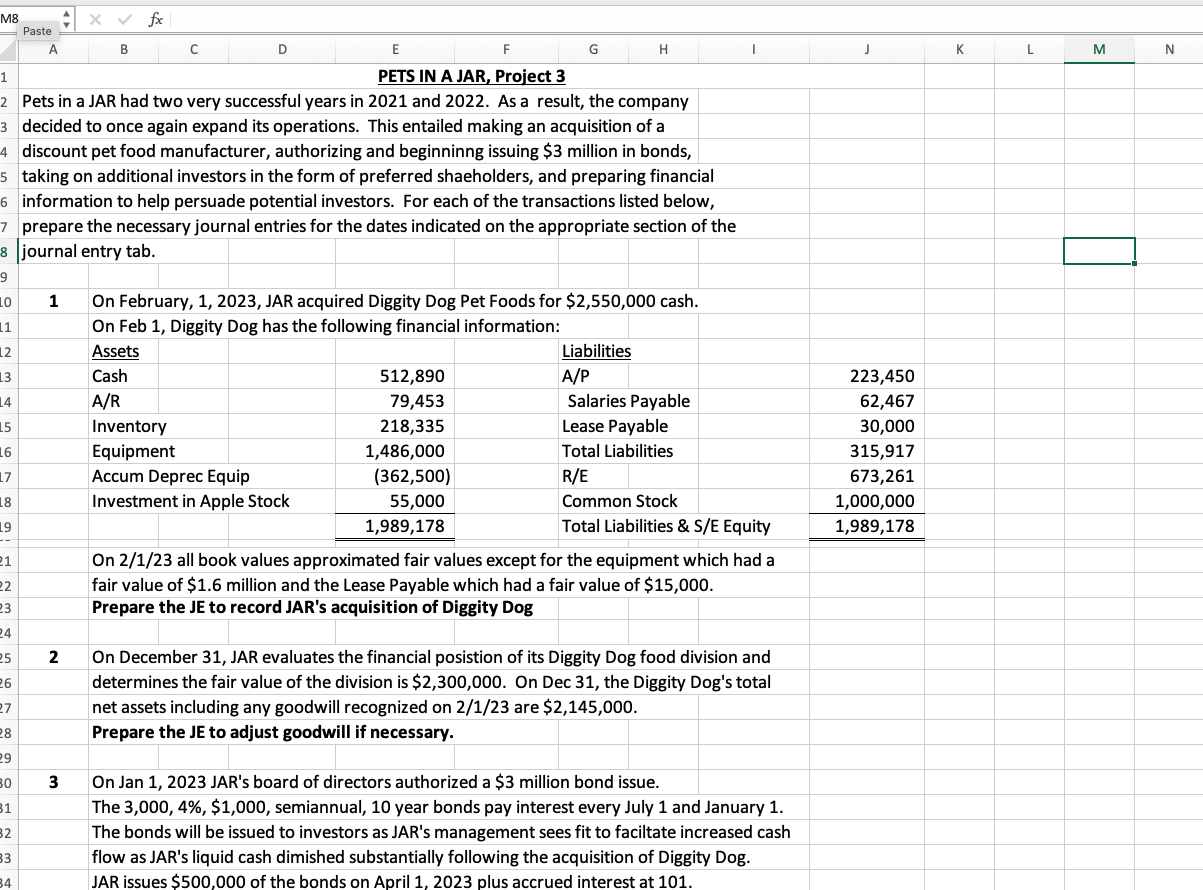

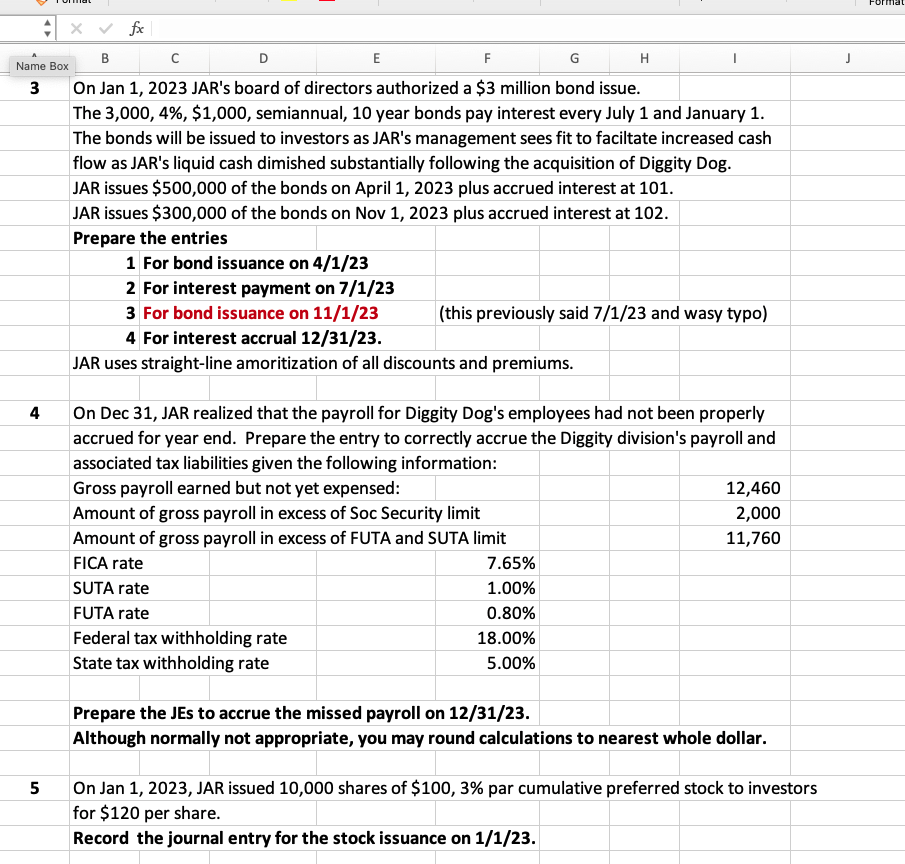

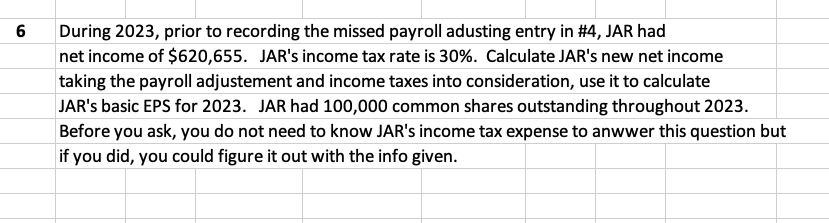

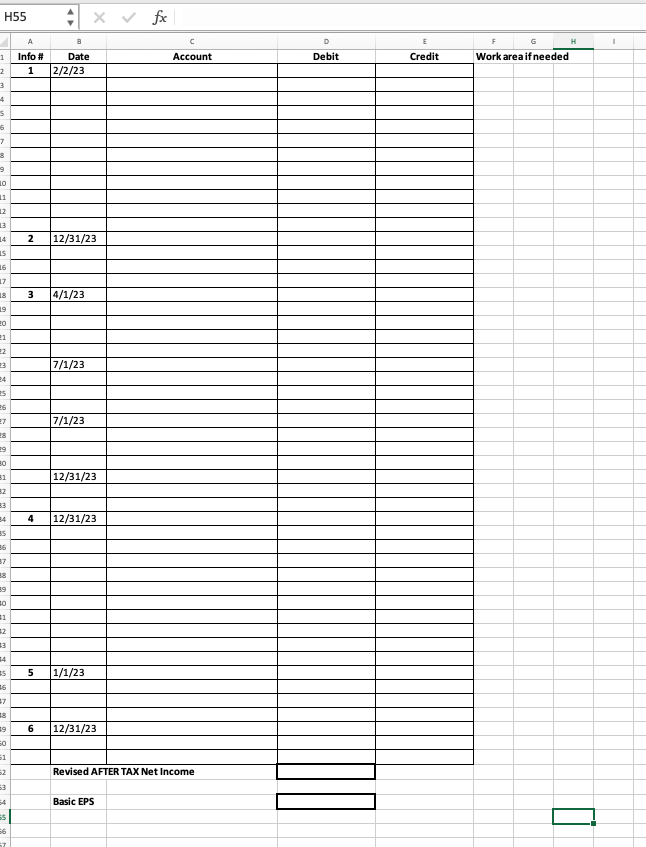

x fx M8 Paste A F G 1 J K L M N 1 B D E H PETS IN A JAR, Project 3 2 Pets in a JAR had two very successful years in 2021 and 2022. As a result, the company 3 decided to once again expand its operations. This entailed making an acquisition of a 4 discount pet food manufacturer, authorizing and beginninng issuing $3 million in bonds, s taking on additional investors in the form of preferred shaeholders, and preparing financial 6 information to help persuade potential investors. For each of the transactions listed below, 7 prepare the necessary journal entries for the dates indicated on the appropriate section of the 8 journal entry tab. 9 10 1 11 12 13 14 A/P 15 16 On February, 1, 2023, JAR acquired Diggity Dog Pet Foods for $2,550,000 cash. On Feb 1, Diggity Dog has the following financial information: Assets Liabilities Cash 512,890 A/R 79,453 Salaries Payable Inventory 218,335 Lease Payable Equipment 1,486,000 Total Liabilities Accum Deprec Equip (362,500) Investment in Apple Stock 55,000 Common Stock 1,989,178 Total Liabilities & S/E Equity On 2/1/23 all book values approximated fair values except for the equipment which had a fair value of $1.6 million and the Lease Payable which had a fair value of $15,000. Prepare the JE to record JAR's acquisition of Diggity Dog 223,450 62,467 30,000 315,917 673,261 1,000,000 1,989,178 R/E 17 18 19 21 22 23 24 25 2 26 On December 31, JAR evaluates the financial posistion of its Diggity Dog food division and determines the fair value of the division is $2,300,000. On Dec 31, the Diggity Dog's total net assets including any goodwill recognized on 2/1/23 are $2,145,000. Prepare the JE to adjust goodwill if necessary. 27 28 29 30 3 31 32 On Jan 1, 2023 JAR's board of directors authorized a $3 million bond issue. The 3,000,4%, $1,000, semiannual, 10 year bonds pay interest every July 1 and January 1. The bonds will be issued to investors as JAR's management sees fit to faciltate increased cash flow as JAR's liquid cash dimished substantially following the acquisition of Diggity Dog. JAR issues $500,000 of the bonds on April 1, 2023 plus accrued interest at 101. 33 34 Formal F G . J Name Box 3 fx B D E On Jan 1, 2023 JAR's board of directors authorized a $3 million bond issue. The 3,000, 4%, $1,000, semiannual, 10 year bonds pay interest every July 1 and January 1. The bonds will be issued to investors as JAR's management sees fit to faciltate increased cash flow as JAR's liquid cash dimished substantially following the acquisition of Diggity Dog. JAR issues $500,000 of the bonds on April 1, 2023 plus accrued interest at 101. JAR issues $300,000 of the bonds on Nov 1, 2023 plus accrued interest at 102. Prepare the entries 1 For bond issuance on 4/1/23 2 For interest payment on 7/1/23 3 For bond issuance on 11/1/23 (this previously said 7/1/23 and wasy typo) 4 For interest accrual 12/31/23. JAR uses straight-line amoritization of all discounts and premiums. 4 On Dec 31, JAR realized that the payroll for Diggity Dog's employees had not been properly accrued for year end. Prepare the entry to correctly accrue the Diggity division's payroll and associated tax liabilities given the following information: Gross payroll earned but not yet expensed: 12,460 Amount of gross payroll in excess of Soc Security limit 2,000 Amount of gross payroll in excess of FUTA and SUTA limit 11,760 FICA rate 7.65% SUTA rate 1.00% FUTA rate 0.80% Federal tax withholding rate 18.00% State tax withholding rate 5.00% Prepare the JEs to accrue the missed payroll on 12/31/23. Although normally not appropriate, you may round calculations to nearest whole dollar. 5 On Jan 1, 2023, JAR issued 10,000 shares of $100, 3% par cumulative preferred stock to investors for $120 per share. Record the journal entry for the stock issuance on 1/1/23. 6 During 2023, prior to recording the missed payroll adusting entry in #4, JAR had net income of $620,655. JAR's income tax rate is 30%. Calculate JAR's new net income taking the payroll adjustement and income taxes into consideration, use it to calculate JAR's basic EPS for 2023. JAR had 100,000 common shares outstanding throughout 2023. Before you ask, you do not need to know JAR's income tax expense to anwwer this question but if you did, you could figure it out with the info given. H55 . fx A B E H 1 1 Account Debit Credit Info # 1 Work area if needed Date 2/2/23 2 3 4 6 7 8 9 10 12 13 2 12/31/23 15 16 17 18 3 4/1/23 19 20 el 7/1/23 es 26 27 7/1/23 28 30 31 12/31/23 32 33 34 4 12/31/23 35 36 37 38 30 31 13 35 5 1/1/23 36 27 18 39 6 12/31/23 50 51 Revised AFTER TAX Net Income 4 Basic EPS 55 [i 56 x fx M8 Paste A F G 1 J K L M N 1 B D E H PETS IN A JAR, Project 3 2 Pets in a JAR had two very successful years in 2021 and 2022. As a result, the company 3 decided to once again expand its operations. This entailed making an acquisition of a 4 discount pet food manufacturer, authorizing and beginninng issuing $3 million in bonds, s taking on additional investors in the form of preferred shaeholders, and preparing financial 6 information to help persuade potential investors. For each of the transactions listed below, 7 prepare the necessary journal entries for the dates indicated on the appropriate section of the 8 journal entry tab. 9 10 1 11 12 13 14 A/P 15 16 On February, 1, 2023, JAR acquired Diggity Dog Pet Foods for $2,550,000 cash. On Feb 1, Diggity Dog has the following financial information: Assets Liabilities Cash 512,890 A/R 79,453 Salaries Payable Inventory 218,335 Lease Payable Equipment 1,486,000 Total Liabilities Accum Deprec Equip (362,500) Investment in Apple Stock 55,000 Common Stock 1,989,178 Total Liabilities & S/E Equity On 2/1/23 all book values approximated fair values except for the equipment which had a fair value of $1.6 million and the Lease Payable which had a fair value of $15,000. Prepare the JE to record JAR's acquisition of Diggity Dog 223,450 62,467 30,000 315,917 673,261 1,000,000 1,989,178 R/E 17 18 19 21 22 23 24 25 2 26 On December 31, JAR evaluates the financial posistion of its Diggity Dog food division and determines the fair value of the division is $2,300,000. On Dec 31, the Diggity Dog's total net assets including any goodwill recognized on 2/1/23 are $2,145,000. Prepare the JE to adjust goodwill if necessary. 27 28 29 30 3 31 32 On Jan 1, 2023 JAR's board of directors authorized a $3 million bond issue. The 3,000,4%, $1,000, semiannual, 10 year bonds pay interest every July 1 and January 1. The bonds will be issued to investors as JAR's management sees fit to faciltate increased cash flow as JAR's liquid cash dimished substantially following the acquisition of Diggity Dog. JAR issues $500,000 of the bonds on April 1, 2023 plus accrued interest at 101. 33 34 Formal F G . J Name Box 3 fx B D E On Jan 1, 2023 JAR's board of directors authorized a $3 million bond issue. The 3,000, 4%, $1,000, semiannual, 10 year bonds pay interest every July 1 and January 1. The bonds will be issued to investors as JAR's management sees fit to faciltate increased cash flow as JAR's liquid cash dimished substantially following the acquisition of Diggity Dog. JAR issues $500,000 of the bonds on April 1, 2023 plus accrued interest at 101. JAR issues $300,000 of the bonds on Nov 1, 2023 plus accrued interest at 102. Prepare the entries 1 For bond issuance on 4/1/23 2 For interest payment on 7/1/23 3 For bond issuance on 11/1/23 (this previously said 7/1/23 and wasy typo) 4 For interest accrual 12/31/23. JAR uses straight-line amoritization of all discounts and premiums. 4 On Dec 31, JAR realized that the payroll for Diggity Dog's employees had not been properly accrued for year end. Prepare the entry to correctly accrue the Diggity division's payroll and associated tax liabilities given the following information: Gross payroll earned but not yet expensed: 12,460 Amount of gross payroll in excess of Soc Security limit 2,000 Amount of gross payroll in excess of FUTA and SUTA limit 11,760 FICA rate 7.65% SUTA rate 1.00% FUTA rate 0.80% Federal tax withholding rate 18.00% State tax withholding rate 5.00% Prepare the JEs to accrue the missed payroll on 12/31/23. Although normally not appropriate, you may round calculations to nearest whole dollar. 5 On Jan 1, 2023, JAR issued 10,000 shares of $100, 3% par cumulative preferred stock to investors for $120 per share. Record the journal entry for the stock issuance on 1/1/23. 6 During 2023, prior to recording the missed payroll adusting entry in #4, JAR had net income of $620,655. JAR's income tax rate is 30%. Calculate JAR's new net income taking the payroll adjustement and income taxes into consideration, use it to calculate JAR's basic EPS for 2023. JAR had 100,000 common shares outstanding throughout 2023. Before you ask, you do not need to know JAR's income tax expense to anwwer this question but if you did, you could figure it out with the info given. H55 . fx A B E H 1 1 Account Debit Credit Info # 1 Work area if needed Date 2/2/23 2 3 4 6 7 8 9 10 12 13 2 12/31/23 15 16 17 18 3 4/1/23 19 20 el 7/1/23 es 26 27 7/1/23 28 30 31 12/31/23 32 33 34 4 12/31/23 35 36 37 38 30 31 13 35 5 1/1/23 36 27 18 39 6 12/31/23 50 51 Revised AFTER TAX Net Income 4 Basic EPS 55 [i 56