Question

Q.7 From the following data related to Mr. Hassan for the tax year ending 30th June 2008. His Basic salary Rs.10,000 Per Month with the

Q.7 From the following data related to Mr. Hassan for the tax year ending 30th June 2008. His Basic salary Rs.10,000 Per Month with the scale Rs.9,000-1000-20,000, Cost of living allowance is 20% of Minimum time scale, Commission is 12% paid only when annual basic salary exceeds amount of Rs.110,000, Dearness Allowance Rs.30,000, Medical Allowance Rs.12,500 Bonus Rs.2,000 Per Month, Provided a rent free unfurnished accommodation and entitled to an Accommodation Allowance of Rs.15,000. Per Month, Provided a car for his personal use only and the cost of car is Rs.1,180,000, Entertainment Allowance Rs.10,000, the CEO of the organization announce for Special Additional Allowances of 7% of Salary as per rule. Because of his special duty a Special Allowance of Rs.2,000 Per Month is also provided, 9% of the basic salary is contributed as Provident Fund by employer and employee both with interest rate of 6% and fund is recognized, Allowance for gas and electricity 60% of Maximum time scale PM, He paid Zakat under Zakat Ordinance and donated to a Agha Khan Hospital fund of Rs.8,000 and Rs.6,000 respectively.

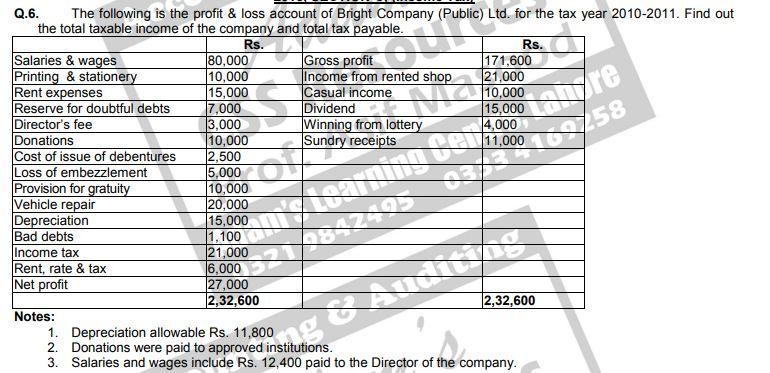

Q.6. The following is the profit & loss account of Bright Company (Public) Ltd. for the tax year 2010-2011. Find out the total taxable income of the company and total tax payable. Rs. Rs. Salaries & wages Printing & stationery Rent expenses Reserve for doubtful debts Director's fee Donations Cost of issue of debentures Loss of embezzlement Provision for gratuity Vehicle repair Depreciation Bad debts Income tax Rent, rate & tax Net profit Notes: 80,000 10,000 15,000 7,000 3,000 10,000 2,500 5,000 10,000 20,000 15,000 1,100 21,000 6,000 27,000 2,32,600 Gross profit Income from rented shop Casual income Dividend Winning from lottery Sundry receipts 171,600 21,000 10,000 15,000 4,000 11,000 2,32,600 1. Depreciation allowable Rs. 11,800 2. Donations were paid to approved institutions. 3. Salaries and wages include Rs. 12,400 paid to the Director of the company.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Mr Hassan total income is Basic salary for one month 10000 For 12 months it should be 1000012 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started