Answered step by step

Verified Expert Solution

Question

1 Approved Answer

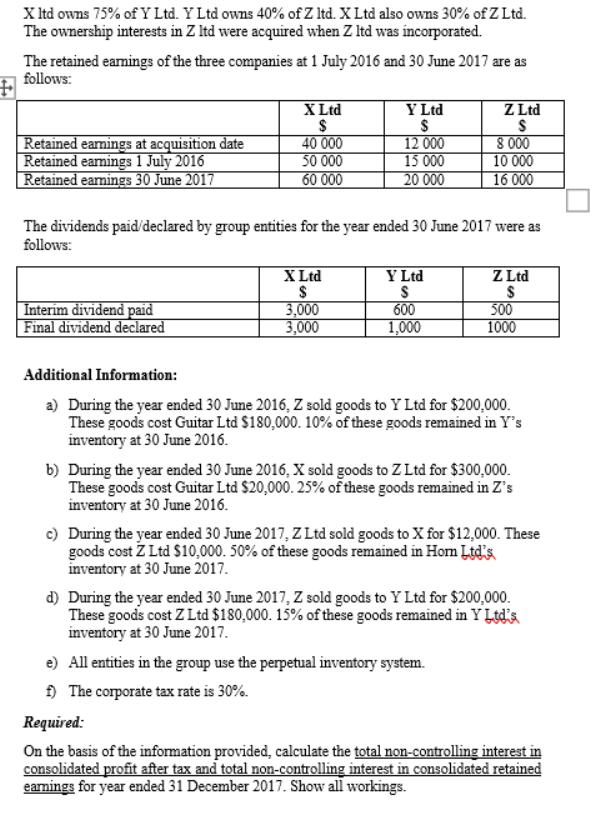

X Itd owns 75% of Y Ltd. Y Ltd owns 40% of Z Itd. X Ltd also owns 30% of Z Ltd. The ownership

X Itd owns 75% of Y Ltd. Y Ltd owns 40% of Z Itd. X Ltd also owns 30% of Z Ltd. The ownership interests in Z Itd were acquired when Z Itd was incorporated. The retained eamings of the three companies at 1 July 2016 and 30 June 2017 are as follows: X Ltd Y Ltd Z Ltd Retained eamings at acquisition date Retained eamings 1 July 2016 Retained eamings 30 June 2017 40 000 50 000 60 000 12 000 15 000 20 000 8 000 10 000 16 000 The dividends paid'declared by group entities for the year ended 30 June 2017 were as follows: X Ltd Y Ltd Z Ltd Interim dividend paid Final dividend declared 3,000 3,000 600 500 1000 1,000 Additional Information: a) During the year ended 30 June 2016, Z sold goods to Y Ltd for $200,000. These goods cost Guitar Ltd $180,000. 10% of these goods remained in Y's inventory at 30 June 2016. b) During the year ended 30 June 2016, X sold goods to Z Ltd for $300,000. These goods cost Guitar Ltd $20,000. 25% of these goods remained in Z's inventory at 30 June 2016. c) During the year ended 30 June 2017, Z Ltd sold goods to X for $12,000. These goods cost Z Ltd $10,000. 50% of these goods remained in Hom Ltd's inventory at 30 June 2017. d) During the year ended 30 June 2017, Z sold goods to Y Ltd for $200,000. These goods cost Z Ltd $180,000. 15% of these goods remained in Y Ltd's inventory at 30 June 2017. e) All entities in the group use the perpetual inventory system. The corporate tax rate is 30%. Required: On the basis of the information provided, calculate the total non-controlling interest in consolidated profit after tax and total non-controlling interest in consolidated retained eamings for year ended 31 December 2017. Show all workings.

Step by Step Solution

★★★★★

3.47 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

The solution of the given question is Company X Ltd Exactly 75 30 Indirect 30 Uncontrolled Interest ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started