Answered step by step

Verified Expert Solution

Question

1 Approved Answer

X Ltd purchases a new lathe for $10,000 in cash on 1 January 2015. It has an estimated useful life of five years. After

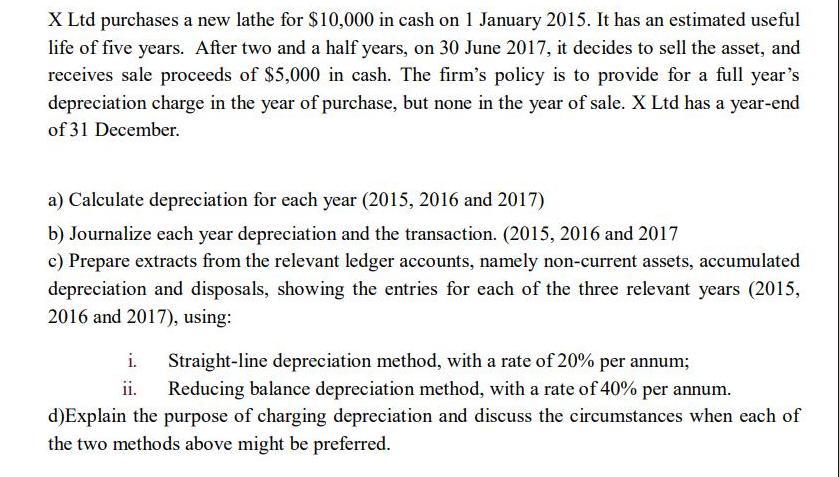

X Ltd purchases a new lathe for $10,000 in cash on 1 January 2015. It has an estimated useful life of five years. After two and a half years, on 30 June 2017, it decides to sell the asset, and receives sale proceeds of $5,000 in cash. The firm's policy is to provide for a full year's depreciation charge in the year of purchase, but none in the year of sale. X Ltd has a year-end of 31 December. a) Calculate depreciation for each year (2015, 2016 and 2017) b) Journalize each year depreciation and the transaction. (2015, 2016 and 2017 c) Prepare extracts from the relevant ledger accounts, namely non-current assets, accumulated depreciation and disposals, showing the entries for each of the three relevant years (2015, 2016 and 2017), using: i. Straight-line depreciation method, with a rate of 20% per annum; Reducing balance depreciation method, with a rate of 40% per annum. d)Explain the purpose of charging depreciation and discuss the circumstances when each of the two methods above might be preferred.

Step by Step Solution

★★★★★

3.42 Rating (171 Votes )

There are 3 Steps involved in it

Step: 1

a Calculate Depreciation for Each Year Given values Cost of Lathe 10000 Estimated Useful Life 5 years Year 2015 Depreciation Cost of Lathe Depreciatio...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started