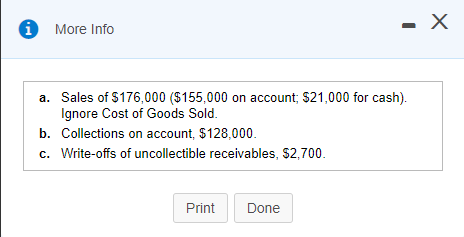

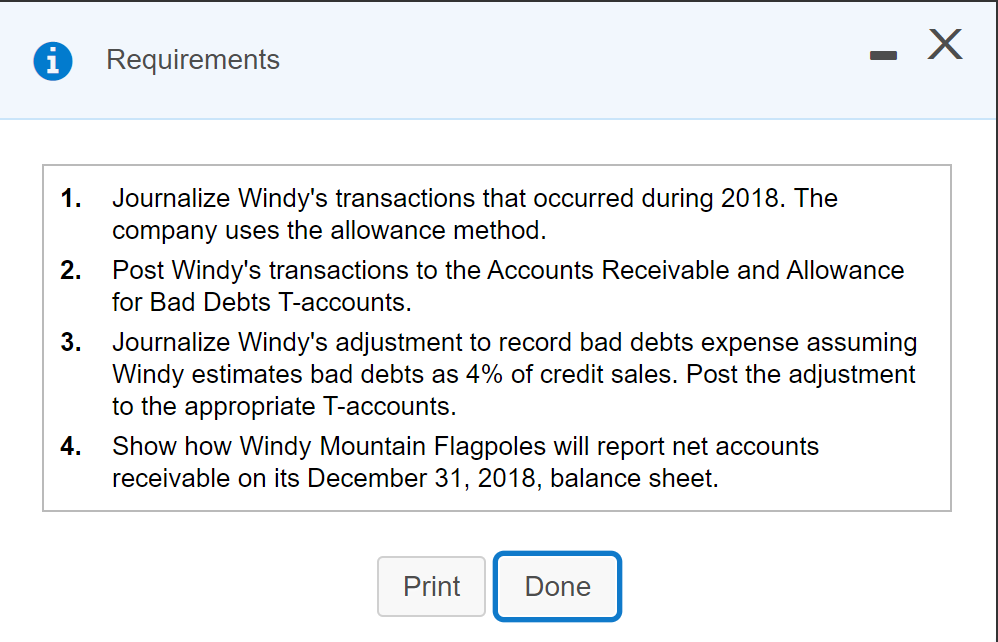

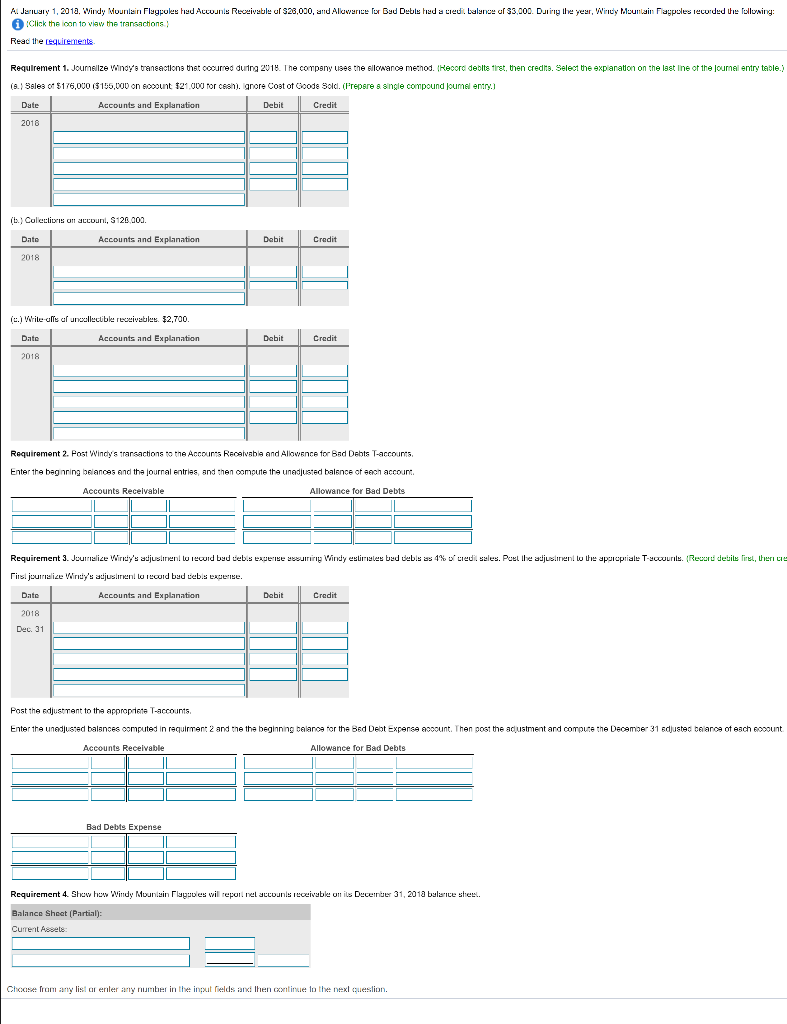

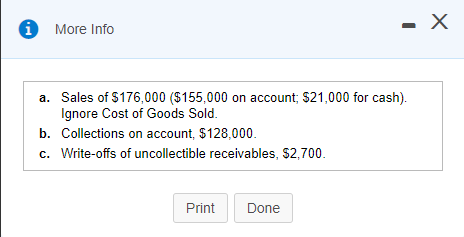

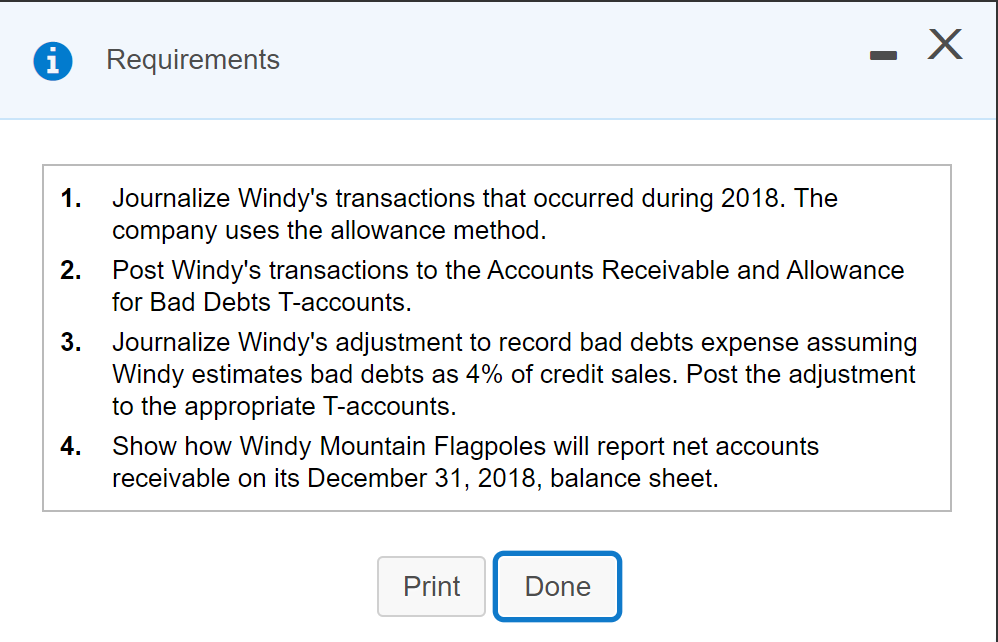

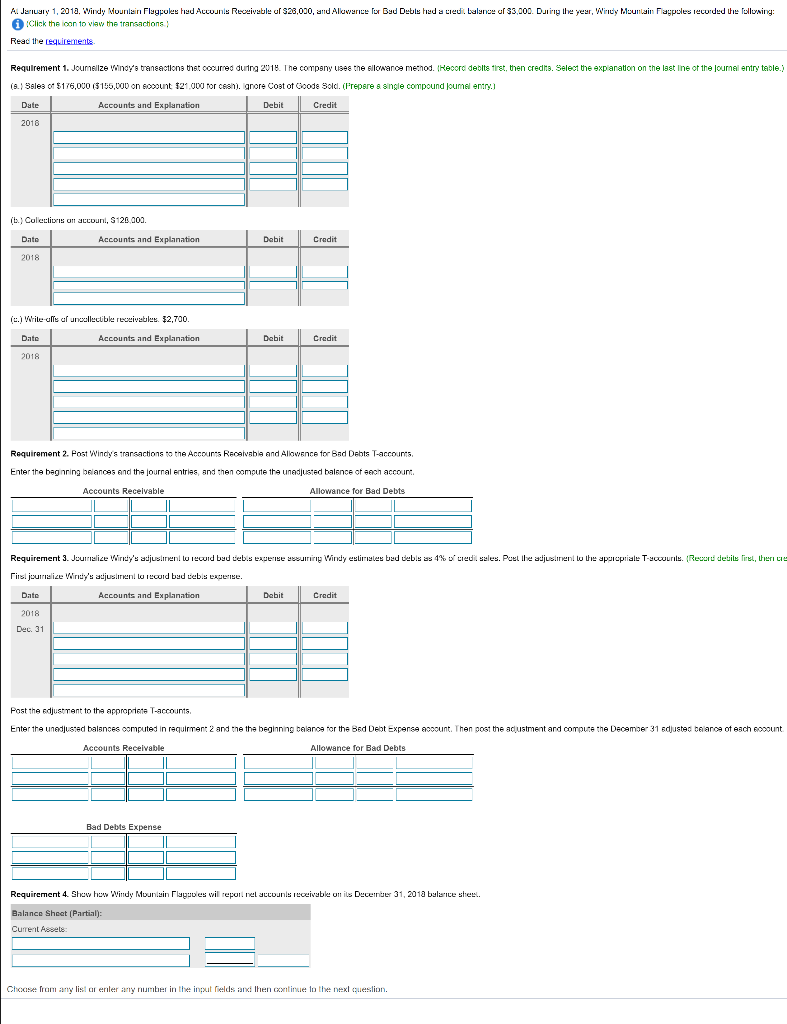

- X More Info a. Sales of $176,000 ($155,000 on account; $21,000 for cash). Ignore Cost of Goods Sold. b. Collections on account, $128,000. c. Write-offs of uncollectible receivables, $2,700. Print Done - X i Requirements 1. 2. 3. Journalize Windy's transactions that occurred during 2018. The company uses the allowance method. Post Windy's transactions to the Accounts Receivable and Allowance for Bad Debts T-accounts. Journalize Windy's adjustment to record bad debts expense assuming Windy estimates bad debts as 4% of credit sales. Post the adjustment to the appropriate T-accounts. Show how Windy Mountain Flagpoles will report net accounts receivable on its December 31, 2018, balance sheet. 4. Print Done A. Jerusy 1, 2010. Windy Mountain Flagpoleshed Accounts Receivable or $23,000, and Aluwerice for Bed Debished a credi. Lalance of $3,000. During the year, Windy Mountain Flagpoles recorded the following: Click the icon to view the transactions Read the requirements Requirement 1. Joumaize Windy's transactions that cocurred during 2018. The company uses the sllowance method. (Record debitstrst, then credits. Select the exparation on the last line of the journal entry table. (9.) Ssles of $175,000 ($155,000 on somount 122.000 for cesh). gnore Cost of Goods Sold. (Prepare a single compound Journal entry Date Accounts and Explanation Debit 2018 Credit its. Collections on account, S120 000. Dato Accounts and Explanation Debit Credit 2018 is. Write all of unoullectible receivables. 32,700. Date Accounts and Explanation 2018 Debit Credit Requirement 2. Post Windys transactions to the Accounts Receivable and allowance for Bad Debts T-accounts, Enter the beginning balances and the journal entries and then compute the unadjusted balance of each account Accounts Receivable Allowance for Bad Debts Requirement 3. Journalize Windy's adjuslinien. Lu record bed veb.sexuese eesulting Windy estirisles bed eble a4% of wediseles. Peelihe adjustment to the prepriale T-Yuuril. Record deuile first, there Cinsi journalize Windy's adjuslinio record badebisexuese. Date Accounts and Explanation Debit Credit 2018 Dec 31 Post the adjustment to the appropriate T-accounts Enter the unadjusted balances computed in requirment 2 and the the beginning balance for the Bed Debt Experse count. Then post the acustment and compute the December 31 adjusted balance of each count Accounts Receivable Allowance for Bad Debts Bad Debts Expense Requirement 4. Show how Windy Mountain Plagues will repol. mel accouns receivable untils December 31, 2018 balance sheel. Balance Sheet (Partial): Current Assets Choose from any list cleriter any number in the input fields and then extinue to the next