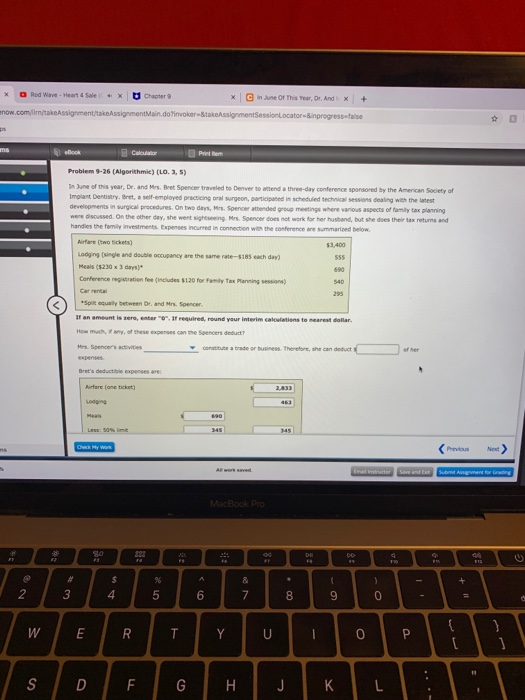

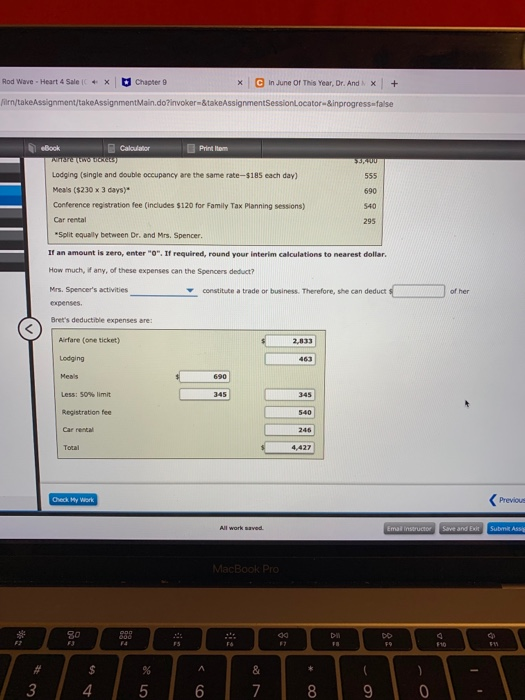

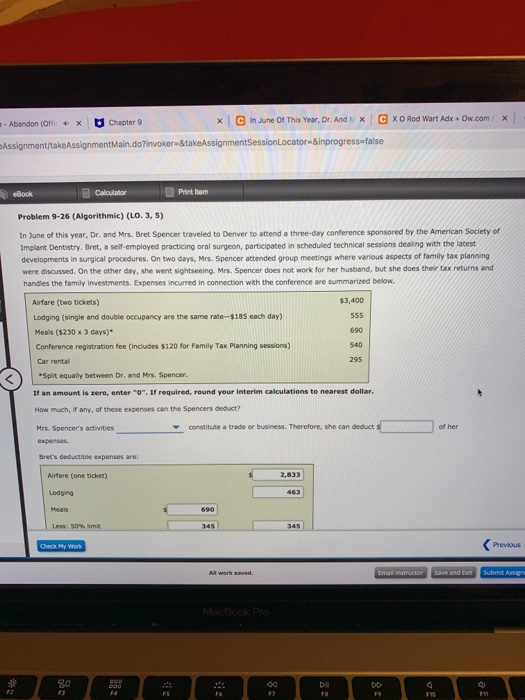

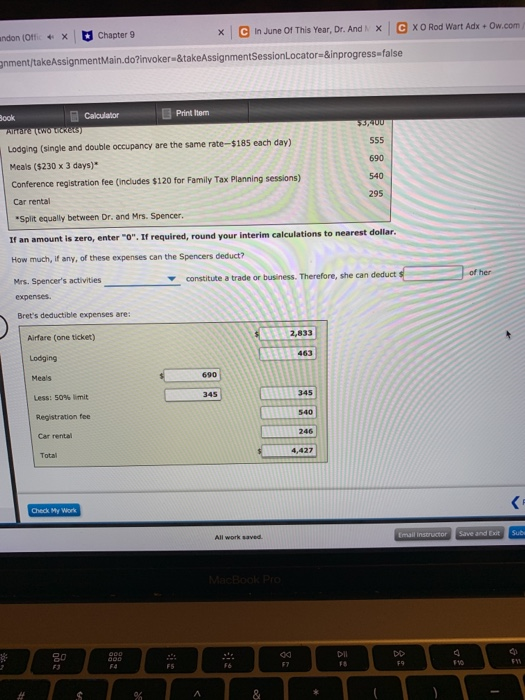

X O Rod Wart Adx + ow.com / v i menesiocatori progressise Problem 9-26 (Algorithmie) (LO. 3, 5) d In June of the year, Dr. and Mrs. Bret Sor eld De n da n ce sponsored by the American Society of monteret ved at d en eget e procedure was aspects of yog were the the day, she went Soencer does not work for her husband, but she does the returns and handies they met Expenses nourred in connection was the conference are summarized below $3,400 Arfarewed Lodging ge and double occupancy are the same rate-5185 each day Meals (230 days) Carference in de 120 of Toxaring s os) I t is a round your interim Galens to meet dollar How much of these canteenen det trade or business. There she can deduct Lin d a mene yang Rod Wave Heart 4 Sale X Chapter 9 x C in June Of This Year, Dr. And x + MirntakeAssignment/takeAssignmentMain.doinvokerStakeAssignmentSessionLocator-&inprogress-false Book Calculator Lodging (single and double occupancy are the same rate-$185 each day) Meals (5230 x 3 days) Conference registration fee (includes $120 for Family Tax Planning sessions) Car rental Solt equally between Dr. and Mrs. Spencer. If an amount is zero, enter"O". If required, round your interim calculations to nearest dollar. How much any of these expenses can the Spencers deduct? constitute a trade or business. Therefore, she can deduct Mrs. Spencer's activities expenses. Bret's deductible expenses are Airfare (one ticket) Lodging Less: 50% limit Registration fee Car rental Cred. My work Previous All work saved marrow Save and be submit Aas MacBook Pro - 2 4 5 6 7 8 9 9 - Abandon O X U Chapter 9 * In June Of This Year, Dr. And x C xo Rod Wart Adx + Ow.com/ x Assignment/takeAssignmentMain.do?invoker-&takeAssignmentSessionLocator-&inprogress=false Calculator Problem 9-26 (Algorithmic) (LO. 3,5) In June of this year, Dr. and Mrs. Bret Spencer traveled to Denver to attend a three-day conference sponsored by the American Society of Implant Dentistry, Bret, a self-employed practicing oral surgeon, participated in scheduled technical sessions dealing with the latest developments in surgical procedures. On two days, Mrs. Spencer attended group meetings where various aspects of family tax planning were discussed. On the other day, she went sightseeing. Mrs. Spencer does not work for her husband, but she does their tax returns and handles the family investments. Expenses incurred in connection with the conference are summarized below. Airfare (two tickets) $3,400 Lodging (single and double occupancy are the same rate-$185 each day) Meals (230 x 3 days) 690 Conference registration fee (includes $120 for Family Tax Planning sessions) Car rental *Split equally between Dr. and Mrs. Spencer If an amount is zero, enter"O". If required, round your interim calculations to nearest dollar. How much, if any of these expenses can the Spencers deduct? Mrs. Soencer's activities constitute a trade or business. Therefore, the can deducts expenses Bret's deductible expenses are: Airfare (one ticket) Lodging Previous Al werk saved. Emaintructor Save and Ex Submit Assign ndon (Offic+ X Chapter 9 x In June Of This Year, Dr. And x C xo Rod Wart Adx + ow.com inment/takeAssignment Main.do?invoker=&takeAssignmentSessionLocator-&inprogress-false A 5400 Calculator Printer WO GROS Lodging (single and double occupancy are the same rate-$185 each day) Meals (5230 x 3 days)" Conference registration fee (includes $120 for Family Tax Planning sessions) Car rental "Split equally between Dr. and Mrs. Spencer. If an amount is zero, enter "O". If required, round your interim calculations to nearest dollar. How much, if any, of these expenses can the Spencers deduct? Mrs. Spencer's activities constitute a trade or business. Therefore, she can deducts expenses Bret's deductible expenses are: Airfare (one ticket) Lodging Meals Less: 50 mit Registration fee Car rental Total Che Won Email instructor Save and Exit Sub